VILLORBA, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A., one of the leading brands worldwide in the production, processing and marketing of roasted coffee, listed on the Milan Stock Exchange (MZB.MI), approved yesterday the Consolidated Results as of June 30, 2019.

Key Highlights:

- Revenues reached euro 439.5 million compared to euro 434.4 million in the first half of 2018; +1.2% at current exchange rates, -1.8% at constant exchange rates. volumes stable

- Gross Profit amounted to euro 196.5 million, +2.7% compared to euro 191.2 million in the first half of 2018 with the margin on revenues of 44.7% compared to 44.0% (+70 basis points)

- Ebitda adjusted and excluding Ifrs 16 effects totalled euro 31.0 million, -3.4% compared to euro 32.1 million in the first half of 2018

- Ebitda amounted to euro 33.9 million, +5.8% compared to euro 32.1 million in the first half of 2018

- Net profit adjusted and excluding Ifrs 16 effects fell to euro 5.1 million, -29.2% compared to euro 7.1 million in the first half of 2018

- Net debt excluding Ifrs 16 effects rose to euro 205.6 million compared to euro 174.7 million at December 31, 2018 (euro 251.5 million at June 30, 2019 including Ifrs 16 effect)

Massimo Zanetti, the Group’s Chairman and Chief Executive Officer, said:

“The first half of 2019 closed with a turnover up +1.2% at current exchange rates, a slight decline at constant exchange rates, mainly due to the trend in the price of the raw material, with a solid growth in the Food Service channel, driven by Asia Pacific and the Americas. I am also pleased to see that the endeavours made to develop new products, to meet the new market trends, are bringing the expected results: in particular I am referring to the development of sustainable products, such as bio-compostable capsules, and to the renewed range of Segafredo products that have been recently introduced in the Italian market.

This gradual improvement in the product mix has enabled us to report a gross profit up by 2.7% compared to the first half of 2018 and makes us confident about growth in the second part of the year, thanks to the marketing and communication initiatives envisaged, especially in Italy.

Based on the current results and the outlook, together with the strategies implemented, we confirm the expectations of profitability growth for the current year.”

Volumes

In the first six months of 2019, the roasted coffee sales volumes of Massimo Zanetti Beverage Group S.p.A. were equal to 62.1 thousand tons, in line with the same period of 2018.

This is a result of a positive impact from Northern Europe (+0.5 thousand tons) mainly in the Mass Market channels, from the Americas (+0.3 thousand tons) in the Private Label channel, Asia-Pacific (+0.5 thousand tons) and has been partially offset by the decrease of Southern Europe (-1.3 thousand tons) mainly in the Private Label and Mass Market channels, linked to the timing of the introduction of new Segafredo products in Italy.

Consolidate Revenues

The Group’s consolidated revenues amounted to Euro 439.5 million in the first half of 2019 showing an increase of Euro 5.0 million (+1.2%) compared to the first half of 2018. This increase is a result of:

- the foreign exchange rates (mainly Euro against the US dollars) had a positive impact of +2.9%

- the roasted coffee sales volumes, in line with the previous year

- partially offset by the decrease of roasted coffee sales price (-1.7%) as a consequence of the decrease of the cost of raw material (green coffee).

Revenue for the six months 2019 includes, for Euro 5.5 million, the impact deriving from the acquisition by Massimo Zanetti Beverage Group, done in February 2019, of the business and asset of a group of companies in Australia known as “The Bean Alliance” (“BAG”).

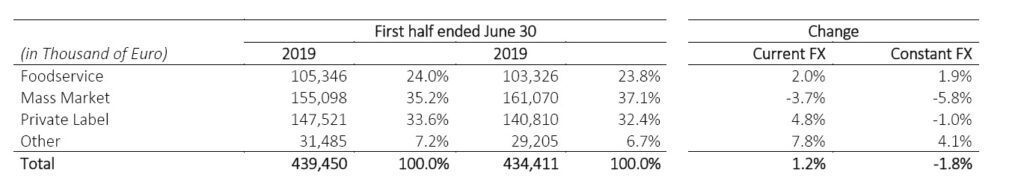

Revenues by channel

The revenues from the Food Service channel, were up 1.9%, at constant exchange rates, compared with the first half of 2018, thanks to the performance in the Americas and in APAC, partially offset by the slight decrease in Europe, largely due to the strategy of selecting high traffic and high visibility customers.

Mass Market declined 5.8% compared with the first half of 2018, due to the weakness of the Americas and the timing effect of the Segafredo relaunch in the Italian Mass Market.

The Private Label revenues are explained by the slight decrease of roasted coffee sales price as a consequence of the reduction of the cost of green coffee.

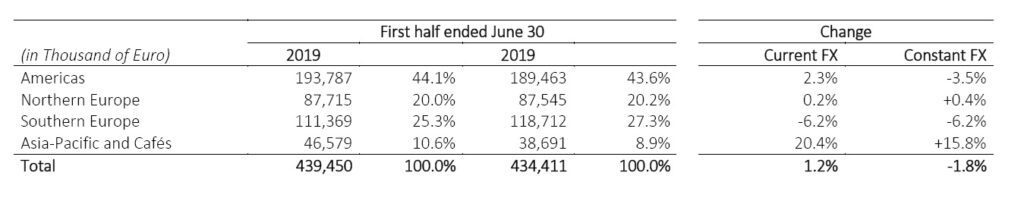

Revenues by region

Revenue in the Americas, at Euro 193.8 million (44.1% of the Group’s revenue) in the first six months of 2019 was down 3.5% at constant exchange rates compared with the first half of 2018, attributable to the Mass Market channel, mainly due to the decline in the market in the cans category, the slight decline of Private Label channel, due to the slight decrease of roasted coffee sales price, partially compensated by the solid growth achieved in the Food Service channel. Revenue generated in Northern Europe, stable at constant exchange rates compared to the first half of 2018, was linked to the slight decrease of roasted coffee sales price in the mass market channel.

