MILAN – We talked with Michael von Luehrte Secretary General of SCTA, who has lived 4 years in Brazil, 5 years in the USA, and he can claim 42 years of experience in the coffee sector. During his career he worked across most agricultural commodities from coffee, cocoa, sugar to cotton, grains and oilseeds, but also dairy. Since more then 6 years he is the Secretary General of the SCTA (the Swiss Coffee Trade Association).

We talked together about one of the key events for the coffee industry, from producers/exporters, to roasters, to traders governmental organizations and civil society : the SCTA Forum and Dinner on Sep 21/22 in Basel.

The SCTA counts 48 members, 26 are trading companies and procurement offices based in Switzerland, the other ones are outside-based trading companies or service providers (logistics and financial services)

Michael: “This is the fourteenth time we’re organizing the SCTA event. It all started just as a dinner and dance event. Over time the event grew in importance, attendance and changed into a full 2 day networking, panels and the gala dinner to celebrate the coffee community as a people business. The panel discussions are focusing on forward looking issues of the coffee industry, not only related to trading but also to logistics, supply chain issues, legislations, politics. Climate change, future supply security, human rights and producer income are covered by the various top level speakers.

The SCTA forum and dinner became the most important gathering for the global coffee trading and exporting, producing community.”

SCTA members account for more than half of the globally traded green coffee. What explains this Swiss supremacy in trading?

“Historically, many of the trading companies are having their roots and origin in Switzerland not only for coffee but across the entire commodity spectrum. The strong banking sector provides the liquidity life lines for commodity traders. Then there are also other arguments. The first one is political stability. The major political parties are represented in the Swiss government providing broader consensus and diversity in opinions plus we’re not exposed to radical changes in laws and especially on the taxes.

Second one, today is one of the most important reasons: the labor pool. You got an extremely skilled labor force in commodity trading here which you rarely find in other countries in the world.”

What is the purpose of the SCTA Next Gen and about the recent SCTA Next Gen Italy Espresso Tour, which took place in May?

“The Next Gen committee is part of the SCTA with the aim to develop, educate the next round of future leaders in the coffee industry. The priorities are related and aligned to the overall SCTA agenda to represent the interests of the green coffee trade. The Next gen team is organizing educational webinars, trips to learn about roasting, warehousing etc. as a platform to reach even a broader audience than the SCTA members. SCTA Next Gen collaborates also with the NCA countrerparts.”

During the event will you have the opportunity to discuss what could be the impacts of the European Deforestation-free products Regulation (EUDR) on world trade?

“The SCTA event will not specifically focus on the EUDR implementation but take a broader more holistic view at the impact of legislations from human rights due diligence, non-deforestation, environmental impact and the way towards net zero during the various panel discussions.

On deforestation, of course we’re not interested in deforesting new areas to expand production. There is still potential to increase productivity in many countries without having to expand into forest areas.

The EUDR is a fact, and the supply chain participants will have to prepare for implementation by Dec 2024, though the guiding implementation details are missing. Technology will enable traceability across the supply chain – there are many solutions being offered in the marketplace and several companies have advanced their own internal systems. The role of the associations here is to ensure that smaller and medium sized companies are having access to respective due diligence tracking tools to be compliant with the legislative requirements for imports into the EU.

We are concerned that not all producing countries are aware of the EU legislative requirements impacting their production and local legal systems. It will be a challenge to bring the 60+ producing countries up to speed in time for the legislation. Consequently, we do see a further concentration on major producing countries and larger producers. We are working closely with the associations of producing countries and producer organizations.

In the medium, long-term the deforestation legislation will become a global standard as the US, Switzerland, the UK and Asian countries will follow the same approach. We have addressed the climate crisis and the potential impact on future coffee supply for many years – this issue is here to stay and we need to accelerate our joint efforts to address those problems. Legislation alone won’t help, but a change of producing and consuming methods, transportation etc – we are calling for all stakeholders from the coffee supply chain, governments, academia and civil society to work together and accelerate the actions. Collaboration instead of confrontation and polarization.

