VILLORBA, Italy — The Board of Directors of Massimo Zanetti Beverage Group S.p.A., one of the leading brands worldwide in the production, processing and marketing of roasted coffee and other selected categories of colonial products, listed on the Milan Stock Exchange (MZB.MI), approved today the Half Year Financial Report at June 30, 2018.

Massimo Zanetti, the Group’s Chairman and Chief Executive Office said: “In the first half of 2018, key profitability indicators have grown considerably: the EBITDA increased by more than 10% and the net profit by more than 60%.

Revenue in the first half of the year, which was substantially stable at an organic level (-3% compared to the first half of 2017), showed a steady improvement in the sales mix, generating a positive expansion of margins.

All geographical areas and all sales channels reported increased volumes, except for the American market, which decreased by 5%. In particular, the Asia-Pacific region reported interestingly growing volumes (+12%) and the Food Service channel performed well in all markets.

Based on the reported results for the first six months and considering the positive outlook for the remaining part of the year, we confirm our expectations of solid growth in profitability for the financial year.”

Volumes

In the first six months of 2018, the roasted coffee sales volumes of Massimo Zanetti Beverage Group S.p.A. showed a slight decline, -1.9% compared to the first half of 2017 (62.1 thousand tons compared with 63.2 thousand tons of the first half 2017).

This trend is due to the decrease in the Americas (-5.3% compared to the first half of 2017) in the Private Label and Mass Market channels, partially offset by positive performance of all other areas: Southern Europe was up 3.2% compared with the first half of 2017, Northern Europe was up 1.9% compared with the first half of 2017, and Asia Pacific and Cafés was up 12.0% compared to the first half of 2017.

Food Service channel performed well in all markets (+3.1%, compared with the first half of 2017), in line with the Group’s strategy which focuses on channel and product mix highly-profitable.

Consolidated Revenue

The Group’s consolidated revenue amounted to Euro 434.4 million in the first half of 2018, compared to Euro 475.6 million of the first half of the prior year, a decrease of 8.7% at current exchange rates, – 3.3% at constant exchange rates compared to the first half of 2017.

Revenue, on a comparable basis*, decreased -3.0% compared to the previous year, equal to Euro 14.4 million, mainly due to:

• the decrease in roasted coffee sales volumes, as explained before (-1.6% compared to the first half of 2017);

• the slight decrease of roasted coffee sales price resulting from the decrease in the average purchase price of green coffee which was partially offset by the positive effects of a different mix in the sales channels in 2018 and 2017. Overall, these items resulted in a decrease in revenue of -1.4% compared to the first half of 2017.

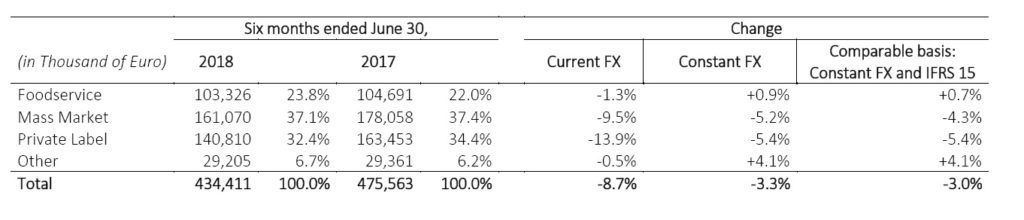

Revenue by Channel

Revenue from the Food Service channel, which account for 23.8% of the Group’s revenue, amount to Euro 103.3 million, showing a growth of 0.7% on a comparable basis, with volumes growth recorded in all markets.

Performance of the Mass Market channel and Private Label channels, equal to 37.1% and 32.4% respectively of the Group’s revenue, is due to the decline in volumes of the Americas, partially offset by the increase in volumes in all other areas, and the slight decrease of roasted coffee sales price as a consequence of the reduction of the cost of green coffee, as explained before.

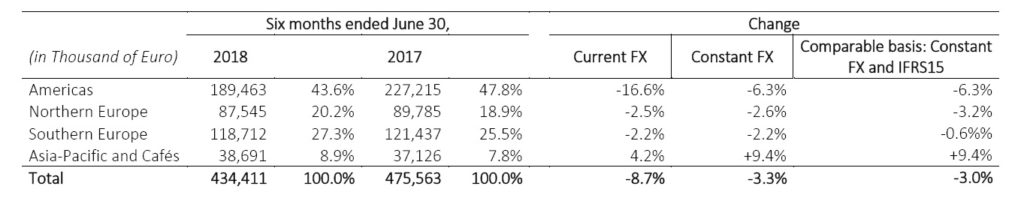

Revenue by Region

Revenue from the Americas amount to Euro 189.5 million (43.6% of the Group’s revenue) a 6.3% reduction on a comparable basis. This performance is explained by the decrease of the Mass Market and Private Label channels, as already explained.

