VILLORBA, Treviso, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A. (MZB Group), one of the leading brands worldwide in the production, processing and marketing of roasted coffee, listed on the Milan Stock Exchange (MZB.MI), approved on March 5, 2020 the draft consolidated results for the financial year ended 31 December 2019 and proposed a dividend of 0.19 euros per share, pay out 42.6%.

Massimo Zanetti, the Group’s Chairman and Chief Executive Officer, said: ‘In 2019, the turnover rose by 2.6% at current forex, highlighting a progressively improving trend over the recent months. Specifically, the Food Service and Mass Market channels improved in all the main markets in the fourth quarter of the year.

Sustainable products performed particularly well, including the San Marco bio-compostable capsules, which were awarded product of the year 2019 in France, our Bean Ground and Drunk Australian coffee, the first certified organic coffee in Australia which was crowned Certified Organic Non-Alcoholic Beverage of the Year 2019, and the new Segafredo Premium D’Arome Bio blend, which brought MZB Group back to head the rankings of the products for the year 2020 in France.

MZB Group: Key Figures

- Revenues: euro 914.5 million compared to euro 891.2 million of 2018; +2.6% at current exchange rates, +0.2% at constant exchange rates. volumes: +2.8%;

- Gross Profit: euro 407.7 million, +4.9% compared to euro 388.8 million 2018 with the margin on revenues of 44.6% compared to 43.6% (+100 basis points);

- Ebitda Adjusted euro 84.0 million, +13.9% compared to 2018; excluding ifrs 16 effects *: euro 73.8 million, stable compared to euro 73.7 million of 2018

- Ebitda: euro 80.5 million, +13.0% compared to 2018

- Net Profit adjusted and excluding ifrs 16 effects *: euro 18.2 million, -8.6% compared to 2018

- Net Debt excluding ifrs 16 effects: euro 219.3 million compared to euro 174.7 million at december 31, 2018 (euro 194.0 million at december 31, 2019 excluding ifrs 16 effect and the acquisition of Café Pacaembu)

- proposed dividend 0.19 euros per share, pay out 42.6%

(*) before non-recurring items of Euro 3.5 million and excluding the effects of the adoption of IFRS 16 accounting standard.

Volumes

In 2019 the roasted coffee sales volumes of Massimo Zanetti Beverage Group were equal to 130.9 thousand tons, +2.8% compared with 2018.

This is a result of a positive performance of all channels in the fourth quarter and of the positive contribution of the acquisitions of the year.

With respect to the geographical areas, the increase related to the Americas (2.3 thousand tons), specifically in the Private Label and the Mass Market channels, Northern Europe (1.2 thousand tons), mainly in the Mass Market channel, and the Asia-Pacific and Cafés area (1.3 thousand tons), which grew in the Private Label and Food Service channels.

Southern Europe, which recorded a decrease by 1.2 thousand tons, has progressively improved over the last few months of the year in the Mass Market channel and showed positive results in the Food Service and Private Label channels.

MZB Group: Consolidated Revenues

The MZB Group ’s consolidated revenues amounted to Euro 914.5 million in 2019 showing an increase of Euro 23.3 million (+2.6%) compared to 2018. This increase is a result of:

- the foreign exchange rates (mainly Euro against the US dollars) had a positive impact of +2.4%

- the roasted coffee sales volumes, +2.5% compared with the same period last year

- the decrease of roasted coffee sales price (-2.3%) as a consequence of the decrease of the cost of raw material (green coffee).