Revenue in Southern Europe decreased by 6.2% compared with the first half of 2018, due to the sales prices adjustment in the Private Label and the timing of the introduction of new Segafredo products in the Italian Mass Market.

Asia-Pacific and Cafés, which also includes the revenue generated by the international network of cafés, posted revenue of Euro 46.6 million, with a growth of 15.8% at constant exchange rates compared with the first half of 2018, also reflecting the recent acquisition of BAG.

Gross Profit

Gross Profit

Gross Profit in equal to Euro 196.5 million and shows an increase of Euro 5.2 million compared with the first half of 2018 (+2.7%). This increase is explained by the favorable impact of exchange rates (Euro 3.7 million compared with the first half of 2018) and by the increase in Gross Profit resulting from the sales of roasted coffee and other products (+2.2 million compared to the first six months of 2018).

The increase in Gross Profit from the sale of roasted coffee is mainly due to the positive impact of the trends in sales and purchase prices respectively of roasted and green coffee and to the different mix in the sales channels. In percent of revenues the Gross Profit increased 70 basis points (from 44.0% of revenues to 44.7%).

Gross Profit for the six months ended June 30, 2019 includes Euro 3.1 million for the impact deriving from the acquisition of BAG.

Ebitda Adjusted

Ebitda adjusted amounts to Euro 35.7 million compared to Euro 32.1 million in the first half of 2018. This result was attributable to:

- the increase in Gross Profit, as mentioned above

- the increase in operating costs (of Euro 3.1 million) mainly driven by the personnel costs and costs for services, impacted also from the acquisition of BAG for Euro 2.5 million

- the positive impact of exchange rate fluctuations (Euro 0.5 million)

- and the positive impact of the adoption of the new accounting standard IFRS 16, applicable since January 1st, 2019 (amounting to Euro 4.7 million) as a result of lower costs for leased assets.

Ebitda adjusted of the first six months of 2019 excludes non-recurring costs of Euro 1.8 million, mainly related to reorganisation plans launched at the subsidiaries as well as the re-launch of the Segafredo Zanetti brand in the Mass Market channel in Italy.

Operating Income (Ebit)

Operating income (EBIT) of Massimo Zanetti Beverage Grup is equal to Euro 11.7 million, a decrease of 2.4 million compared to the first half of 2018. In addition to that disclosed about EBITDA, the decrease is mainly attributable to the increase in amortisation and depreciation, equal to Euro 4.2 million. This increase is mainly affected by the impact deriving from the first application of IFRS 16, from January 1, 2019, that raise amortisation and depreciation for Euro 4.4 million due to the new accounting of lease contracts.

Net Profit

The net profit is equal to Euro 3.5 million, a decrease of Euro 3,7 million (-51.6%) compared to the six months ended June 30, 2018. In addition to what was previously described for the operating profit, this increase is also due to the combined effect of:

- the increase in net finance costs Euro 2.1 million, mainly due to: i) the impact deriving from the first application of IFRS 16 for Euro 0.6 million; ii) increase in net finance costs due to the fair value on derivatives for Euro 0.7 million; iii) increase on interests expenses for Euro 0.6 million;

- the increase in the shares of losses of companies accounted for using the equity method, amounting to Euro 0.4 million;

- the decrease in income taxes amounting to Euro 1.2 million, mainly due to the decrease of taxable income generated by the Group in the six months ended June 30, 2019 compared to 2018.

Net Debt

Net debt, excluding the effect of the IFRS 16 adoption, is equal to Euro 205.5 million compared to 174.7 million at December 31, 2018. During the first half, non-recurring investments were made for a total of Euro 22.3 million, compared to Euro 0.6 million in the first half of 2018.

These investments included the acquisition by Massimo Zanetti Beverage Group of the business and assets of a group of companies based in Melbourne known as “The Bean Alliance” and the acquisition of the Portuguese companies Cafés Nandi SA and Multicafès Industria de Cafè based in Amadora, near Lisbon.

Lastly, the adoption of the new accounting standard IFRS 16 increased the Net Debt by Euro 45.9 million. As a result, the Net Debt as of June 30, 2019, after the adoption of IFRS 16, amounted to Euro 251.5 million.

Forecast for operations and significant subsequent events

In view of the results achieved in the first half of 2019 and considering current trends, the expectations relating to the performance of the Group for 2019, assuming the absence of extraordinary transactions, excluding those already announced in the first half of 2019, are as follows:

- slight increase in revenues driven by:

- the improvement in product and channel mix

- growth in volumes in line with market trends

- increase in EBITDA adjusted of approximately 3%

- net debt is expected to be around Euro 195 million These forecasts are assumed at constant exchange rates and exclude the impact of the application of IFRS 16.

Conference Call to present first half 2019 Financial Results

The Group’s First half 2019 results were presented during a conference call held yesterday at 5:45 CET.

Digital Playback service will be available for 8 days, dialling the following numbers: +1 718 705 8797 (US and Canada), +39 02 72495 (Italy), +44 1 212 818 005 (UK) with the following passcode: 936#

The presentation will be available before the conference call on the website of Massimo Zanetti Beverage Group www.mzb-group.com and on the storage system (www.emarketstorage.com). The recording file will be available on the company website.