VILLORBA, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A. (Mzb Group), one of the leading brands worldwide in the production, processing and marketing of roasted coffee, listed on the Milan Stock Exchange (MZB.MI), approved on Thursday the Interim Financial Report as at March 31st 2020.

In the first three months of 2020, the roasted coffee sales volumes of Massimo Zanetti Beverage Group were equal to 34.1 thousand tons, +9.6% compared with the first quarter 2019, +3.6% on a comparable basis.

The first quarter of the year saw the positive performance of coffee sales volumes in the first two months and the progressive reduction in volumes in the Food Service channel, starting on March 9, after the full closure of all noncore activities, first in Italy and subsequently in most of the country of Europe and around the world.

With respect to the geographical areas, the increase related to the Americas +16.2% compared with the same period of last year (+6.1% on a comparable basis) thanks to a positive performance on all channels. Northern Europe increased +0.9% thanks to a positive performance of the Mass Market channel, which offset the decline of the Food Service channel.

Southern Europe, which recorded a decrease of 0.9% compared with the first quarter 2019, has been affected by the Italian and Iberian performance in the Food Service channel. Asia, Pacific and Cafès division was up 17.4% (+6.8% on a comparable basis) versus same period of last year thanks to the positive performance of the Mass Market and Private Label channel which have offset the decline experienced in the Food Service channel.

Consolidated Revenues

Consolidated revenues of Mzb Group amounted to Euro 222.8 million showing an increase of Euro 5.1 million (+2.3%) compared to the first quarter of 2019. This increase is a result of:

- the roasted coffee sales volumes (+8.3%) compared to the first quarter of 2019

- the foreign exchange rates (+1.0%) compared to the first quarter of 2019

- the decrease of roasted coffee sales price (-7.0%) as a consequence of the decrease of the cost of raw material (green coffee) and to the change in product and channel mix, mainly as a result of lower sales in the Food Service channel.

Revenues on a comparable basis (at constant forex and with the same perimeter) decreased 1.0% compared to the first quarter of 2019.

Massimo Zanetti, the Chairman and Chief Executive Officer of Mzb Group, said:

“The results for the first quarter of 2020 are affected by the national and global measures aimed at containing the spread of Covid-19. After performing positively in January and February, the Food Service channel suffered a sharp slowdown in the main markets, partially offset by the progress in the Mass Market and Private Label channels.

At present, the impact on the performance of the year is still unclear, given the constantly-evolving context, the inevitable uncertainty surrounding the duration of the current restrictive measures, the timing of the reopening process and the consequent speed of economic recovery. Probably, another two or three months will be necessary to get a clearer picture. Meanwhile, we are implementing all the initiatives necessary to preserve the Group’s solidity and cost containment actions in all geographical areas.

We are a global company that has always valued and respected the local trends and habits of the various markets: this is one of our distinctive features and the basis for building confidence with our consumers around the world. In this respect, I am proud to say that, at this particular time, one of our brands, Kulta Katrina, has become the leading brand on the Finnish market, thereby rewarding management’s efforts to develop new, certified and organic products. Coffee is present in every moment of our lives and I believe that, even in this context of great discontinuity, improvement opportunities can be identified thanks to our strong desire to start again successfully.”

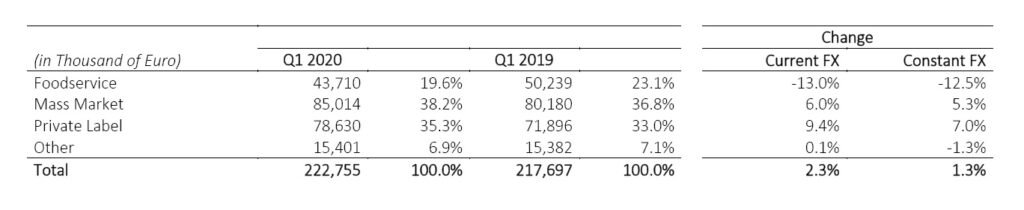

Mzb Group: Revenues by channel

The revenues from the Food Service channel were down 12.5% (-14.4% on a comparable basis) compared with the first quarter of 2019 as a result of the complete closure of all non-essential activities in all countries to limit the spread of Covid-19.

Mass Market increased 5.3% at constant FX (+2.7% on a comparable basis) compared with the first quarter of 2019 and showed to positive performance of all countries.

The Private Label revenues increased 7.0% (+4.4% on a comparable basis) thanks to positive development of all areas.