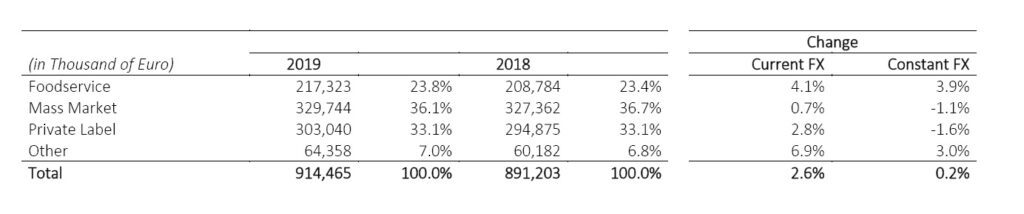

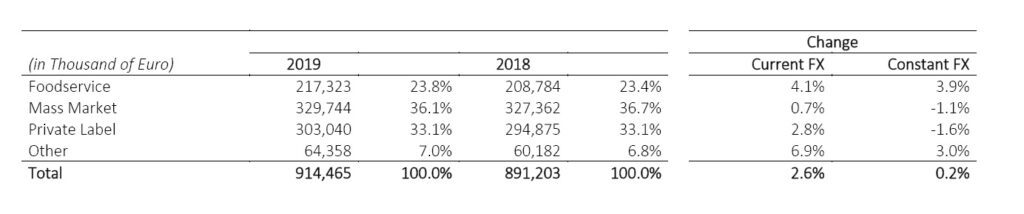

Revenues by channel

The revenues from the Food Service channel were up 4.1% at current exchange rates, +3.9% at constant exchange rates, compared with 2018, thanks to the performance of the fourth quarter, up 5.7% at current forex compared with the same period last year.

Mass Market increased 0.7% at current forex (-1.1% at constant FX) compared with 2018. The channel showed a progressive improvement in all the geographical areas in the last quarter (+6.8% compared to the fourth quarter of 2018), after a first half negatively affected by the weakness of the Americas and the timing effect of the introduction of the renewed Segafredo product range in Italy.

The Private Label revenues are explained by the slight decrease of roasted coffee sales price as a consequence of the reduction of the cost of green coffee.

Revenues by region

Revenue in the Americas, at Euro 405,7 million in 2019 was down 2.2% at constant exchange rates compared with 2018, attributable to the Private Label channel, due to the slight decrease of roasted coffee sales price, a consequence of the decrease of the cost of raw material (green coffee).

The Mass Market shows an improving trend in the fourth quarter while the food service channel is up double digit.

Revenue generated in Northern Europe, increased 1.4% at constant exchange rates compared to 2018, showing a solid performance in the Mass Market in the second part of the year.

Revenue in Southern Europe decreased by 3.0% compared with 2018, due to the sales prices adjustment in the Private Label and the timing of the introduction of new Segafredo products in the Italian Mass Market.

Asia-Pacific and Cafés, which also includes the revenue generated by the international network of cafés, posted revenue of Euro 98.1 million, with a growth of 19.0% at constant exchange rates compared with 2018, also reflecting the Australian acquisition.

Gross Profit

Gross Profit at Euro 407.7 million shows an increase of Euro 18.9 million compared with 2018 (+4.9%). This increase is explained by the favourable impact of exchange rates (Euro 6.7 million compared with 2018) and by the increase in Gross Profit resulting from the sales of roasted coffee and other products.

The increase in Gross Profit from the sale of roasted coffee (+2.3%) is mainly due to the positive impact of the increase of volumes (+2.8%) partially compensated by the trends in sales and purchase prices respectively of roasted and green coffee and the different mix in the sales channels.

In percent of revenues the Gross Profit increased 100 basis points (from 43.6% of revenues to 44.6%).

Ebitda Adjusted

Ebitda adjusted amounts to Euro 84.0 million compared to Euro 73.7 million of 2018. This result was attributable to:

- the increase in Gross Profit, as mentioned above

- and the positive impact of the adoption of the new accounting standard IFRS 16, applicable since January 1st, 2019 (amounting to Euro 10.3 million) mainly as a result of lower costs for leased assets.

- the positive impact of exchange rate fluctuations (Euro 1.1 million)

- the increase in operating costs (of Euro 13.2 million) mainly driven by the personnel costs and costs for services, also impacted from the acquisitions, partly offset by lower depreciations.

Ebitda adjusted of 2019 excludes non-recurring costs of Euro 3.5 million, mainly related to reorganization plans launched at the subsidiaries as well as the re-launch of the Segafredo Zanetti brand in the Mass Market channel in Italy.

Operating Income (Ebit)

Operating income (EBIT) is equal to Euro 34.0 million, a decrease of 2.4 million compared to 2018. In addition to that disclosed about EBITDA, the decrease is mainly attributable to the increase in amortization and depreciation, equal to Euro 11.6 million.

