TURNHOUT, Belgium – Miko Group reported its half-year results for 2022. The company posted an adjusted turnover of to EUR 130 million, up 169% and an adjusted EBITDA of EUR 15.4 million, up 133%. Miko has been active in coffee service for over 200 years, and was floated on Euronext Brussels in 1998. Miko is an international group with companies in Belgium, France, UK, the Netherlands, Germany, Denmark, Norway, Sweden, Poland, the Czech Republic, Slovakia, and Australia.

Miko Group: Notes on the accounts

Since mid-2021, the Miko Group has only focused on its coffee service activities after the sale of the plastic packaging division – Miko Pac – to the German packaging group PACCOR.

Therefore, with the aim of making the results comparable, the results achieved by the plastics division in the first half of 2021, as well as all revenues and costs associated with the sale of the plastics division in that year, were excluded.

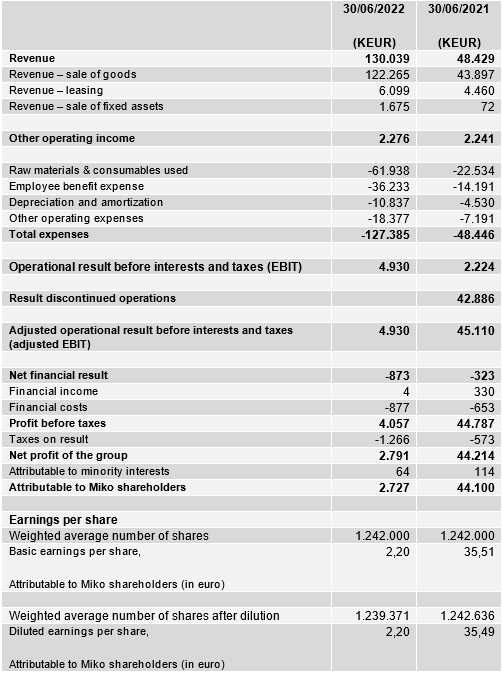

After excluding these figures, the adjusted EBIT and EBITDA increased by 122 % and 133 % respectively, to EUR 4.9 million and EUR 15.4 million. The net result rose by + 125 % to EUR 2.7 million.

The remaining activity is the “coffee service”. In various “home” markets, a coffee service is offered under the motto “Your coffee, our concern”, mainly through its own subsidiaries to the out-of-home segment, such as offices, companies, the hospitality sector and institutions.

In the first half of the year, there were two opposing market trends observed:

- on the one hand, geopolitical instability pushed up raw material prices and operating costs. The costs resulting from these inflationary trends could not be passed on fully to the market;on the other hand, the consequences of COVID-19 in 2022 were less significant than in 2021, except in the Dutch market, which is important for our group, where a lockdown was still in place until mid-March.

The above results also include those of the Dutch vending operator MAAS and the Belgian private label roaster SAS Koffie. They were both acquired in the second half of 2021. Without these acquisitions, EBITDA would have increased by 80 %. Investments of EUR 14.6 million were made.

In April of this year, Miko fell victim to a cyber attack. A large team of internal and external professionals took rapid action, ensuring that Miko was soon operational again and the financial consequences were minimised.

In May, Miko announced that a new flower had been discovered in its rainforest reserve. This was registered as MA(a)Sdevallia purocafeana, named after the recently acquired MAAS coffee company. Miko is using part of the proceeds from the sales of its sustainable Puro coffee to purchase rainforest worldwide, and already has more than 500,000,000 m2. This is the fourth biological species discovered in its reserve. In addition to a frog (officially called “Pristimantis puruscafeum”), there are also two orchids in the list.

Prospects

Frans Van Tilborg, CEO of the Miko Group, explains: “We can be satisfied with our performance in the first half of the year, given the well-known difficult market conditions.

In certain segments of our client base, such as government departments, working from home remains the norm for the time being. We are currently noticing a steady increase in the numbers of people returning to the office. It is not possible either to predict the future impact of the continuing geopolitical instability. This is why we are not presenting any prospects.”

Consolidated half-yearly results Miko Group

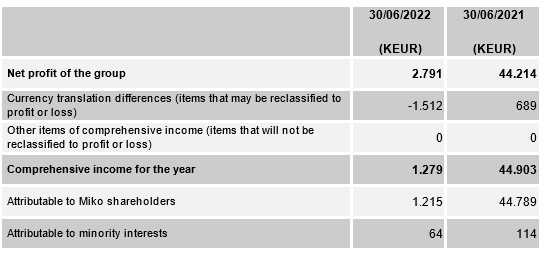

Consolidated overview of comprehensive income