MILAN – Nestlé has today reported full-year organic sales growth just shy of expectations, as high inflation continued to suppress consumer demand for the food giant’s products prompting some shoppers to turn to cheaper white-label products. Organic sales, which exclude the impact of currency movements and acquisitions, rose 7.2% in the year ended December 31. Analysts had on average expected organic sales growth of 7.4%.

The Swiss giant said that it expects organic sales to climb by around 4% this year, below expectations of 4.7%, according to a consensus forecast provided by the company. It also forecasts a “moderate increase” of its underlying trading operating profit (UTOP) margin.

Coffee saw high single-digit growth, with positive sales developments across brands, supported by strong demand in out-of-home channels.

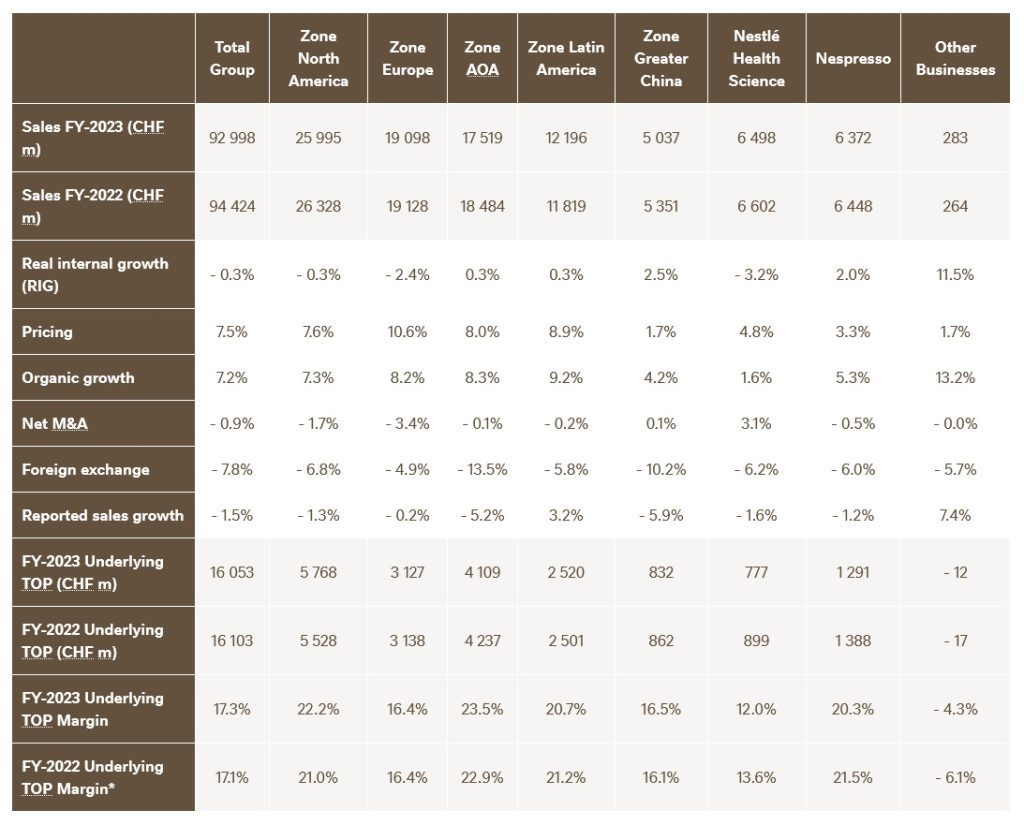

Nestlé – 2023 key figures:

- Organic growth reached 7.2%, with pricing of 7.5% and real internal growth (RIG) of -0.3%. Growth was broad-based across geographies and categories.

- Total reported sales were CHF 93.0 billion, a decrease of 1.5% (FY-2022: CHF 94.4 billion). Foreign exchange decreased sales by 7.8%. Net divestitures had a negative impact of 0.9%.

- The underlying trading operating profit (UTOP) margin was 17.3%, increasing by 20 basis points on a reported basis and by 40 basis points in constant currency. The trading operating profit (TOP) margin was 15.6%, increasing by 160 basis points.

- Underlying earnings per share increased by 8.4% in constant currency and by 0.1% on a reported basis to CHF 4.80. Earnings per share increased by 23.7% to CHF 4.24 on a reported basis, mainly reflecting one-off items in the prior year.

- Free cash flow was CHF 10.4 billion, an increase of CHF 3.8 billion following a significant reduction in working capital.

