ATLANTA, U.S. – Newell Brands Inc. (NASDAQ: NWL) (the “Company” or “Newell Brands”) announced today that it has commenced a debt tender offer (the “Offer”) to purchase for cash up to the Maximum Tender Amount (as defined below) in aggregate principal amount of the Company’s outstanding securities listed in Table I below (collectively, the “Notes”), subject to the Acceptance Priority Levels as defined below. The “Maximum Tender Amount” is an aggregate principal amount equal to $300 million.

The Offer is intended to allow the Company to reduce the amount and cost of the Company’s outstanding indebtedness. The Company expects to fund the Offer with available cash on hand.

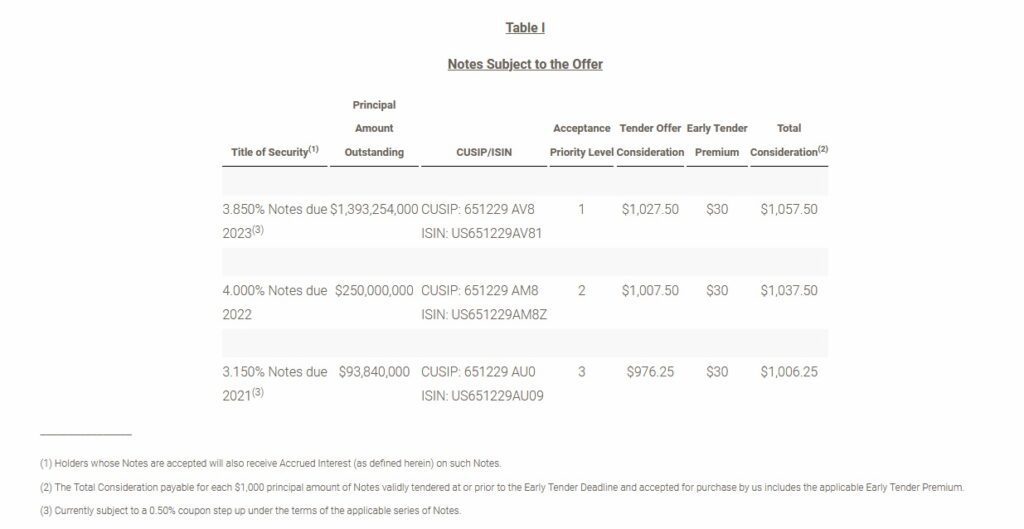

Subject to the Maximum Tender Amount, the amounts of each series of Notes that are purchased in the Offer will be determined in accordance with the acceptance priority levels specified in Table I above (the “Acceptance Priority Levels”), with 1 being the highest Acceptance Priority Level and 3 being the lowest Acceptance Priority Level.

The Offer is being made pursuant to, and is subject to, the satisfaction or waiver of the terms and conditions set forth in the Offer to Purchase dated November 10, 2020. The Offer will expire at midnight, New York City time, at the end of December 9, 2020, unless extended or terminated (the “Expiration Time”). Tenders of Notes may be properly withdrawn at any time at or prior to 5:00 p.m., New York City time, on November 24, 2020. Tenders of Notes may not be properly withdrawn after the withdrawal deadline, except where additional withdrawal rights are required by law.

The Offer is being made pursuant to, and is subject to, the satisfaction or waiver of the terms and conditions set forth in the Offer to Purchase dated November 10, 2020. The Offer will expire at midnight, New York City time, at the end of December 9, 2020, unless extended or terminated (the “Expiration Time”). Tenders of Notes may be properly withdrawn at any time at or prior to 5:00 p.m., New York City time, on November 24, 2020. Tenders of Notes may not be properly withdrawn after the withdrawal deadline, except where additional withdrawal rights are required by law.

