VILLORBA, Italy — The Board of Directors of Massimo Zanetti Beverage Group S.p.A., one of the leading brands worldwide in the production, processing and marketing of roasted coffee and other selected categories of colonial products, listed on the Milan Stock Exchange (MZB.MI), approved yesterday (November 8, 2018) the Interim Report for the Nine Months ended September 30, 2018.

Massimo Zanetti, the Group’s Chairman and Chief Executive Officer said: “In the first nine months of 2018, we achieved satisfactory profitability: EBITDA increased 5.0% on a comparable basis and net profit by more than 50%.

Revenues for the first nine months of the year is slightly down on a comparable basis (-3.7% compared to the first nine months of 2017) and reflects the continuous improvement in the sales mix fuelled by the performance of the food service channel and highly-profitable products, which resulted in the organic growth of the gross profit.

All geographical areas recorded an increase in volumes, except for the US market, down by 5.4%. Specifically, volumes rose considerably in the Asia-Pacific region (+8.7%).

Furthermore, the recent acquisition of the Australian group “The Bean Alliance” will enable us to seize additional opportunities in this high-potential area as of next year. Based on the results achieved in the first nine months of 2018 and given the positive outlook for the fourth quarter, we confirm our expectations of solid growth in profitability for the year”.

Volumes

In the first nine months of 2018, the roasted coffee sales volumes of Massimo Zanetti Beverage Group S.p.A. showed a slight decline, -2.2% compared to the first nine months of 2017 (93.4 thousand tons compared with 95.6 thousand tons of the same period of last year).

This trend is due to the decrease in the Americas (-5.4% compared to the first nine months of 2017) in the Private Label and Mass Market channels, partially offset by positive performance of all other areas: Southern Europe was up 0.6% compared with the first nine months of 2017, Northern Europe was up 4.2% compared with the first nine months of 2017, and Asia Pacific and Cafés was up 8.7% compared to the first nine months of 2017.

Food Service channel increased +2.0%, compared with the first nine months of 2017 mainly due to a positive performance of Americas and Apac and a substantially stable performance in Europe.

Consolidated Revenue

The Group’s consolidated revenue amounted to Euro 654.0 million in the first nine months of 2018, compared to Euro 708.5 million of the first nine months of the prior year, a decrease of 7.7% at current exchange rates, – 4.1% at constant exchange rates compared to the first nine months of 2017.

Revenue, on a comparable basis*, decreased -3.7% compared to the previous year, equal to Euro 26.5 million, mainly due to:

• the decrease in roasted coffee sales volumes, as explained before (-2.2% compared to the first nine months of 2017);

• the decrease of roasted coffee sales price resulting from the decrease in the average purchase price of green coffee which was partially offset by the positive effects of a different mix in the sales channels in 2018 and 2017.

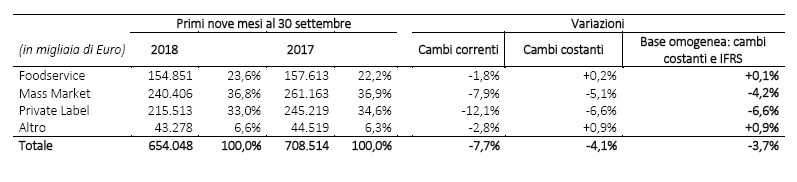

Revenue by Channel

Revenue from the Food Service channel, which account for 23.6% of the Group’s revenue, amount to Euro 154.9 million, stable on last year on a comparable basis, with volumes growth recorded in Americas and Apac and a slight decrease in Europe.

Performance of the Mass Market channel and Private Label channels, equal to 36.8% and 33.0% respectively of the Group’s revenue, is due to the decline in volumes of the Americas and the slight decrease of roasted coffee sales price as a consequence of the reduction of the cost of green coffee, as explained before.

Revenue by Region

Revenue from the Americas amount to Euro 288.4 million (44.1% of the Group’s revenue) a 6.9% reduction on last year on a comparable basis. This performance is explained by the decrease of the Mass Market and Private Label channels, as already explained.