- Board proposes a dividend of CHF 3.00 per share, an increase of 5 centimes, marking 29 consecutive years of dividend growth. In 2023, CHF 12.8 billion were returned to shareholders through a combination of dividend and share buybacks.

- 2024 outlook: “we expect organic sales growth around 4% and a moderate increase in the underlying trading operating profit margin. Underlying earnings per share in constant currency is expected to increase between 6% and 10%.”

- 2025 mid-term targets fully confirmed: mid single-digit organic sales growth and an underlying trading operating profit margin range of 17.5% to 18.5% by 2025. Underlying earnings per share in constant currency to increase between 6% and 10%.

Nestlé – Zone North America

Organic growth was 7.3%, with pricing of 7.6%. RIG was -0.3%, reflecting soft consumer demand, capacity constraints and the winding down of the frozen meals and pizza business in Canada. RIG turned positive in the fourth quarter. Net divestitures reduced sales by 1.7%, as a result of the divestment of a majority stake in Freshly as well as the disposal of the Gerber Good Start infant formula brand in 2022. Foreign exchange had a negative impact of 6.8%. Reported sales in Zone North America decreased by 1.3% to CHF 26.0 billion.

Sales for Nestlé Professional and Starbucks out-of-home continued to grow at a double-digit rate, led by new customer acquisition. The beverages category, including Starbucks products, Coffee mate and Nescafé, posted mid single-digit growth.

Zone Europe

Organic growth was 8.2%, with pricing of 10.6%. RIG was -2.4%, reflecting demand elasticity and capacity constraints. Foreign exchange negatively impacted sales by 4.9%. Net divestitures reduced sales by 3.4%. Reported sales in Zone Europe decreased by 0.2% to CHF 19.1 billion.

Coffee saw mid single-digit growth, led by Nescafé soluble and ready-to-drink products.

Zone Asia, Oceania and Africa (AOA)

Organic growth was 8.3%, with 0.3% RIG. Pricing increased to 8.0%, with broad-based contributions from all geographies and categories. Foreign exchange reduced sales by 13.5%, impacted by significant currency depreciation. Reported sales in Zone AOA decreased by 5.2% to CHF 17.5 billion.

Coffee saw high single-digit growth, with robust demand for Nescafé and Starbucks products, particularly for ready-to-drink offerings.

Japan reported mid single-digit growth, led by Purina PetCare, KitKat and ready-to-drink Nescafé. The new Starbucks soluble coffee offering resonated strongly with consumers.

Zone Latin America

Organic growth was 9.2%, with pricing of 8.9%. RIG was 0.3%, turning positive in the second half. Foreign exchange had a negative impact of 5.8%. Reported sales in Zone Latin America increased by 3.2% to CHF 12.2 billion.

Coffee reported high single-digit growth, led by Nescafé soluble and ready-to-drink coffee. Sales for Nestlé Professional grew at a strong double-digit rate, with continued customer expansion for branded coffee solutions.

Zone Greater China

Organic growth was 4.2%, with RIG of 2.5% and pricing of 1.7%. Foreign exchange had a negative impact of 10.2%. Reported sales in Zone Greater China decreased by 5.9% to CHF 5.0 billion. Coffee reported low single-digit growth, supported by ready-to-drink offerings.

Nestlé – Nespresso

Organic growth was 5.3%, with pricing of 3.3%. RIG was 2.0%. Foreign exchange negatively impacted sales by 6.0%. Reported sales in Nespresso decreased by 1.2% to CHF 6.4 billion.

Organic growth was 5.3%, with pricing of 3.3%. RIG was 2.0%. Foreign exchange negatively impacted sales by 6.0%. Reported sales in Nespresso decreased by 1.2% to CHF 6.4 billion.

The key growth contributor was the Vertuo system, which continued to see broad-based momentum. Growth in out-of-home channels was also strong, with further adoption of the Momento system, particularly in the office segment. Innovation continued to resonate with consumers, including the launch of home compostable coffee capsules and the ultra-premium Nº 20 limited edition, a unique arabica variety.

In 2023, Nespresso was recognized as one of the top 100 most valuable brands in the world, according to Interbrand annual ranking

By geography, North America posted double-digit growth, with continued market share gains. Europe reported low single-digit growth. Other regions combined saw mid single-digit growth.

The underlying trading operating profit margin of Nespresso decreased by 120 basis points.

Significant cost inflation and the appreciation of the Swiss franc more than offset pricing actions and cost efficiencies. The business continued to invest in the rollout of the Vertuo system as well as in brand marketing.