We’re trying to educate the law makers about the complexity and issues of the coffee supply chain, and that we need a collaborative approach as the private sector is too small to address these issues by its own. So governments in consuming and producing countries need to join forces with the private sector but also civil society to get faster to tangible results.

The Swiss government is fully aligned and supportive to this view and we also collaborate with other commodity sectors like cocoa, palm, soy to drive the sustainability agenda forward. The private sector has been a frontrunner in many ways already on a lot of these topics of traceability, block chain, transparency across the supply chain and about reporting.

On reporting, for instance, in Switzerland we are having mandatory due diligence requirements, since January 1 st 2023. Larger cooperations must report their human rights assessments and action plans as part of their annual reports.”

Are you going to discuss also about fair trade and a more sustainable supply chain, focusing on the producers?

“We all depend on the farmers – no production no trade no roasting no consumption. So, the industry has an implicit interest in ensuring an economically viable production meeting all the requested sustainability criteria. Sustainability is part of the general business culture and the principle of continuous improvement. As an association we try to foster collaboration and coordination of the various stakeholders. Discussions are sometimes polarized.

The event will kick off on September 21 st with Next Gen sustainability context, to look at innovative sustainability projects.

The afternoon panels are focusing on the collaborative approach with civil society and the private sector to address the key challenges and legislations and also to discuss concrete technological solutions and advances to ensure a realistic implementation.”

And what is about the specialty coffee?

“Specialty coffees represent a small but growing portion of the global market of about 10 % and are a way for farmers to expand their income and differentiation. Many trading companies and exporters are offering conventional and specialty coffee and are the ones managing the logistics and imports for both categories – so playing a vital role in ensuring traceability and sustainability across the categories.

We intend to represent and cover all aspects of the green coffee market. This year we are having also Perù as a guest country showcasing specialty coffees at their booth in the forum area.”

In Basel are you going to discuss about the forecast of the performance of Arabica and Robusta market?

“It will be a part of it, but it’s a long-term discussion. We see it from a big picture. We always witness the short-term supply demand distortions and moves (obviously the latest was the frost of Brazil two years ago). Brazil is gradually normalizing and returning to larger crops.

We are not talking specifically about price forecasting, not only because of antitrust considerations, but also because we want to address the big forward-looking challenges of the green coffee market and trade.

We will talk about climate change and the long-term issues like the challenge of the future of coffee. If you extrapolate, actual demand growth of 2. -2.5% until 2050, we will need to come up with 2/3 times more coffee production. On the same amount of land and in competition to food crops – profitability per hectare will drive the future level of production but also prices.

We will also discuss the way towards zero emissions from thought leaders. There is a lot of innovation out there and improvements happening without being mandated but just because of a necessity to adjust farming practices.”

And what about Italy in this event?

“Italy is going to be there. It’s such important coffee market and a lot of traders, roasters (not only the big ones) are going to attend to the SCTA event. For the gala dinner itself, the attendance is limited to 770, but for all the days, we’re expecting an attendance of about 1000 people.

The SCTA members are representing more than 50-60% of globally traded green coffee. Everyone wants to attend this important event. Since many producing countries are there, it is a fantastic opportunity to network and arrange individual meetings with the clients.”

What about the logistical issues that had come with pandemic now it’s over?

“I would say yes looking at the decline in freight rates. The back lock from China has resolved itself and now there’s a constant flow of containers. Number of ships went down during the pandemic and prices went up and the shipping companies enjoyed record earnings. They started building new ships which are coming now gradually to the market.”

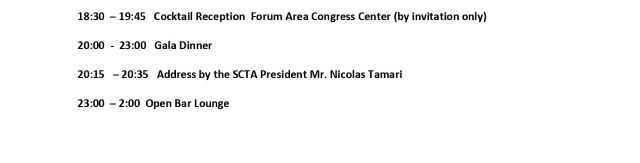

The SCTA event program