This is mainly a result of the first application of IFRS 16, from January 1, 2019, that raised amortization and depreciation by Euro 9.3 million and by the foreign rates fluctuations impact for Euro 0.6 million.

Net Profit

The net profit is equal to Euro 15.3 million, a decrease of Euro 4.6 million compared to 2018. In addition to what was previously described for the operating profit, this decrease is also due to the combined effect of:

- the increase in net finance costs for Euro 1.5 million, mainly due to: i) the impact deriving from the first application of IFRS 16 for Euro 1.3 million; ii) decrease of exchange losses for Euro 0.6 million; iii) higher interest charges for Euro 0.9 million.

- the increase in income taxes amounting to Euro 0.7 million.

Net Debt

Net debt, excluding the effect of the IFRS 16 adoption, is equal to Euro 219.3 million compared to 174.7 million at December 31, 2018. This increase is mainly due to the following:

- Free Cash Flow with a positive impact of Euro 32.7 million in 2019;

- dividends paid amounting to Euro 6.7 million;

- interest paid of Euro 6.3 million;

- non-recurring investments equal to Euro 53.5 million includes the discounted value of potential earn-out and deferred payment deriving from acquisitions.

Excluding IFRS 16 effect and the acquisition of Café Pacaembu net debt would have amounted to Euro 194.0 million at December 31, 2019.

Lastly, the adoption of the new accounting standard IFRS 16 increased the Net Debt by Euro 47.2 million. As a result, the Net Debt as of December 31, 2019, after the adoption of IFRS 16, amounted to Euro 266.5 million.

MZB Group: Forecast for operations and significant subsequent events

In view of the results achieved in 2019 and considering current trends, the expectations relating to the performance of the MZB Group for 2020, assuming the absence of extraordinary transactions, are as follows:

- slight increase in revenues driven by:

- the improvement in product and channel mix

- growth in volumes in line with market trends

- EBITDA adjusted in line with 2020

- Net debt is expected to be around Euro 250 million, assuming investments of Euro 50 million.

MZB Group: Financial statement of the parent company proposed dividend, other resolutions and calling of the shareholders’ meeting

The Board of Directors also approved the financial statements of the parent company, Massimo Zanetti Beverage Group S.p.A., the annual report on corporate governance and ownership structure and the 2019 Consolidated nonfinancial statement (pursuant to Italian d. Lgs. n. 245/2016).

Revenues of the parent company amount to Euro 12.3 million compared to Euro 10.6 million in 2018. The net profit for the year is Euro 9.4 million compared to Euro 7.8 million in 2018.

Equity amounts to Euro 162.4 million compared to Euro 160.1 million at December 31, 2018. Net debt is Euro 180.0 million (Euro 150.8 million at December 31, 2018).

The Board of directors resolved to propose to shareholders the distribution of a gross dividend of Euro 0.19 per ordinary share, for a total of approximately Euro 6,517,000.

If approved, the dividend will be paid on May 20, 2020 (ex-dividend date on May 18 and record date on May 19).

Furthermore, at the end of the Board of Directors’ meeting, Pilar Braga resigned from her post of non-executive director of the Company, effective from March 6, 2020, to embark on a new professional path.

In accepting Pilar Braga’s resignation, the Chairman, also on behalf of the entire Board of Directors, expressed his heartfelt gratitude to Pilar Braga for her dedication, commitment and professionalism, which contributed to the growth of the Group. Based on the information provided to the Company, Pilar Braga does not hold directly or indirectly shares of the Company.

Finally, the Board of Directors decided to call the Shareholders in an ordinary meeting on 22 April 2020 also to renew the entire Board of Directors. Also for this reason, the Board of Directors decided not to co-opt a new director to replace Pilar Braga, pursuant to article 2386.

The shareholders were called in a meeting, including in an extraordinary session, to amend the By-laws and bring them into line with the new legal provisions on gender balance in the bodies of listed companies.

The notice of call of the Extraordinary and Ordinary Shareholders’ Meeting of 22 April 2020 and all the relevant documents will be made available to the public, in accordance to the law, on the company website (www.mzbgroup.com, section IR shareholder information/shareholders meeting), and at the registered office of Massimo Zanetti Beverage Group S.p.A. and through the storage mechanism www.emarketstorage.com.