CHICAGO, USA – Mondelēz International reported fourth quarter and FY 2022 results. “Our 2022 results demonstrate the strength and diversification of our portfolio as we delivered broad-based growth in terms of regions, categories, and brands.

We delivered strong gross profit dollar growth, driven by double-digit top-line growth supported by both pricing and volume, enabling robust cash flow generation and significant return of capital to shareholders.

These results were underscored by continued strength in emerging and developed markets as well as solid contributions from our recently acquired businesses,” said Dirk van de Put, Chairman and Chief Executive Officer.

“We made significant progress against our strategy of accelerating growth and focusing our portfolio in the attractive, resilient categories of chocolate, biscuits and baked snacks, while continuing to invest in our brands and capabilities.

We also continued to deliver strong marketplace execution amid challenging operating conditions and continued macroeconomic volatility.”

Mondelēz International: Full Year Highlights

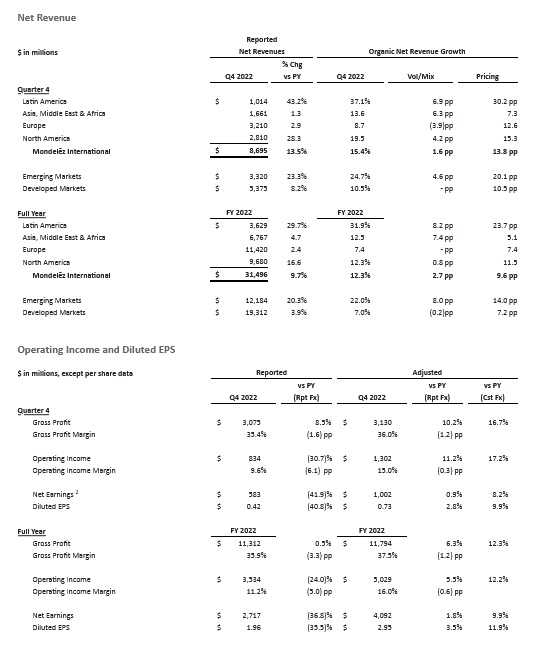

- Net revenues for the full year increased +9.7% driven by Organic Net Revenue1 growth of +12.3% with underlying Volume/Mix of +2.7%. For the fourth quarter, Net revenues increased +13.5% driven by Organic Net Revenue1 growth of +15.4% with underlying Volume/Mix of +1.6%

- Diluted EPS was $1.96, down 35.5%; Adjusted EPS1 was $2.95, up +11.9% on a constant currency basis

- Cash provided by operating activities was $3.9 billion, a decrease of $0.2 billion versus prior year; Free Cash Flow1 was $3.0 billion, down $0.2 billion versus prior year

- Return of capital to shareholders was $4.0 billion; increased dividend per share by 10%

- Announced agreement with Perfetti Van Melle to acquire our developed markets gum business in the U.S., Canada and Europe. Deal expected to close in Q4 2023.

Full Year Commentary

Net revenues increased 9.7 percent driven by Organic Net Revenue growth of 12.3 percent, and incremental sales from the company’s acquisitions, primarily Chipita, Clif Bar and Ricolino, partially offset by unfavorable currency. Pricing and volume drove Organic Net Revenue growth.

Gross profit increased $58 million, and gross profit margin decreased 330 basis points to 35.9 percent primarily driven by unfavorable year-over-year change in mark-to-market impacts from derivatives and a decrease in Adjusted Gross Profit1 margin. Adjusted Gross Profit increased $1,362 million at constant currency, while Adjusted Gross Profit margin decreased 120 basis points to 37.5 percent due to higher raw material and transportation costs and unfavorable mix, partially offset by pricing.

Operating income decreased $1,119 million and operating income margin was 11.2 percent, down 500 basis points primarily due to unfavorable year-over-year change in mark-to-market impacts from derivatives, impact from the European Commission legal matter3, higher acquisition-related costs, lower Adjusted Operating Income1 margin and higher acquisition integration costs and contingent consideration adjustments, partially offset by lower restructuring costs. Adjusted Operating Income increased $583 million at constant currency while Adjusted Operating Income margin decreased 60 basis points to 16.0 percent, with input cost inflation and unfavorable mix, partially offset by pricing and SG&A leverage.

Diluted EPS was $1.96, down 35.5 percent, primarily due to lapping prior-year net gains on equity method transactions, unfavorable year-over-year mark-to-market impacts from currency and commodity derivatives, the impact from the European Commission legal matter, higher acquisition-related costs, incremental costs incurred due to the war in Ukraine, higher acquisition integration costs and contingent consideration adjustments and higher intangible asset impairment charges, partially offset by an increase in Adjusted EPS, lower Simplify to Grow program costs and lower negative impacts from enacted tax law changes.

Adjusted EPS was $2.95, up 11.9 percent on a constant currency basis driven by strong operating gains and fewer shares outstanding, partially offset by higher interest expense and lower income from equity method investments.

Capital Return: The company returned $4.0 billion to shareholders in cash dividends and share repurchases.

Fourth Quarter Commentary

Net revenues increased 13.5 percent driven by Organic Net Revenue growth of 15.4 percent, and incremental sales from the company’s acquisitions of Chipita, Clif Bar and Ricolino, partially offset by unfavorable currency. Pricing and volume drove Organic Net Revenue growth.

Gross profit increased $242 million, and gross profit margin decreased 160 basis points to 35.4 percent primarily driven by a decrease in Adjusted Gross Profit1 margin and unfavorable year-over-year change in mark-to-market impacts from derivatives, partially offset by lower restructuring costs. Adjusted Gross Profit increased $473 million at constant currency, while Adjusted Gross Profit margin decreased 120 basis points to 36.0 percent due to higher raw material and transportation costs and unfavorable mix, partially offset by pricing.

Operating income decreased $370 million and operating income margin was 9.6 percent, down 610 basis points primarily due to impact from the European Commission legal matter, higher restructuring costs, unfavorable year-over-year change in mark-to-market impacts from derivatives, higher acquisition integration costs and contingent consideration adjustments, lower Adjusted Operating Income1 margin and higher acquisition-related costs, partially offset by lower divestiture-related costs. Adjusted Operating Income increased $201 million at constant currency while Adjusted Operating Income margin decreased 30 basis points to 15.0 percent, with input cost inflation and unfavorable mix, partially offset by pricing and SG&A leverage.

Diluted EPS was $0.42, down 40.8 percent, primarily due to the impact from the European Commission legal matter, unfavorable year-over-year mark-to-market impacts from currency and commodity derivatives, lower restructuring costs, higher acquisition integration costs and contingent consideration adjustments, partially offset by an increase in Adjusted EPS and 2017 malware incident recoveries, net.

Adjusted EPS was $0.73, up 9.9 percent on a constant currency basis driven by strong operating gains and fewer shares outstanding, partially offset by higher taxes, higher interest expense and lower income from equity method investments.

Capital Return and Renewal of Share Repurchase Program: The company returned $0.7 billion to shareholders in cash dividends and share repurchases. The Board of Directors also approved a new program authorizing the repurchase of up to $6.0 billion of our Class A common stock through December 31, 2025. This share repurchase program authorization replaces our existing authorization.