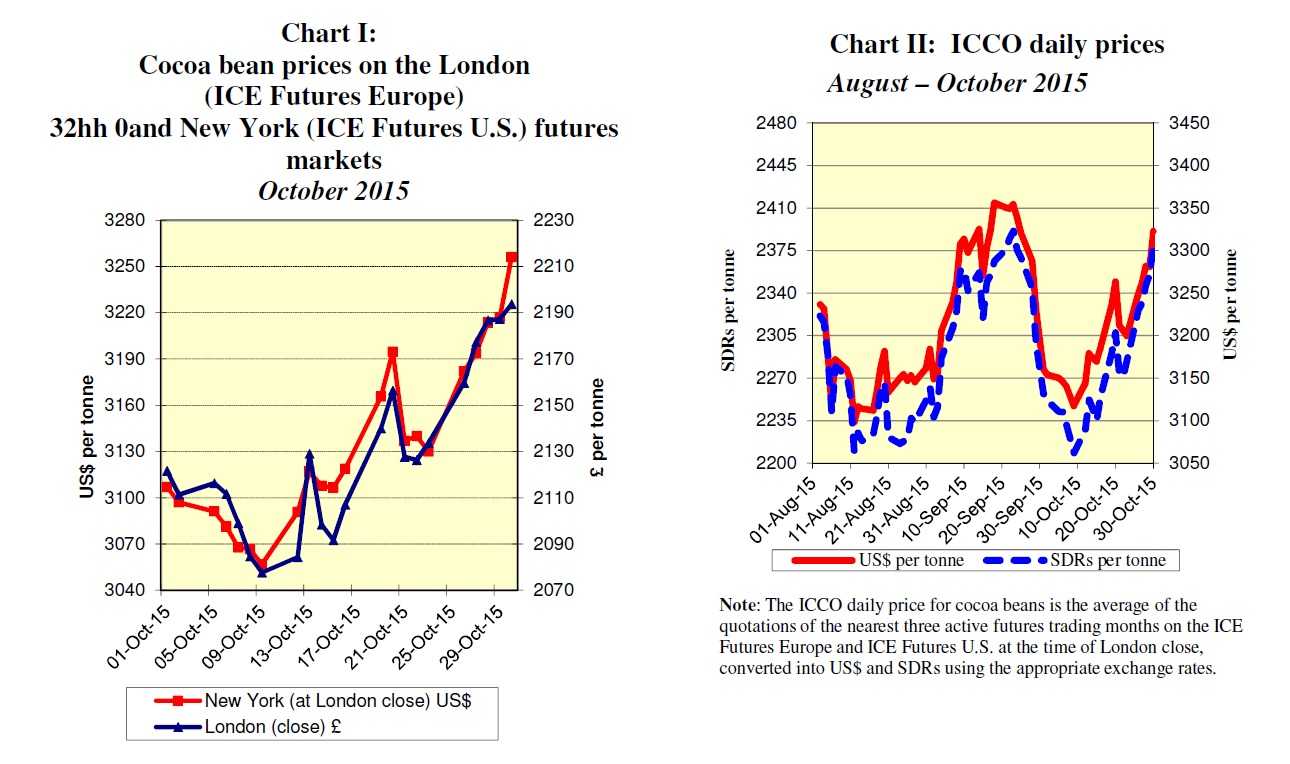

The current review of the cocoa market situation reports on price movements on the international markets during the month of October 2015. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets in October.

