TURNHOUT, Belgium – Miko, the Euronext Brussels-listed coffee service specialist, announced that the operating results of its continued recurring business in 2024 posted double-digit growth over last year. EBIT and EBITDA advanced 10% and 13%, respectively. Sales increased by 9%.

Miko has traditionally focused on the coffee service market. Under the motto “Your coffee, our care”, Miko provides a total package of hot drinks and related services to the out-of-home market, such as companies, the hospitality industry and institutions.

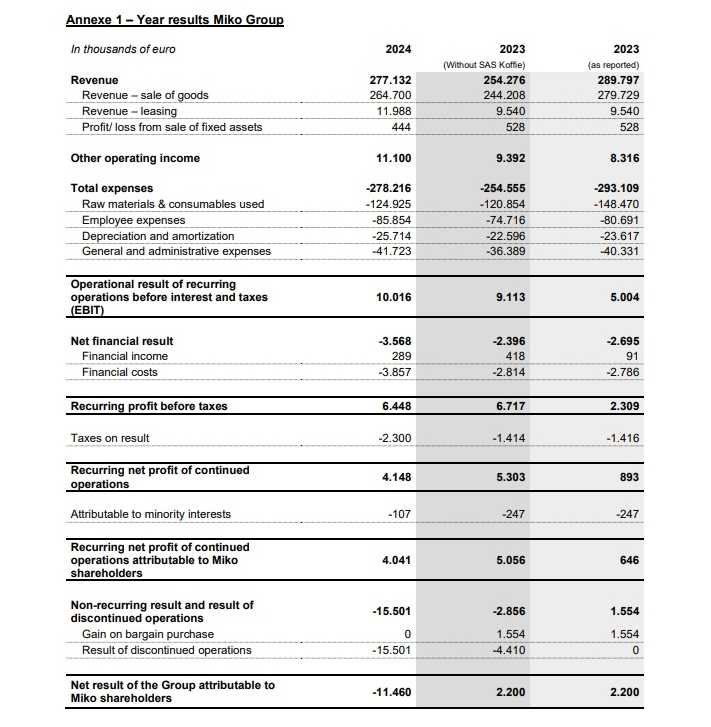

Turnover of the coffee service, in this case the continued recurring activity, grew by 9% to 277.1 mio euro.

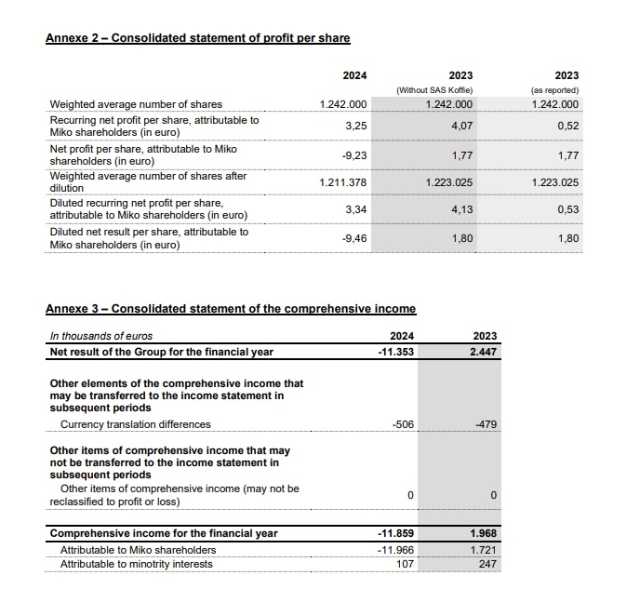

EBIT, EBITDA experienced growth of 10% to 10.0 mio euro, and 13% to 35.9 mio euro, respectively. Net profit decreased 20% to 4 mio euro. Partly due to the increase in interest of 1.1 mio euro and increasing corporate taxes, net profit dropped 20% to 4 mio euro.

Within the recurring core business, good results were recorded in all home countries. Investments in property, plant and equipment amounted to 32.2 mio euro. This mainly concerns commercial investments in coffee machines placed on rent or loan with customers.

This growth in core business is overshadowed by a non-recurring loss of 15.5 mio euro. This is the sum of 2 significant events.

On the one hand, there was exceptional revenue of 5 mio euro. To respond to the consolidation trend in the sector, the plastic processing division Miko Pac was sold in 2021 to the German company Paccor, which was then 6 times larger. Meanwhile, in the same context of scale expansion, Paccor had already been sold on to an industry peer. When Miko Pac was sold, it was stipulated, on the basis of a business plan, that an earn-out of EUR 5 million could be earned on the results of 2023, which has now been secured.

On the other hand, at the end of May it was decided to sell subsidiary SAS NV, which focused entirely on private label coffee for the retail market, to the investment company Nimbus.

This resulted in a significant loss of value and additional costs amounting to 20.5 mio euro. The strategic rationale behind the decision to acquire coffee roaster SAS at the end of 2021 was inspired by the fact that after COVID, home-based work was increasing sharply. To respond to this, diversification into the retail sector was made.

Moreover, SAS was only a 15-minute drive from the headquarters at Miko, and it could therefore also fit perfectly into a brand-new roastery that Miko is going to build. Just four months later, an armed conflict in Europe triggered explosive inflation and the retail sector came under heavy fire. SAS’s results also suffered.

Despite 2024 being a turbulent year, the Board of Directors proposes to the general meeting to pay a dividend of 1.87 euros gross per share. This is in line with last year.

Says Frans Van Tilborg, CEO of the Miko Group: “2024 was a very turbulent year. The decision to exit from SAS was very painful. We took this decision barely 2.5 years after the takeover. But sometimes you have to dare to move quickly. We are now ready as a group to focus 100% on what we are good at: coffee service.

This core activity is running well. Today there is uncertainty because of the very erratic movements in the prices of raw materials. Coffee prices have recently exploded to record highs. The coffee price index rose from 182 in early 2024 to a provisional recent historic high of 433. Calculating such increases always remains a huge challenge. The increase occurred mainly from the fourth quarter onward. From then on, margins came under pressure. A second boom occurred early this year. This will also be at the expense of 2025 margins.”

After 25 years as managing director of Miko, including 15 as CEO, Frans Van Tilborg will pass the torch to Karl Hermans as of January 1, 2026. The latter has been a board member within the group for 10

years. He headed several subsidiaries. Frans Van Tilborg will remain active and will focus on a number of international tasks. He also remains a member of the board of directors.

Miko results

About Miko

Miko has been active in coffee service for more than 200 years. The group achieved sales of 277.1 million euros in 2024. Miko is an international group with its own companies in Belgium, France, the United Kingdom, the Netherlands, Germany, Denmark, Norway, Sweden, Poland, the Czech Republic, Slovakia, and Australia.