VILLORBA, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A. (MZB Group) – one of the leading brands worldwide in the production, processing and marketing of roasted coffee, listed on the Milan Stock Exchange – approved yesterday the First Half Report as at June 30, 2020.

Volumes increased by 1.0% (-5.2% on a comparable basis*) compared to the first half 2019. Revenues amounted to euro 404.0 million compared to euro 439.5 million of first half 2019, or an 8.1% decrease at current exchange rates , an 8.5% decrease at constant exchange rates and a 10.8% decrease on a comparable basis.

Gross profit reached euro 169.5 million compared to euro 196.5 million of the first half 2019 with the margin on revenues of 41.9% compared to 44.7% of the first half 2019.

(*) comparable basis: at constant forex and LFL (like-for-like, at the same perimeter, excluding acquisitions of Café Pacaembu completed in October 2019 and Bean Alliance Group, completed at the end of January 2019).

Massimo Zanetti, Chairman and Chief Executive Officer of MZB Group, said: “The results for the first half of 2020 have been particularly affected by the global measures aimed at containing the spread of Covid-19. In particular, most markets with significant exposure to the Food Service channel suffered an abrupt slowdown beginning in March, partially offset by the uptrend in the Mass Market channel in all geographical areas.

The results recorded by the Food Service channel in June indicate a significant recovery, and this positive performance was also confirmed in July, with encouraging signs in various markets.

In addition, I am proud to note that our sustainable, certified and organic products continue to deliver solid results and that the e-commerce channel is growing rapidly.

At present, the impact on the performance of the year is still unclear, given the constantly-evolving context, and probably another couple of months will be necessary to get a clearer picture. Meanwhile, we are implementing all the initiatives necessary to preserve the Group’s solidity and carrying out cost containment actions in all geographical areas.

I am convinced that it is in this environment of extreme discontinuity that the strengths of our company, which is at once global and local, and which has always harnessed and focused on the new tendencies and original habits in the various markets, will enable us to move quickly to identify new trends, such as sustainable products, and to create significant opportunities for improvement.”

Volumes

The first half of the year has been characterized by the progressive reduction in volumes in the Food Service channel, impacted by the measures adopted by governments worldwide to combat the spread of the virus Covid-19, with the full closure of all non-core activities, in most of the country around the world for several weeks.

In particular, April was more affected by these lockdown measures, and, as the restrictions were gradually eased, May and especially June saw a recovery that was increasingly robust.

In the six months of 2020, the roasted coffee sales volumes of MZB Group were equal to 62.7 thousand tons, +1.0% compared with the first half 2019, -5.2% on a comparable basis.

At the geographical level, the Americas recorded 9.2% growth on the first half of 2019, driven by the positive performance of all channels; on a comparable basis, volumes declined slightly, by 1.4%. Northern Europe recorded an increase in volumes of 1.1% on the first half of 2019 due to the positive performance of the Mass Market channel, which offset the decline recorded in the Food Service channel.

Southern Europe, with a decline in volumes of 17.9% compared to the first half of 2019, was particularly impacted by the weak performance of the Food Service and Private Label channels. The Asia-Pacific and Cafés area was down by 14.2% (-19.0% on a comparable basis) compared to the first half of 2019, due to the Food Service and Private Label channels, partially offset by the growth of the Mass Market channel.

MZB Group – Consolidated Revenues

MZB Group ‘s consolidated revenues amounted to Euro 404.0 million showing a decrease of Euro 35.4 million (-8.1%) compared to the first half of 2019. This decline is mainly due to the decrease of roasted coffee sales price (-9.4%) partially offset by the increase of the roasted coffee sales volumes (+0.9%) compared to the first half of 2019 and by the favorable impact of foreign exchange rates (+0.4%) compared to the first half of 2019.

The decrease of roasted coffee sales price has been, in turn, impacted by (i) the measures adopted by governments worldwide to limit the Covid-19 pandemic, which heavily penalised the mix in products and sales channels, and by (ii) the decrease of the cost of raw material (green coffee). Revenues on a comparable basis (at constant forex and with the same perimeter) decreased 10.8% compared to the first half of 2019.

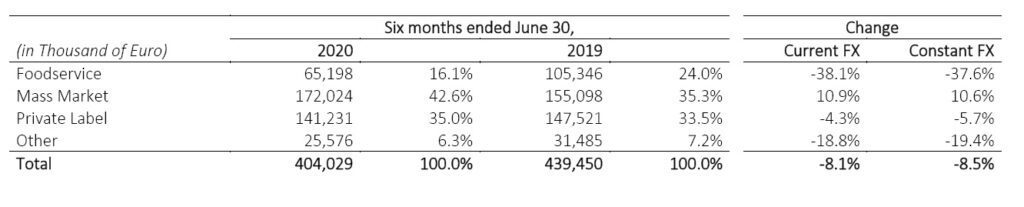

MZB Group – Revenues by Channel

The revenues from the Food Service channel were down 37.6% at constant FX (-38.9% on a comparable basis) compared with the first half of 2019 as a result of the complete closure of all non-essential activities in all countries to limit the spread of Covid-19. Mass Market increased 10.6% at constant FX (+8.2% on a comparable basis) compared with the first half of 2019 and showed to positive performance of all countries. The Private Label revenues decreased 5.7% at constant FX (-8.6% on a comparable basis).