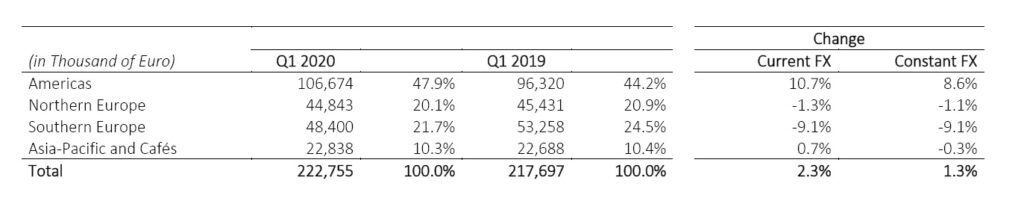

Revenues by region

Revenue in the Americas, at Euro 106.7 million in the first quarter of 2020, was up 8.6% at constant exchange rates compared with the first quarter of 2019, attributable to a positive performance of all channels.

Revenue generated in Northern Europe, decreased 1.1% at constant exchange rates compared to the first quarter of 2019, showing a decrease of sales of the Food Service channel in March partially offset by a solid growth of the Mass Market channel.

Revenue in Southern Europe decreased 9.1% compared to the first quarter of 2019 due to the negative performance of the Food Service channel while Mass Market and Private Label showed positive growth.

Revenues from Asia Pacific, which also include those from the international network of cafés, amount to Euro 22.8 million, a decrease of 4.5% on a comparable basis, due to the decline of the Food Service channel, partially offset by the solid growth of Mass Market and Private Label channels.

Gross Profit

Gross Profit at Euro 96.3 million in the first three months of 2020 shows a decrease of Euro 0.7 million compared with the first quarter of 2019 (-0.8%). This is mainly explained by the decline of Gross Profit resulting from the sales of roasted coffee only partially offset by the impact of the exchange rates (+0.6%).

The increase in Gross Profit from the sale of roasted coffee is mainly due to the trends in sales and purchase prices respectively of roasted and green coffee and the different mix in the sales channels in the first quarter 2020 and 2019 (-11.4%), partially compensated by the positive impact of the increase of volumes (+9.6%). In percent of revenues the Gross Profit is 43.2% compared with 44.6% of the first quarter of 2019.

Ebitda

EBITDA amounts to Euro 12.9 million in the first quarter 2020, compared with Euro 17.2 million of the first quarter 2019, a decrease of Euro 4.2 million. The result is mainly due to the factors mentioned above impacting Gross Profit, and the combined effect of:

- the positive impact of exchange rate fluctuations (Euro 0.1 million)

- and the increase in operating costs (of Euro 3.0 million) driven also by the acquisitions completed during 2019. On a comparable basis the increase is related to the personnel costs, as a result of the strengthening of the sales and marketing structure, partly offset by lower services costs.

Operating Income (Ebit)

Operating income (EBIT) is equal to Euro 0.8 million, a decrease of Euro 5.3 million compared to the first quarter of 2019. In addition to that disclosed about EBITDA, the decrease is attributable to the increase in amortization and depreciation, for Euro 1.1 million.

Net Result

Net result is equal to Euro -3.3 million, a decrease of Euro 5.7 million compared to the first quarter of 2019. This performance, in addition to what was previously described for the operating profit, is also due to the combined effect of:

- the increase in net finance costs for Euro 1.5 million, mainly due to:

- exchange losses for Euro 1.8 million;

- higher interest charges for Euro 0.2 million referred to bank loan contracts only partially offset by the decrease of the net financial expenses of the valuation at fair value of derivative contracts on interest rates for Euro 0.5 million;

- the decrease in the shares of losses of companies accounted for using the equity method, amounting to Euro 0.2 million;

- the decrease in income taxes amounting to Euro 1.0 million mainly due to lower profit before taxes compared with the first quarter of 2019.

Net Debt

Net debt is equal to Euro 289.7 million at March 31, 2020 an increase of Euro 23.2 million compared to December 31, 2019. This increase is mainly due to the following:

- free Cash Flow impact of Euro 19.3 million, mainly due to the net working capital absorption

- interest paid in the first three months of 2020 amounting to Euro 2.2 million

- exchange rate differences and other variations for Euro 1.7 million

Mzb Group: Forecast for operations and significant subsequent events – update in relation to Covid-19 impacts

After the end of 2019 and after the approval of results for the financial year ended 31 December 2019 by the Board of Directors of Mzb Group, held on March 5, 2020, the global outburst of the pandemic COVID-19 emergency caused an extreme pressure on national health systems and the need for the Government to issue measures to contain the further outbreak of the virus.

The Government’s measures deeply influenced social and working habits of individuals and the global economy as well affecting the dynamics of the distribution channels, including the foodservice, which is one of the sales channels of Massimo Zanetti Beverage Group.

Given the continuously evolving context causing uncertainty on the duration of the lockdown, the timeline for the reopening process and the subsequent speed of economic recovery, at the moment Management confirms the decision taken during the Board of Directors of April 23 to suspend the financial guidance to the market, disclosed on March 5, 2020 before the outbreak of Covid-19 pandemic.