VEVEY, Switzerland – Nestlé reported today nine-month sales for 2021, raising full-year organic sales growth guidance. Organic growth reached 7.6%, with real internal growth (RIG) of 6.0% and pricing of 1.6%. Growth was supported by continued momentum in retail sales, steady recovery of out-of-home channels, increased pricing and market share gains.

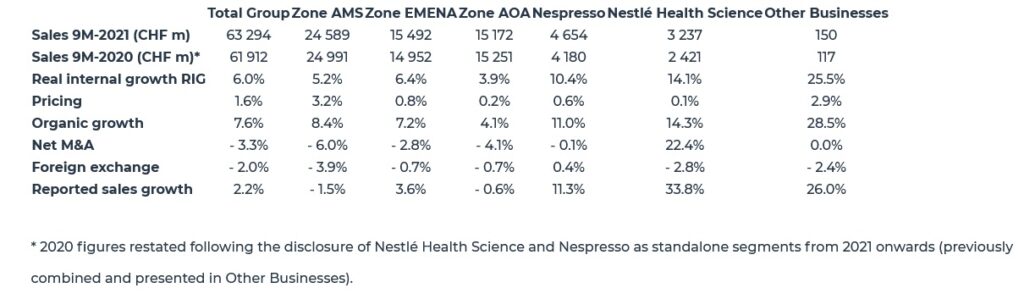

Total reported sales increased by 2.2% to CHF 63.3 billion (9M-2020: CHF 61.9 billion). Foreign exchange reduced sales by 2.0%. Net divestitures reduced sales by 3.3%.

Continued progress in portfolio management. On August 9, 2021, Nestlé completed the acquisition of the core brands of The Bountiful Company.

Full-year guidance for 2021 updated: the company expects full-year organic sales growth between 6% and 7%. The underlying trading operating profit margin is expected around 17.5%, reflecting initial time delays between input cost inflation and pricing, as well as the one-off integration costs related to the acquisition of The Bountiful Company’s core brands.

Beyond 2021, our mid-term outlook for continued moderate margin improvement remains unchanged. Underlying earnings per share in constant currency and capital efficiency are expected to increase this year.

Mark Schneider, Nestlé CEO, commented: “We are pleased with Nestlé’s strong organic growth in the nine months, driven by broad-based contributions from most geographies and categories. The relentless focus of our teams on local execution and agility enabled us to navigate input cost inflation and supply chain constraints. In the third quarter, we increased pricing in a responsible manner, while maintaining strong real internal growth. Investments in innovation, digitalization and sustainability further supported growth by enhancing the relevance and differentiation of our offerings.

Nestlé continues to take actions on sustainability. We recently laid out our plans to support a just transition to regenerative food systems, which will help achieve our climate targets as we work closely with farming communities around the world to improve soil health, restore water cycles and increase biodiversity for the long-term.”

Nestlé: Group Sales

Nestlé: Group Sales

Organic growth reached 7.6%, with RIG of 6.0%. Pricing increased to 1.6%, accelerating to 2.1% in the third quarter.

Growth was broad-based across most geographies and categories. Organic growth reached 7.1% in developed markets, based mostly on RIG with positive pricing. Organic growth in emerging markets was 8.3%, with robust RIG and positive pricing.

By product category, the largest contributor to organic growth was coffee, fueled by strong momentum for the three main brands Nescafé, Nespresso and Starbucks. Starbucks products posted 15.5% growth, with sales reaching CHF 2.2 billion across 79 markets. Purina PetCare saw double-digit growth, led by science-based and premium brands Purina Pro Plan, Fancy Feast and Purina ONE, as well as veterinary products. Prepared dishes and cooking aids posted high single-digit growth, based on strong sales developments for Maggi, Stouffer’s and Lean Cuisine. Vegetarian and plant-based food offerings saw double-digit growth, with continued expansion of the product range, led by Garden Gourmet. Dairy reported mid single-digit growth, based on sustained demand for fortified milks, coffee creamers and ice cream. Confectionery recorded high single-digit growth, supported by a strong sales development for KitKat. Sales in Nestlé Health Science grew at a double-digit rate, reflecting strong demand for consumer care products particularly vitamins, minerals and supplements. Infant Nutrition posted negative growth, impacted by lower birth rates globally in the context of the pandemic and a sales decline in China. In the third quarter, growth in Infant Nutrition was positive outside of China. Water reported mid single-digit growth, with strong demand in North America and emerging markets in the third quarter.