Revenue from Europe are slightly negative mainly due to the reduction in sales prices as a consequence of the decrease in the purchase price of green coffee.

Revenue from Asia-Pacific, which also include those from the international network of cafés, amount to Euro 57.8 million, up by 6.8% on a like for like basis, compared to the first nine months of 2017.

Gross Profit

Gross profit amounts to Euro 258.8 million for the nine months ended September 30, 2018, was down by Euro 6.3 million compared to the nine months ended September 30, 2017. This decrease is mainly explained by the unfavorable effect of exchange rates (with an impact of Euro 8.8 million, compared to the first nine months of 2017).

On a comparable basis, Gross Profit increases by Euro 4.8 million (+1.7% compared to the first nine months of 2017), mainly due to the sale of roasted coffee (+2.9% compared to the first nine months of 2017).

The increase in Gross Profit from the sale of roasted coffee is in turn mainly due to the positive impact of the trends in sales and purchase prices respectively of roasted and green coffee and to the positive effect of the different mix in the sales channels in the first nine months of 2018 and 2017 (+5.2% compared to the first nine months of 2017), partially offset by the decrease in roasted coffee volumes (-2.2% compared to the first nine months of 2017).

In percent of revenue the Gross Profit increased 250 basis points (from 41.2% of revenue to 43.7%).

EBITDA

EBITDA amounts to Euro 50.6 million (7.7% on revenue). In the nine months of 2017 EBITDA adjusted of costs associated with reorganization of Portugal (amounting to Euro 1.8 million) was 49.2 million (6.9% on revenues). Excluding the negative impact of exchange rate fluctuations for Euro 1.1 million, EBITDA increased by 5.0% on a comparable basis driven by the positive increase of Gross Profit (for Euro 4.8 million compared with the same period of 2017) partially offset by the slight increase of operating costs (equal to Euro 2.3 million).

perating Income (EBIT)

Operating income (EBIT) amounted to Euro 23.7 million for the nine months ended September 30, 2018, an increase of +19.6% compared to Euro 19.8 million of the nine months ended September 30, 2017. In addition to as previously described for EBITDA, this increase is attributable to the decrease in amortization and depreciation, amounting to Euro 0.7 million, mainly as a result of foreign exchange fluctuations.

Net Profit

The net profit amounts to Euro 12.4 million, up 50.9% compared to first nine months of 2017. Income taxes increased Euro 332 thousand, mainly due to the increased taxable income generated by the Group in the nine months ended September 30, 2018 compared to the same period of 2017.

Net Debt

Net debt is equal to Euro 201.0 million, compared to 191.0 million at December 31, 2017. During the first nine months the net recurring investments amount to Euro 20.7 million compared to Euro 26.2 million of the first nine months of 2017. During the period 5.9 million dividends were distributed, compared with 5.3 million of the same period of 2017.

Forecast for operations and significant subsequent events

In view of the results achieved in the first nine months of 2018 and considering current trends as well as assuming the absence of extraordinary transactions, management expectations for 2018 is:

- revenue on a comparable basis* substantially in line with 2017

- EBITDA adjusted* increase of approximately +5.0%

- a reduction in net debt to below Euro 180 million. * on a comparable basis: at constant exchange rates and with the retrospective application of IFRS 15 on 2017 revenue.

Conference Call to present nine months 2018 Financial Results

The Group’s nine months 2018 results will be presented during the conference call to be held today at 5:30 CET. To access the call, please use one of the following dial-in numbers: +1 718 705 8794 (US and Canada), +39 02 805 88 11 (Italy), +44 121 281 8003 (UK) ; +33 170 918 703 (France) and +39 02 805 88 27 (Press).

Digital Playback service will be available for 8 days, dialling the following numbers: +1 718 705 8797 (US and Canada), +39 02 72495 (Italy), +44 1 212 818 005 (UK) with the following passcode: 902#

The presentation will be available before the conference call on the company website www.mzb-group.com and on the storage system (www.emarketstorage.com). The recording file will be available on the company website.