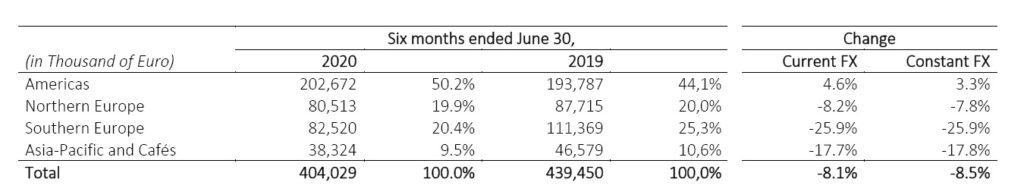

MZB Group – Revenues by Region

Revenue in the Americas, at Euro 202.7 million in the first half of 2020, was up 3.3% at constant exchange rates (- 1.2% on a comparable basis) compared with the first half of 2019, attributable to a positive performance of the Mass Market channel.

Revenue generated in Northern Europe, decreased 7.8% at constant exchange rates compared to the first half of 2019, showing a decrease of sales of the Food Service channel, starting in March, partially offset by a solid growth of the Mass Market channel.

Revenue in Southern Europe decreased 25.9% at constant exchange rates compared to the first half of 2019 due to the negative performance of the Food Service channel.

Revenues from Asia Pacific, which also include those from the international network of cafés, amount to Euro 38.3 million, a decrease of 19.9% on a comparable basis, due to the decline of the Food Service channel, partially offset by the growth of Mass Market channel.

Gross Profit

Gross Profit at Euro 169.5 million in the first six months of 2020 shows a decrease of Euro 27.0 million compared with the first half of 2019 (-13.7%).

This is mainly explained by the decline of Gross Profit resulting from the sales of roasted coffee only partially offset by the impact of the exchange rates (+0.3%).

The trend in Gross Profit from the sale of roasted coffee is mainly due to the effect of the aforementioned pandemic on the mix sold in 2020, in addition to the trends in sales and purchase prices respectively of roasted and green coffee (-14.0%), partially compensated by the positive impact of the increase of volumes (+1.0%). In percent of revenues the Gross Profit is 41.9% compared with 44.7% of the first half of 2019.

EBITDA Adjusted

EBITDA adjusted amounts to Euro 14.7 million in the first half 2020, compared with Euro 35.7 million of the first half 2019. In addition to the factors commented on at the level of gross profit, this change was influenced by the positive impact of exchange rate fluctuations of Euro 0.1 million and by the decrease in operating costs of Euro 6.4 million.

On a comparable basis, this decline was primarily driven by the cost containment measures taken to mitigate the impact of Covid-19.

Adjusted EBITDA excludes non-recurring costs incurred, amounting to Euro 2.8 million (Euro 1.8 million in the first half of 2019). These costs are primarily related to efficiency projects in America as well as the accrual to the bad debt provision made exceptionally to take into account the likely impacts of potential credit loss due to the Covid19 pandemic.

Operating Income (EBIT)

Operating income (EBIT) is equal to Euro -12.4 million, a decrease of Euro 24.1 million compared to the first half of 2019. In addition to that disclosed about EBITDA, the decrease is attributable to the increase in amortization and depreciation, for Euro 2.1 million.

Net Result

Net result is equal to Euro -17.0 million in the first half 2020, a decrease of Euro 20.4 million compared to the first half of 2019. This performance, in addition to what was previously described for the operating profit, is also due to the combined effect of:

- the decrease in the shares of losses of companies accounted for using the equity method, amounting to Euro 0.7 million;

- the decrease in income taxes amounting to Euro 3.0 million, mainly due to lower profit before taxes compared with the first half of 2019.

Net Debt

Net debt before IFRS 16 effect is equal to Euro 240.6 million as of June 30, 2020, compared with Euro 217.4 million as of December 31, 2019. The adoption of IFRS 16 accounting standard increased the net debt of Euro 46.7 million as of June 30, 2020 and Euro 49.1 million as of December 31, 2019. Net debt (including IFRS 16 effect) is equal to Euro 287.3 million at June 30, 2020 an increase of Euro 20.8 million compared to December 31, 2019. This increase is mainly due to the following:

- Free Cash Flow negative for Euro 9.4 million

- Dividend paid for Euro 6.5 million

- Interest paid in the first six months of 2020 amounting to Euro 3.4 million

Forecast for operations and significant subsequent events – update in relation to Covid-19 impacts

The results for the first half of the year were affected by the Covid-19 health emergency and by the containment measures adopted to combat the spread of the virus. In particular, April was more affected by these lockdown measures, and, as the restrictions were gradually eased, May and June saw a recovery that was increasingly more robust than initially forecast.

The preliminary results for July also indicate that this trend continues. Given the continuously evolving context causing uncertainty, at the moment Management confirms the decision taken during the Board of Directors of April 23 to suspend the financial guidance to the market, disclosed on June 5, 2020 before the outbreak of Covid-19 pandemic.