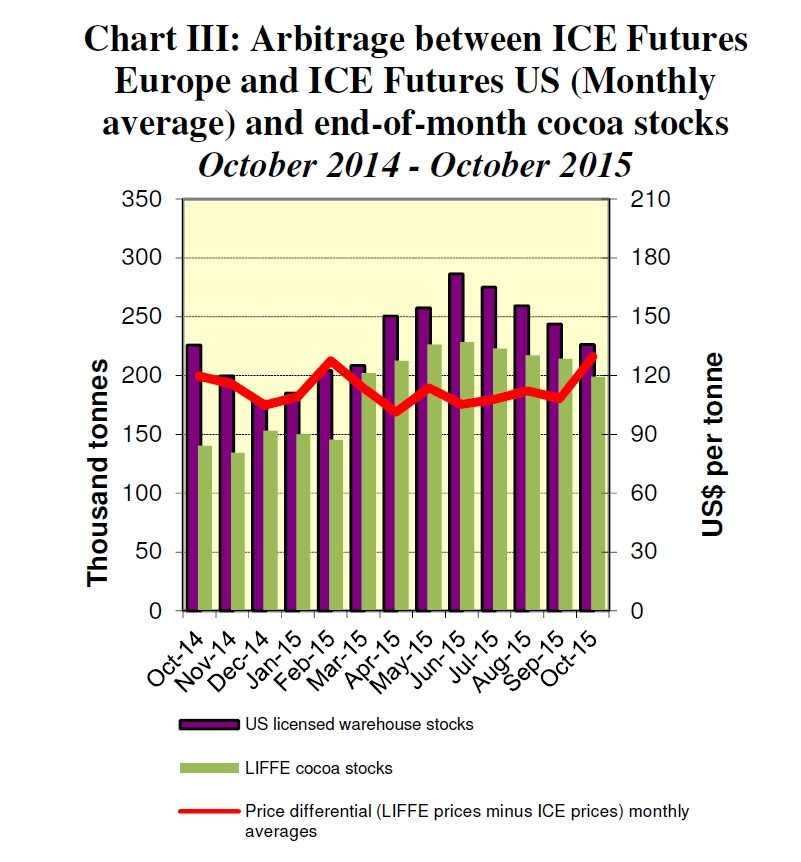

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from August to October 2015, while Chart III illustrates the end-of-month stocks in licensed warehouses in Europe and in the United States and the arbitrage between the ICE futures markets in London and New York.

Price movements

In October, the ICCO daily price averaged US$3,198 per tonne, down by US$80 compared with the average price recorded in the previous month (US$3,278) and ranged between US$3,117 and US$3,323 per tonne.

During the beginning of the 2015/2016 cocoa year, the downward trend in cocoa futures prices initiated at the end of the previous month, continued until the end of the second week of October.

Indeed, under the influence of reports of higher than previously expected figures for the 2014/2015 total crops for both Côte d’Ivoire and Ghana, of 1,794 million tonnes and approximately 740,000 tonnes respectively, coupled with strong weekly arrivals in Côte d’Ivoire in the new season, cocoa futures prices lost more than seven per cent of their value from the peaks reached in September, at £2,078 per tonne in London and at US$3,057 per tonne in New York.

Some profit-taking activities also contributed to these price falls within both markets during that period.

Some profit-taking activities also contributed to these price falls within both markets during that period.

Thereafter, moving towards the end of the month, cocoa futures prices followed an upward trend.

Although strong arrivals and purchases data from major producing countries as well as the release of poor North American and Asian third quarter grindings data were expected to play a bearish tone on cocoa prices, concerns related to the potential impact of dry weather conditions in both Côte d’Ivoire and Ghana in the July-September period on the main harvest were the fundamental reasons behind the increase in cocoa futures prices.

The prospect of presidential elections in the main cocoa producing country, Côte d’Ivoire, held on 25 October, also added a bullish tone.

However, the elections went peacefully, and indeed the incumbent President, H.E Alassane Ouattara, won the election by a landslide majority.

Thus, during the last week of the month, cocoa futures prices attained their highest level for the month, at £2,194 per tonne in London and at US$3,256 per tonne in New York.

Certified warehouse stocks of cocoa beans

As shown in Chart III, cocoa stocks in licensed warehouses in the United States and certified stocks held by ICE Futures Europe nominated warehouse-keepers both decreased.

Compared to the previous month, volumes fell from 243,652 tonnes to 226,414 tonnes in New York and from 214,210 tonnes to 198,900 tonnes in London. Moreover, the arbitrage spread (difference in price) between ICE Futures Europe and ICE Futures US markets decreased to an average of US$134 in October.

Supply and demand situation

The 2015/2016 cocoa harvest started very strongly in West Africa, in contrast to the views of some analysts who had anticipated a large supply deficit for the current crop year.

Indeed, news agency data estimated that total cocoa arrivals at Ivorian ports as at 1 November had reached approximately 280,000 tonnes since the start of the current cocoa season, being approximately 64,000 tonnes higher compared with the corresponding period for the previous year.

In Ghana, cocoa purchases recorded by the Ghana Cocoa Board totalled 192,128 tonnes as at 22 October. This represented a 118% increase compared with the same period for the previous year.

On the demand side, the third quarter European grindings data showed a two per cent increase compared with the same period for the previous year, rising to 334,362 tonnes. However, North American grindings fell by 10.01% year-on-year to 124,229 tonnes, but increased by more than three per cent from the previous quarter.

In Asia, compared with the previous year, industry data showed a 1.6% fall to 149,162 tonnes, representing a five per cent increase from the previous quarter. These largely anticipated data reflect the relative weakness of chocolate demand worldwide.

At the end of November, the ICCO Secretariat will release its revised supply and demand estimates for the 2014/2015 cocoa year in its Quarterly Bulletin of Cocoa Statistics.