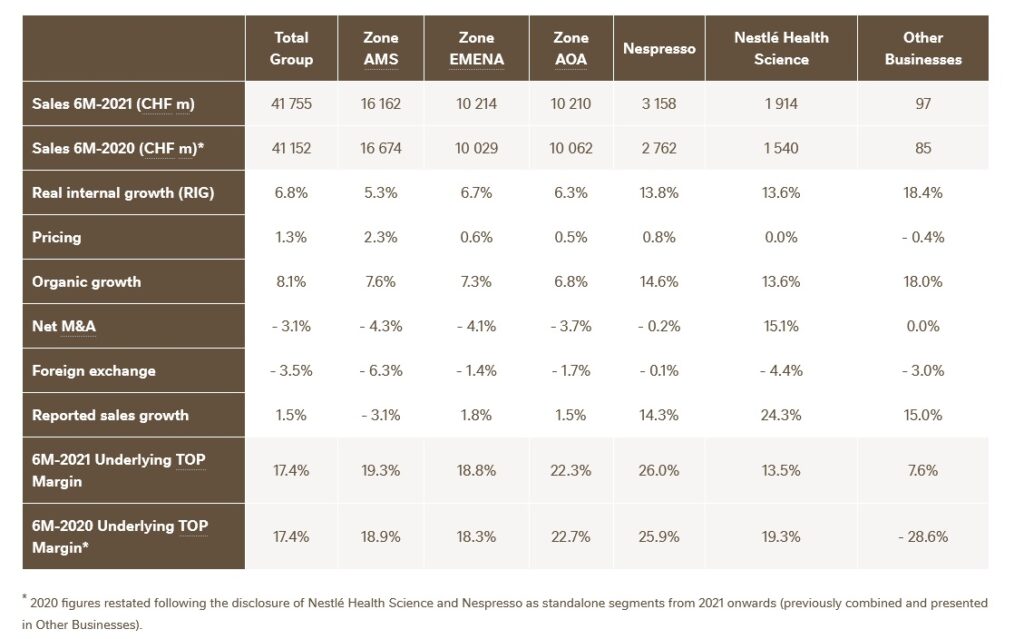

VEVEY, Switzerland – Nestlé reported today half-year results for 2021 and raised full-year organic sales growth guidance. Organic growth reached 8.1%, with real internal growth (RIG) of 6.8% and pricing of 1.3%. Growth was supported by continued momentum in retail sales, a return to growth in out-of-home channels, increased pricing and market share gains. Total reported sales increased by 1.5% to CHF 41.8 billion (6M-2020: CHF 41.2 billion), or US$45.7 billion. Foreign exchange reduced sales by 3.5%, reflecting appreciation of the Swiss franc against most currencies. Net divestitures had a negative impact of 3.1%.

The underlying trading operating profit (UTOP) margin was 17.4%, unchanged versus the prior year. The trading operating profit (TOP) margin decreased by 20 basis points to 16.7%.

Underlying earnings per share increased by 10.5% in constant currency and increased by 8.3% on a reported basis to CHF 2.17. Earnings per share increased by 3.2% to CHF 2.12 on a reported basis. Free cash flow was CHF 2.8 billion

Further progress in portfolio management. In April, Nestlé entered into an agreement to acquire core brands of The Bountiful Company. The transaction is expected to close in August. On July 26, 2021, Nestlé and Starbucks strengthened their collaboration to bring ready-to-drink coffee beverages to select markets across South-East Asia, Oceania and Latin America.

Full-year 2021 outlook updated: we expect full-year organic sales growth between 5% and 6%. The underlying trading operating profit margin is now expected around 17.5%, reflecting initial time delays between input cost inflation and pricing as well as the one-off integration costs related to the acquisition of The Bountiful Company’s core brands. Beyond 2021, our mid-term outlook for continued moderate margin improvement remains unchanged. Underlying earnings per share in constant currency and capital efficiency are expected to increase this year.

Mark Schneider, Nestlé CEO, commented:”I would like to thank the Nestlé team for their continued commitment to meeting consumer needs and their relentless focus on execution. Organic growth was strong across most geographies and categories, with robust momentum in retail sales and a return to growth in out-of-home channels. Through fast-paced innovation, strong brand support, increased digitalization and stringent portfolio management we have built the foundation for delivering consistent mid single-digit organic growth for years to come.