Revenue from Europe are slightly negative due to the reduction in sales prices as a consequence of the decrease in the purchase price of green coffee, while volumes increased in all channels.

Revenue from Asia-Pacific, which also include those from the international network of cafés, amount to Euro 38.7 million, up by 9.4% on a like for like basis, compared to the first half of 2017.

Gross Profit

Gross profit amounts to Euro 191.2 million for the six months ended June 30, 2018, was down by Euro 4.7 million compared to the six months ended June 30, 2017.

This decrease is mainly explained by the unfavorable effect of exchange rates (with an impact of Euro 8.3 million, compared to the first half of 2017). On a comparable basis, Gross Profit increases by Euro 5.1 million (+2.6% compared to the first half of 2017), mainly due to the sale of roasted coffee (+3.1% compared to the first half of 2017).

The increase in Gross Profit from the sale of roasted coffee is in turn mainly due to the positive impact of the trends in sales and purchase prices respectively of roasted and green coffee and to the positive effect of the different mix in the sales channels in the first half of 2018 and 2017 (+4.9% compared to the first half of 2017), partially offset by the decrease in roasted coffee volumes (-1.8% compared to the first half of 2017).

In percent of revenue the Gross Profit increased 280 basis points (from 41.2% of revenue to 44.0%).

EBITDA

EBITDA amounts to Euro 32.1 million (7.4% on revenue), compared to Euro 29.1 million in 2017 (6.1% on revenue), up by 10.2% compared to the first half of 2017.

The increase of EBITDA is due to the increase of Gross Profit, for Euro 5.1 million on a comparable basis, partially offset by the negative impact of exchange rate fluctuations (Euro 1.1 million) and the slight increase of operating costs on a comparable basis (equal to Euro 1.0 million).

Operating Income (EBIT)

Operating income (EBIT) amounted to Euro 14,1 million for the six months ended June 30, 2018, an increase of +30.2% compared to Euro 10.8 million of the six months ended June 30, 2017. In addition to as previously described for EBITDA, this increase is attributable to the decrease in amortization and depreciation, amounting to Euro 0.3 million.

Net profit

The net profit amounts to Euro 7.1 million, up 62.3% compared to first half of 2017. Income taxes increased Euro 480 thousand, mainly due to the increased taxable income generated by the Group in the six months ended June 30, 2018 compared to the same period of 2017.

Net debt

Net debt amounting to Euro 190.7 million is stable compared to 191.0 million at December 31, 2017. During the first half the net recurring investments amount to Euro 13.4 million compared to Euro 19.1 million of the first half of 2017.

During the period 5.8 million dividends were distributed, compared with 5.3 million of the same period of 2017.

Forecast for operations and significant subsequent events

In view of the results achieved in the first half of 2018 and considering current trends as well as assuming the absence of extraordinary transactions, management expectations for 2018 is:

Conference Call to present first half 2018 Financial Results

The Group’s First Half 2018 results will be presented during the conference call to be held today at 5:30 CET. To access the call, please use one of the following dial-in numbers: +1 718 705 8794 (US and Canada), +39 02 805 88 11 (Italy), +44 121 281 8003 (UK) ; +33 170 918 703 (France) and +39 02 805 88 27 (Press).

Digital Playback service will be available for 8 days, dialling the following numbers: +1 718 705 8797 (US and Canada), +39 02 72495 (Italy), +44 1 212 818 005 (UK) with the following passcode: 936#

The presentation will be available before the conference call on the company website www.mzb-group.com and on the storage system (www.emarketstorage.com). The recording file will be available on the company website.

Declaration by the manager in charge of the company’s financial reports

The Manager in charge of the Company’s financial reports, Leonardo Rossi, pursuant to paragraph 2 of Article 154-bis of Italy’s Consolidated Law on Finance (TUF), declares that, based on his knowledge, the accounting information contained in this press release corresponds to the documented results, books and accounting records.