Holders of Notes that are validly tendered and not properly withdrawn at or prior to 5:00 p.m., New York City time, on November 24, 2020 (unless extended, the “Early Tender Deadline”) and accepted for purchase will receive the applicable Total Consideration, which includes the applicable early tender premium specified in Table I above (the “Early Tender Premium”). Payment for Notes that are validly tendered and not properly withdrawn at or prior to the Early Tender Deadline and accepted for purchase will be made as soon as reasonably practicable following the Early Tender Deadline (such date, the “Early Settlement Date”). Payment for Notes that are validly tendered following the Early Tender Deadline but at or prior to the Expiration Date and accepted for purchase will be made as soon as reasonably practicable following the Expiration Date (such date, the “Final Settlement Date” and, together with the Early Settlement Date, the “Settlement Date”). The Company expects that the Early Settlement Date will be on or about November 30, 2020. Holders of Notes who validly tender their Notes following the Early Tender Deadline and at or prior to the Expiration Time will only receive the applicable “Tender Offer Consideration” for such Notes accepted for purchase, which is an amount equal to the applicable Total Consideration minus the Early Tender Premium. There are no guaranteed delivery provisions in connection with the Offer.

Promptly after the Early Settlement Date, the Company will also issue a press release specifying, among other things, the aggregate principal amount of each series of Notes validly tendered at or prior to the Early Tender Deadline and accepted for purchase, as well as the results of proration, if applicable.

Payments for Notes purchased will include the applicable accrued and unpaid interest on the Notes from, and including, the most recent interest payment date prior to the applicable Settlement Date up to, but not including, the applicable Settlement Date, rounded to the nearest cent (“Accrued Interest”).

If the Offer is not fully subscribed as of the Early Tender Deadline, subject to the Maximum Tender Amount, Notes validly tendered and not properly withdrawn at or prior to the Early Tender Deadline will be accepted for purchase in priority to other Notes tendered following the Early Tender Deadline, even if such Notes tendered following the Early Tender Deadline have a higher Acceptance Priority Level than Notes tendered at or prior to the Early Tender Deadline.

Notes of a series may be subject to proration if the aggregate principal amount of the Notes of such series validly tendered and not properly withdrawn would cause the Maximum Tender Amount to be exceeded. Furthermore, if the Offer is fully subscribed as of the Early Tender Deadline, holders who validly tender Notes following the Early Tender Deadline will not have any of their Notes accepted for purchase.

Newell Brands’ obligation to accept for payment and to pay for the Notes validly tendered in the Offer is subject to the satisfaction or waiver of the conditions described in the Offer to Purchase.

Citigroup Global Markets Inc., HSBC, and RBC Capital Markets, LLC are serving as the Lead Dealer Managers in connection with the Offer. The information agent and tender agent is Global Bondholder Services Corporation. The full details of the Offer, including complete instructions on how to tender Notes, are included in the Offer to Purchase. Holders are strongly encouraged to read carefully the Offer to Purchase, including materials incorporated by reference therein, because they will contain important information. Copies of the Offer to Purchase are available at https://www.gbsc-usa.com/newellbrands/ and requests for copies may also be directed to the information agent at (212) 430-3774 (banks and brokers) or (866) 807-2200 (all others). Questions regarding the Offer should be directed to Citigroup Global Markets Inc. at (212) 723-6106 (collect) or (800) 558-3745 (toll free), HSBC Securities (USA) Inc. at (212) 525-5552 (collect) or (888) HSBC-4LM (toll free), and RBC Capital Markets, LLC, Liability Management Group, at (212) 618-7843 (collect) or (877) 381-2099 (toll free).

None of the Company or its affiliates, their respective boards of directors, the dealer managers, the information agent and tender agent or the trustee with respect to any Notes is making any recommendation as to whether holders should tender any Notes in response to the Offer, and neither the Company nor any such other person has authorized any person to make any such recommendation. Holders must make their own decision as to whether to tender any of their Notes, and, if so, the principal amount of Notes to tender.

This news release shall not constitute an offer to sell, a solicitation to buy or an offer to purchase or sell any securities. The Offer is being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law.

About Newell Brands

Newell Brands (NASDAQ: NWL) is a leading global consumer goods company with a strong portfolio of well-known brands, including Paper Mate®, Sharpie®, Dymo®, EXPO®, Parker®, Elmer’s®, Coleman®, Marmot®, Oster®, Sunbeam®, FoodSaver®, Mr. Coffee®, Rubbermaid Commercial Products®, Graco®, Baby Jogger®, NUK®, Calphalon®, Rubbermaid®, Contigo®, First Alert®, Mapa®, Spontex® and Yankee Candle®. Newell Brands is committed to enhancing the lives of consumers around the world with planet friendly, innovative and attractive products that create moments of joy and provide peace of mind.

This press release and additional information about Newell Brands are available on the company’s website, www.newellbrands.com.