ATLANTA, U.S. — Newell Brands Inc. (NASDAQ: NWL) (the “Company” or “Newell Brands”) announced on November 25 the early results of its previously announced debt tender offer (the “Offer”) to purchase for cash up to an aggregate principal amount equal to $300,000,000 (the “Maximum Tender Amount”) of the Company’s outstanding securities listed in the table below (collectively, the “Notes”), subject to the Acceptance Priority Levels specified in the table below.

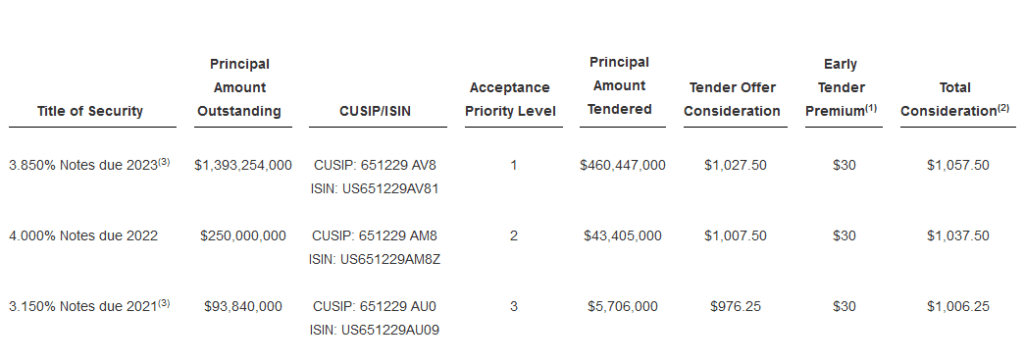

According to Global Bondholder Services Corporation, information agent and tender agent for the Offer, as of 5:00 p.m., New York City time, on November 24, 2020 (the “Early Tender Deadline”), Newell Brands had received valid tenders in aggregate principal amount of $509,558,000 from holders of the Notes as set forth in the table below (click to enlarge):

(1) As set forth in the Offer to Purchase (as defined below), the Early Tender Premium will be payable only to holders of the Notes that were validly tendered (and not validly withdrawn) as of the Early Tender Deadline, and that are accepted for purchase.

(1) As set forth in the Offer to Purchase (as defined below), the Early Tender Premium will be payable only to holders of the Notes that were validly tendered (and not validly withdrawn) as of the Early Tender Deadline, and that are accepted for purchase.

(2) The Total Consideration payable for each $1,000 principal amount of Notes validly tendered at or prior to the Early Tender Deadline and accepted for purchase by us includes the applicable Early Tender Premium. Holders whose Notes are accepted will also receive Accrued Interest (as defined below) on such Notes.

(3) Currently subject to a 0.50% coupon step up under the terms of the applicable series of Notes.

Because the aggregate principal amount of validly tendered Notes exceeded the Maximum Tender Amount, the Notes will be purchased subject to the Maximum Tender Amount, the Acceptance Priority Levels and proration as described in the Offer to Purchase dated November 10, 2020 (the “Offer to Purchase”). Accordingly, Newell Brands expects to accept for purchase and pay for $300,000,000 aggregate principal amount of its 3.850% Notes due 2023 (the “2023 Notes”) on a prorated basis, and none of its 4.000% Notes due 2022 or 3.150% Notes due 2021, on the Early Settlement Date (as defined below).

Holders of 2023 Notes that were validly tendered and not properly withdrawn at or prior to the Early Tender Deadline and accepted for purchase will receive the applicable Total Consideration specified in the table above, which includes the applicable Early Tender Premium specified in the table above. Payments for 2023 Notes purchased will include the applicable accrued and unpaid interest on the 2023 Notes from, and including, the most recent interest payment date prior to the applicable settlement date up to, but not including, the applicable settlement date, rounded to the nearest cent (“Accrued Interest”). The settlement date for 2023 Notes tendered at or prior to the Early Tender Deadline and accepted for purchase is expected to be November 30, 2020 (the “Early Settlement Date”).

Although the Offer is scheduled to expire at midnight, New York City time, at the end of December 9, 2020, unless extended or terminated (the “Expiration Time”), because the Offer was fully subscribed as of the Early Tender Deadline, the Company does not expect to accept for purchase any Notes tendered after the Early Tender Deadline. Notes not accepted for purchase will be promptly returned or credited to the holder’s account.

Citigroup Global Markets Inc., HSBC, and RBC Capital Markets, LLC are serving as the Lead Dealer Managers in connection with the Offer. The information agent and tender agent is Global Bondholder Services Corporation. The full details of the Offer, including complete instructions on how to tender Notes, are included in the Offer to Purchase. Holders are strongly encouraged to read carefully the Offer to Purchase, including materials incorporated by reference therein, because they contain important information. Copies of the Offer to Purchase are available at https://www.gbsc-usa.com/newellbrands/ and requests for copies may also be directed to the information agent at (212) 430-3774 (banks and brokers) or (866) 807-2200 (all others). Questions regarding the Offer should be directed to Citigroup Global Markets Inc. at (212) 723-6106 (collect) or (800) 558-3745 (toll free), HSBC Securities (USA) Inc. at (212) 525-5552 (collect) or (888) HSBC-4LM (toll free), and RBC Capital Markets, LLC, Liability Management Group, at (212) 618-7843 (collect) or (877) 381-2099 (toll free).

None of the Company or its affiliates, their respective boards of directors, the dealer managers, the information agent and tender agent or the trustee with respect to any Notes is making any recommendation as to whether holders should tender any Notes in response to the Offer, and neither the Company nor any such other person has authorized any person to make any such recommendation. Holders must make their own decision as to whether to tender any of their Notes, and, if so, the principal amount of Notes to tender.

This news release shall not constitute an offer to sell, a solicitation to buy or an offer to purchase or sell any securities. The Offer is being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law.