DEERFIELD, Ill., U.S. – Mondelēz International, Inc. reported on Tuesday its first quarter 2017 results. “We had a solid start to the year despite challenging market conditions,” said Irene Rosenfeld, Chairman and CEO.

“We delivered both top-line organic growth and strong margin expansion in the quarter, while also making critical investments for our future.

We remain confident in and committed to our balanced strategy for both top- and bottom-line growth, continuing to focus on what we can control to deliver long-term value creation for our shareholders.”

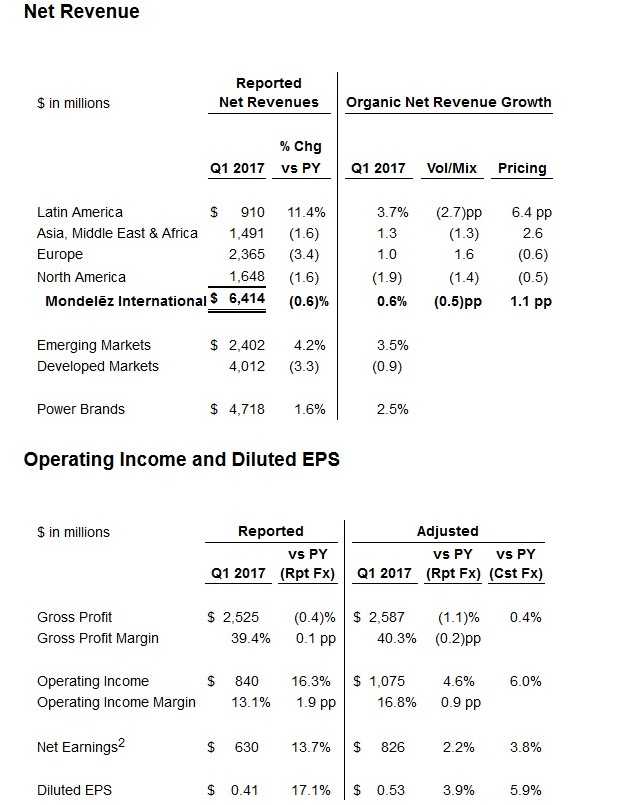

- Net revenues decreased 0.6 percent, driven by currency headwinds. Organic Net Revenue increased 0.6 percent, with growth in all regions except North America.

- Gross profit margin was 39.4 percent, an increase of 10 basis points driven primarily by lower Restructuring Program implementation costs. Adjusted Gross Profit margin was 40.3 percent, a decrease of 20 basis points, driven by unfavorable mix impacts and higher input costs, partially offset by strong net productivity and improved pricing.

- Operating income margin was 13.1 percent, up 190 basis points, reflecting the Adjusted Operating Income gains and the benefit from the settlement of a Cadbury tax matter. Adjusted Operating Income margin increased 90 basis points to 16.8 percent due primarily to continued reductions in overhead costs and supply chain productivity savings.

- Diluted EPS was $0.41, up 17 percent, driven primarily by operating gains and the benefit from the settlement of a Cadbury tax matter.

- Adjusted EPS was $0.53 and grew 6 percent on a constant-currency basis, driven primarily by operating gains.

- Capital Return: The company repurchased over $470 million of its common stock and paid approximately $300 million in cash dividends.

2017 Outlook

2017 Outlook

Mondelēz International provides guidance on a non-GAAP basis, as the company cannot predict some elements that are included in reported GAAP results, including the impact of foreign exchange. Refer to the Outlook section in the discussion of non-GAAP financial measures below for more details.

The company continues to expect Organic Net Revenue to increase at least 1 percent in 2017 and Adjusted Operating Income margin in the mid-16 percent range.

The company also expects double-digit Adjusted EPS growth on a constant-currency basis.

The company estimates currency translation would reduce net revenue growth by approximately 1 percent3 and Adjusted EPS by approximately $0.023. In addition, the company expects Free Cash Flow1 of approximately $2 billion.

Conference Call

Mondelēz International will host a conference call for investors with accompanying slides to review its results at 5 p.m. ET today.

A listen-only webcast will be provided at www.mondelezinternational.com. An archive of the webcast will be available on the company’s web site. The company will be live tweeting the event at www.twitter.com/MDLZ.