By channel, organic growth in retail sales was 6.6%. E-commerce sales grew by 17.2%, reaching 14.1% of total Group sales, with strong momentum in most categories, particularly coffee, Purina PetCare and culinary. Organic growth in out-of-home channels was 22.8%, helped by the further easing of movement restrictions in some geographies.

Net divestitures decreased sales by 3.3%, largely related to the Nestlé Waters North America, Yinlu and Herta transactions. Divestitures were partially offset by acquisitions, including Freshly and the core brands of The Bountiful Company. The negative impact on sales from foreign exchange moderated to 2.0%. Total reported sales increased by 2.2% to CHF 63.3 billion.

Portfolio Management

Nestlé is transforming its global water business, sharpening its focus on international premium and mineral water brands and healthy hydration products. In March, Nestlé completed the acquisition of Essentia Water, a premium functional water brand in the U.S., and the sale of its regional spring water brands, purified water business and beverage delivery service in the U.S. and Canada.

Nestlé Health Science continues to focus on building a nutrition and health powerhouse. On August 9, 2021, Nestlé completed the acquisition of the core brands of The Bountiful Company for USD 5.75 billion. The Bountiful Company is the number one pure-play leader in the highly attractive and growing global nutrition and supplement category. In July, Nestlé completed the acquisition of Nuun, a leading company in the fast-growing functional hydration market, and entered into an agreement with Seres Therapeutics to jointly commercialize SER-109, an investigational oral microbiome therapeutic in the U.S. and Canada.

Building on the successful global coffee alliance, Nestlé continues to expand the reach of Starbucks branded coffee and tea products outside Starbucks retail stores. In July, Nestlé and Starbucks announced a new collaboration to bring Starbucks ready-to-drink coffee beverages to select markets across South-East Asia, Oceania and Latin America.

Zone Americas (AMS)

- 8.4% organic growth: 5.2% RIG; 3.2% pricing.

- North America posted mid single-digit organic growth, with robust RIG and positive pricing.

- Latin America reported double-digit organic growth, with both strong RIG and pricing.

Organic growth was 8.4%, with strong RIG of 5.2% supported by volume and mix. Pricing increased to 3.2%, accelerating to 5.0% in the third quarter. Net divestitures reduced sales by 6.0%, as the divestment of the Nestlé Waters North America brands more than offset the acquisitions of Freshly and Essentia Water. Foreign exchange had a negative impact of 3.9%. Reported sales in Zone AMS decreased by 1.5% to CHF 24.6 billion.

Zone AMS reported high single-digit organic growth, building on a strong sales development in 2020. Increased pricing, continued innovation, strong momentum in e-commerce and a further recovery of out-of-home channels supported growth. The Zone saw continued broad-based market share gains, led by coffee, pet food and dairy.

North America posted mid single-digit growth in the context of significant supply chain constraints. Sales in Purina PetCare grew at a high single-digit rate, led by Purina Pro Plan, Fancy Feast and Purina ONE. Purina Pro Plan LiveClear, the breakthrough allergen-reducing cat food, continued to see strong momentum and expanded its range to cover all life stages. Nestlé Professional and Starbucks out-of-home products saw strong double-digit growth, helped by a low base of comparison. Frozen and chilled food reported mid single-digit growth. Strong sales developments for Stouffer’s, Lean Cuisine, Freshly and Hot Pockets were partially offset by a sales decrease in pizza, following a high base of comparison in 2020. Sales in the beverages category, including Starbucks at-home products, Coffee mate and Nescafé, grew at a mid single-digit rate. Water reported mid single-digit growth, accelerating to a double-digit rate in the third quarter with a strong sales development for Essentia. Home-baking products, including Toll House and Carnation, saw a sales decline following exceptional demand in 2020.

