VILLORBA, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A., one of the leading brands worldwide in the production, processing and marketing of roasted coffee and other selected categories of colonial products, listed on the Milan Stock Exchange (MZB.MI), approved on May 10, 2018, the Interim Financial Report as at March 31st 2018.

Massimo Zanetti, the Group’s Chairman and Chief Executive Officer, said:

“Massimo Zanetti said: “The results achieved in the first quarter of 2018 confirm the success and the efficiency of our strategy, which is focused on increasing profitability, thanks to the progressive improvement of the product and channel mix.

The revenue of the period is substantially stable at organic level (-2.6%), with the Food Service channel growing strongly, thanks to the positive performance of all the main areas.

Specifically, robust growth was recorded in Asia Pacific (+10.7% at constant FX). Furthermore, the projects to improve operating efficiency launched in some key markets, such as Italy and the Iberian Peninsula, and the general cost control enabled the Group to improve profitability indicators.

Based on the results achieved and the positive expectations, the Group confirms the guidance of the year which envisages a solid increase in profitability.”

Volumes

In the first three months of 2018, the roasted coffee sales volumes of Massimo Zanetti Beverage Group S.p.A. remained substantially in line with the previous year (30.6 thousand tons compared with 30.9 thousand tons of the first quarter 2017).

This trend is due to the already known decrease in the Private Label channel (-2.6%) and the stable volumes of the Mass Market channel (-0.6%), while the Food Service channel performed well (+5.1%), in line with the Group’s strategy which focuses on a product mix based on highly-profitable products.

As for the geographical areas, the decrease mainly concerned the Americas (0.9 thousand tons) in the Private Label and Mass Market channels and has been partially offset by the positive performance of Southern Europe (increased by 0.5 thousand tons) mainly in Mass Market and Private Label channel and, to a lower extent, by the Northern Europe and Asia-Pacific performance.

Consolidated Revenues

The Group’s consolidated revenues amounted to Euro 211.2 million in the first quarter of 2018, compared to Euro 233.6 million of the first quarter of the prior year.

The decrease of Euro 22.4 million is mainly explained by external factors: the foreign exchange rates (due to the noticeable strengthening of the Euro against the US dollars) had a negative impact of -6.7% (equal to Euro 15.7 million) and the application of IFRS 15 on 2017 revenues had a negative impact of -0.3% (equal to Euro 0.7 million).

Excluding those external factors, at organic level, revenues slightly decreased 2.6% (equal to Euro 6.1 million) mainly due to:

- the decrease in roasted coffee sales volumes (-0.9% equal to 2.1 million); and

- the slight decrease of roasted coffee sales price (-1.7% equal to Euro 3.4 million) as a consequence of the decrease of the cost of raw material (green coffee).

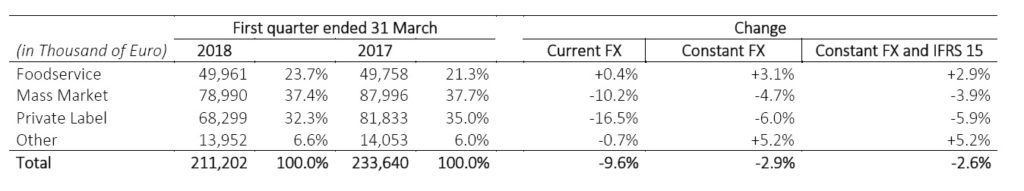

Revenues by Channel

Revenues from the Food Service channel, which account for 23.7% of the Group’s revenues, amount to Euro 50.0 million, showing an organic growth of 2.9%, thanks to the solid performance recorded in all major markets.

Performance of the Mass Market channel and Private Label channels equal to 37.4% and 32.3% respectively of the Group’s revenues is explained by the Americas and the slight decrease of roasted coffee sales price as a consequence of the reduction of the cost of green coffee, as explained before.