Mark Schneider, Nestlé CEO, commented:”I would like to thank the Nestlé team for their continued commitment to meeting consumer needs and their relentless focus on execution. Organic growth was strong across most geographies and categories, with robust momentum in retail sales and a return to growth in out-of-home channels. Through fast-paced innovation, strong brand support, increased digitalization and stringent portfolio management we have built the foundation for delivering consistent mid single-digit organic growth for years to come.

Nestlé continues to invest for future profitable growth. We are creating a global leader in vitamins, minerals and supplements with the acquisition of The Bountiful Company’s core brands. The expansion of our partnership with Starbucks into ready-to-drink coffee will open new opportunities in a fast-growing segment. Our portfolio choices, strong execution and decisive actions on sustainability enable us to create value for all stakeholders.”

Group sales

Organic growth reached 8.1%, with RIG of 6.8%. Pricing increased to 1.3%, reflecting input cost inflation.

Growth was broad-based across most geographies. Organic growth was 6.7% in developed markets, based mostly on RIG. Organic growth in emerging markets was 10.0%, with strong RIG and positive pricing.

By product category, the largest contributor to organic growth was coffee

Fueled by strong demand for the three main brands Nescafé, Nespresso and Starbucks. Starbucks products posted 16.7% growth, with sales reaching CHF 1.4 billion across 79 markets. Purina PetCare saw double-digit growth led by science-based and premium brands Purina Pro Plan, Purina ONE and Felix, as well as veterinary products. Prepared dishes and cooking aids posted high single-digit growth, based on strong demand for Maggi and Stouffer’s. Vegetarian and plant-based food offerings continued to see strong double-digit growth, led by Garden Gourmet. Dairy reported high single-digit growth, led by fortified milks, coffee creamers and ice cream. Confectionery recorded double-digit growth, supported by a strong sales development in impulse products. Sales in Nestlé Health Science grew at a double-digit rate, reflecting strong demand for vitamins, minerals and supplements and healthy-aging products. Infant Nutrition saw a sales decrease, impacted by lower birth rates in the context of the pandemic. Water returned to positive growth, led by international premium brands S. Pellegrino and Perrier.

By channel, organic growth in retail sales was 7.3%, moderating to a mid single-digit rate in the second quarter due to a high base of comparison in 2020. E-commerce sales grew by 19.2%, reaching 14.6% of total Group sales, with strong momentum in most categories particularly coffee, Purina PetCare and culinary. Organic growth in out-of-home channels was 21.3%, helped by the easing of movement restrictions in some geographies.

Net divestitures decreased sales by 3.1%, largely related to the divestments of Nestlé Waters North America brands, the Herta charcuterie business and the Yinlu peanut milk and canned rice porridge businesses. Foreign exchange reduced sales by 3.5%, reflecting the appreciation of the Swiss franc versus most currencies. Total reported sales increased by 1.5% to CHF 41.8 billion.

Nespresso

Nespresso ‘s organic growth reached 14.6%, based on strong RIG of 13.8% and pricing of 0.8%. Foreign exchange reduced sales by 0.1%. Reported sales in Nespresso increased by 14.3% to CHF 3.2 billion (US$3.5 billion).

Nespresso ‘s organic growth reached 14.6%, based on strong RIG of 13.8% and pricing of 0.8%. Foreign exchange reduced sales by 0.1%. Reported sales in Nespresso increased by 14.3% to CHF 3.2 billion (US$3.5 billion).

Nespresso saw double-digit organic growth, reflecting continued expansion of the Vertuo system and robust demand for the Original system. Growth was fueled by new consumer adoption, a return to positive growth in boutiques and out-of-home channels, as well as innovation. New products included Kahawa ya Congo, the first organic coffee in the Reviving Origins range, and the roll-out of Momento, a versatile touchless machine that creates specialty coffees with fresh milk for out-of-home channels.

By geography, the Americas, EMENA and AOA all posted double-digit growth. Overall Nespresso gained market share, with contributions from most markets.

The underlying trading operating profit margin of Nespresso increased by 10 basis points. Operating leverage and structural cost reductions more than offset increased consumer-facing marketing expenses.