Latin America posted double-digit growth, with broad-based contributions across geographies and most product categories. Sales in Mexico grew at a double-digit rate, led by Nescafé and confectionery brands Carlos V and KitKat. Brazil reported double-digit growth, reflecting strong demand for confectionery, coffee and fortified milks. Chile also recorded double-digit growth, supported by confectionery and ice cream. By product category, the largest contributor to growth was Purina PetCare with strong sales developments across all brands, markets and channels. Sales in confectionery, coffee, particularly Nescafé Dolce Gusto, and Nestlé Professional all grew at a strong double-digit rate. Growth in dairy moderated to a low single-digit rate, following exceptionally strong demand in 2020 particularly for home cooking and baking products. Infant Nutrition saw mid single-digit growth, accelerating to a high single-digit rate in the third quarter based on robust demand for new premium and functional products.

Zone Europe, Middle-East and North Africa (EMENA)

- 7.2% organic growth: 6.4% RIG; 0.8% pricing.

- Western Europe saw mid single-digit organic growth with strong RIG and slightly negative pricing.

- Central and Eastern Europe posted double-digit organic growth, with strong RIG and positive pricing.

- Middle East and North Africa reported high single-digit organic growth, with a balanced contribution from RIG and pricing.

Organic growth reached 7.2%, with strong RIG of 6.4% supported by volume and mix. Pricing increased by 0.8%, turning positive in Western Europe in the third quarter. Net divestitures reduced sales by 2.8%, largely related to the divestiture of the Herta charcuterie business. Foreign exchange negatively impacted sales by 0.7%. Reported sales in Zone EMENA increased by 3.6% to CHF 15.5 billion.

Zone EMENA reported high single-digit organic growth, based on product innovation and continued strong momentum in e-commerce and specialist channels. All markets posted positive growth, with strong sales developments led by Russia, Turkey, the United Kingdom and Italy. The Zone continued to see broad-based market share gains, particularly for pet food, coffee and plant-based products.

By product category, Purina PetCare posted double-digit growth driven by premium brands Felix, Gourmet and Purina Pro Plan, as well as veterinary products. Tails.com continued its geographic expansion, with more than 250 000 monthly subscribers across nine markets. Sales in coffee grew by almost 10%, supported by strong momentum for Nescafé and Starbucks at-home products with continued innovation across all coffee brands. Nestlé Professional reported strong double-digit growth, helped by further recovery in out-of-home channels. Water posted mid single-digit growth, led by S.Pellegrino. Sales in confectionery grew at a mid single-digit rate, based on improved demand for impulse and gifting products. Culinary saw low single-digit growth. Strong demand for Garden Gourmet and Mindful Chef was partially offset by slightly negative growth in Maggi and pizza following elevated demand in 2020. The recent launch of Wunda, the high-protein pea-based milk alternative, resonated strongly with consumers. Infant Nutrition posted slightly negative growth due to lower birth rates in the context of the pandemic, but saw high single-digit growth in the third quarter with continued market share gains.

Zone Asia, Oceania and sub-Saharan Africa (AOA)

- 4.1% organic growth: 3.9% RIG; 0.2% pricing.

- China posted low single-digit organic growth, based on positive RIG and slightly negative pricing.

- South-East Asia saw slightly negative organic growth, with negative RIG and pricing.

- South Asia reported double-digit organic growth, with strong RIG and positive pricing.

- Sub-Saharan Africa recorded double-digit organic growth, led by strong RIG with positive pricing.

