MILAN – Nestlé posted its strongest nine-month sales growth in 14 years, with organic sales rising 8.5% thanks to price hikes offsetting cost inflation. The world’s largest packaged food company reported yesterday organic sales of 69.13 billion Swiss francs ($69.49 billion) in the first nine months of the year.

Nestlé also raised its full-year guidance saying it expects organic growth of “about 8%” for the whole year, which would put it at the top end of a range of 7% to 8% previously announced.

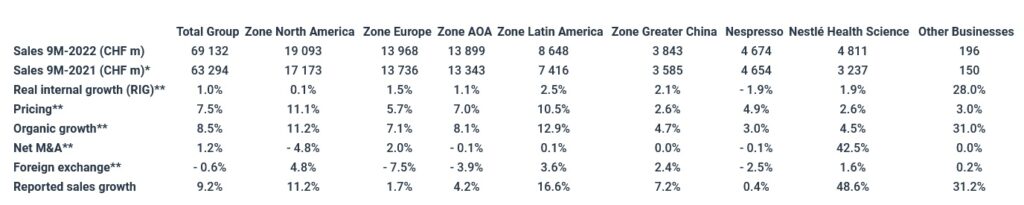

Pricing increased by 7.5%, reflecting substantial cost inflation.

Sales in coffee grew at a high single-digit rate, with positive sales developments for Nescafé, Starbucks and Nespresso.

Nestle said Wednesday that it would acquire Seattle’s Best Coffee brand from Starbucks Corp. for an undisclosed sum in a move to bolster its U.S. coffee business.

Under the Global Coffee Alliance, Nestlé distributes Starbucks consumer products and foodservice beverages across more than 80 markets. Nestlé says that the deal for Seattle’s Best will strengthen the alliance “by allowing both companies to focus on their core strengths”.

“We delivered strong organic growth as we continued to adjust prices responsibly to reflect inflation,” said Chief Executive Mark Schneider. “The challenging economic environment is a concern for many people and is impacting their purchasing power.”

“Nestlé reported a good set of results as sales beat expectations thanks to its ability to pass on price rises to customers without it impacting on demand,” commented Chris Beckett, the head of equity research at Quilter Cheviot quoted by The Guardian.

“How long this continues in the face of challenging economic conditions remains to be seen, however,” he added (click to enlarge).

By product category, Purina PetCare was the largest contributor to organic growth, with continued momentum for science-based and premium brands Purina Pro Plan, Purina ONE and Fancy Feast as well as veterinary products.

By product category, Purina PetCare was the largest contributor to organic growth, with continued momentum for science-based and premium brands Purina Pro Plan, Purina ONE and Fancy Feast as well as veterinary products.

Confectionery reported double-digit growth, reflecting particular strength for KitKat and seasonal products.

Water posted double-digit growth, despite supply chain constraints, led by premium brands, S. Pellegrino, Acqua Panna and Perrier.

Dairy reported mid single-digit growth, with continued momentum for coffee creamers and a recovery for home-baking products.

Cocoa and malt beverages saw high single-digit growth, with particular strength for Milo as well as Nesquik ready-to-drink formats.

By channel, organic growth in retail sales remained robust at 7.3%. Within retail, e-commerce sales grew by 8.4%, building on growth of 17.2% in the first nine months of 2021. Organic growth in out-of-home channels reached 26.1%, with sales exceeding 2019 levels.

Net acquisitions increased sales by 1.2%, largely related to the acquisitions of the core brands of The Bountiful Company and Orgain. The impact on sales from foreign exchange was negative at 0.6%. Total reported sales increased by 9.2% to CHF 69.1 billion.

Nespresso

Organic growth was 3.0%, with pricing of 4.9%. RIG was – 1.9% following double-digit growth in 2021 during the pandemic (click to enlarge the table above). Foreign exchange negatively impacted sales by 2.5%. Reported sales in Nespresso increased by 0.4% to CHF 4.7 billion.

Organic growth was 3.0%, with pricing of 4.9%. RIG was – 1.9% following double-digit growth in 2021 during the pandemic (click to enlarge the table above). Foreign exchange negatively impacted sales by 2.5%. Reported sales in Nespresso increased by 0.4% to CHF 4.7 billion.

Nespresso reported low single-digit organic growth, following double-digit growth in 2021, with consumption remaining above pre-pandemic levels.

The Vertuo system saw further momentum, with broad-based contributions across geographies. During the third quarter, Nespresso launched Vertuo Pop, a new compact machine made with recycled materials, in a number of European markets.

Growth was also supported by a further recovery in out-of-home channels, with continued expansion of the Momento system and improved sales development for the office segment.

By geography, North America posted double-digit growth with continued market share gains. Europe reported a sales decrease. Other regions combined recorded high single-digit growth.

Nestlé: Full-year Outlook

Full-year 2022 outlook updated: we now expect organic sales growth around 8%. The underlying trading operating profit margin is expected around 17.0%. Underlying earnings per share in constant currency and capital efficiency are expected to increase.