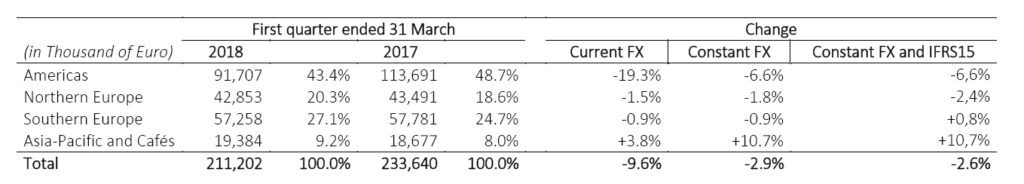

Revenues by Region

Revenues from the Americas amount to Euro 91.7 million (43.4% of the Group’s revenues), a 6.6% organic reduction. This performance is explained by the decrease of the Mass Market and Private Label channels.

Revenues from Europe are slightly negative due to the reduction in sales prices as a consequence of the decrease in the purchase price of green coffee and a different timing of the promotional activities in some countries.

Revenues from Asia-Pacific, which also include those from the international network of cafés, amount to Euro 19.4 million, up by 10.7% organic.

Gross Profit

Gross profit amounts to Euro 93.2 million, a Euro 3.6 million decrease compared with the first quarter of 2017. This decrease is explained by external factors: the unfavorable impact of exchange rates (-5.4%) and the impact of the change of IFRS 15 on 2017 revenues (-0.7%).

Excluding those external factors, the organic gross profit increased Euro 2.3 million (+2.4%), mainly due to the sales of roasted coffee (+2.3%). This increase is due to the positive trends of sales prices and channel mix and the reduction in the raw material cost -green coffee- (+3.1%), partially offset by the decrease in roasted coffee volumes (-0.8%).

In percent of revenues the Gross Profit increased 270 basis points (from 41.4% of revenues to 44.1%).

Ebitda

EBITDA amounts to Euro 15.2 million (7.2% on revenues), compared to Euro 13.9 million in 2017 (6.0% on revenues), up by 9.4%.

In addition to the comments already set forth with regard to Gross Profit, this result is mainly due to the slight increase of costs (equal to Euro 0.3 million) and the negative impact of exchange rate fluctuations (Euro 0.8 million).

Operating Income (Ebit)

Operating income (EBIT) is equal to Euro 6.4 million compared to Euro 4.8 million of the first quarter of 2017. In addition to that disclosed about adjusted EBITDA, the decrease is mainly attributable to the decrease in amortization and depreciation.

Net Profit

The net profit for the year of Euro 2.8 million, improved by 20.6% compared to first quarter of 2017. In addition to what disclosed above, the increase is mainly due to the combined effect of the increase in net financial charges mainly due to foreign exchange losses and the reduction in income taxes, mainly as a consequence of the changes in the tax legislation introduced by the US government.

Net Debt

Net debt amounting to Euro 190.5 million is stable compared to 191.0 million at December 31, 2017. During the first quarter the net recurring investments amount to Euro 5.8 million compared to Euro 7.9 million of the first quarter of 2017.

Forecast for operations and significant subsequent events

In view of the results achieved in the first quarter of 2018 and considering current trends as well as assuming a substantial stability of exchange rates and the absence of extraordinary transactions, management expectations for 2018 is unchanged:

▪ revenues increase of approximately 2.0% – 4.0%

▪ Ebitda adjusted increase of approximately 5.0% – 8.0%

▪ a reduction in net debt to below Euro 180 million.

Conference call to present first quarter 2018 financial results

The Group’s First Quarter 2018 results were presented during the conference call held yesterday, May 10, 2018 at 5:45 CET.

Digital Playback service will be available for 8 days, dialling the following numbers: +1 718 705 8797 (US and Canada), +39 02 72495 (Italy), +44 1 212 818 005 (UK) with the following passcode: 917#

The presentation will be available on the storage system (www.emarketstorage.com). The recording file will be available on the company website.

Declaration by the manager in charge of the company’s financial reports

The Manager in charge of the Company’s financial reports, Leonardo Rossi, pursuant to paragraph 2 of Article 154-bis of Italy’s Consolidated Law on Finance (TUF), declares that, based on his knowledge, the accounting information contained in this press release corresponds to the documented results, books and accounting records.