- Japan, South Korea and Oceania saw mid single-digit organic growth. Strong RIG was partially offset by negative pricing.

Organic growth was 4.1%, with RIG of 3.9% and pricing of 0.2%. Net divestitures had a negative impact of 4.1%, largely related to the divestment of the Yinlu peanut milk and canned rice porridge businesses in China. Foreign exchange reduced sales by 0.7%. Reported sales in Zone AOA decreased by 0.6% to CHF 15.2 billion.

Zone AOA reported mid single-digit organic growth in a difficult economic environment with regional lockdowns. In the third quarter, growth turned slightly negative, reflecting a sales decline in Infant Nutrition in China and a high base of comparison in 2020. Most categories gained market share, led by coffee, culinary and pet food.

China saw low single-digit growth, as strong sales developments in most categories were partially offset by a sales decrease in Infant Nutrition. The largest growth contributor was Nestlé Professional, with sales exceeding 2019 levels. Coffee, culinary, dairy and Purina PetCare all grew at strong double-digit rates, supported by new digitally-driven product launches. Infant Nutrition posted a sales decline. Turnaround initiatives continue to progress, with further actions being implemented.

South-East Asia saw slightly negative growth in a difficult economic environment with movement restrictions. The Philippines saw a sales decline, also impacted by a high base of comparison in 2020. Indochina posted low single-digit growth, with a sales decrease in on-the-go products and out-of-home channels. Sales in Malaysia grew at a high single-digit rate.

South Asia recorded double-digit growth, supported by strong e-commerce momentum and distribution expansion in rural areas. Growth was broad-based across most categories, led by Maggi, KitKat and Nescafé.

Sub-Saharan Africa recorded double-digit growth, based on strong sales developments for Milo, Maggi and Nescafé led by affordable offerings.

Japan posted high single-digit growth, led by Nescafé, Purina PetCare and KitKat. Sales in South Korea grew at a strong double-digit rate, driven by coffee. Oceania reported positive growth, with market share gains and robust demand for KitKat, Purina PetCare and Maggi.

By product category, the key growth drivers were culinary, coffee and Nestlé Professional. Sales in confectionery and ice cream grew at a high single-digit rate, with good sales momentum in Malaysia. Dairy reported mid single-digit growth, led by strong demand for fortified milks. Infant Nutrition saw a sales decline, with growth turning positive outside of China in the third quarter.

Nespresso

- 11.0% organic growth: 10.4% RIG; 0.6% pricing.

Organic growth reached 11.0%, based on strong RIG of 10.4% and pricing of 0.6%. Foreign exchange positively impacted sales by 0.4%. Reported sales in Nespresso increased by 11.3% to CHF 4.7 billion.

Nespresso posted double-digit growth, moderating to a mid single-digit rate in the third quarter due to a high base of comparison in 2020. The Vertuo system continued to see strong growth, with the Original system also contributing positively. Increased consumer adoption and innovation supported growth. Nespresso expanded its coffee offerings across the Vertuo system, including Peru Organic, and added Novecento and Millenio to the Italian Heritage range for the Original System. The Nespresso x Chiara Ferragni summer collection and social media campaign resonated strongly with consumers.

By channel, boutiques and out-of-home channels saw a further recovery, with a continued positive sales development in e-commerce.

By geography, the Americas and AOA posted double-digit growth. EMENA saw high single-digit growth.

Overall Nespresso gained market share, with contributions from most markets.

Outlook

Full-year guidance for 2021 updated: we expect full-year organic sales growth between 6% and 7%. The underlying trading operating profit margin is expected around 17.5%, reflecting initial time delays between input cost inflation and pricing, as well as the one-off integration costs related to the acquisition of The Bountiful Company’s core brands. Beyond 2021, our mid-term outlook for continued moderate margin improvement remains unchanged. Underlying earnings per share in constant currency and capital efficiency are expected to increase this year.