Just as CDs rendered vinyl records practically obsolete in the 1990s, so it sometimes seems that fresh coffee (preferably served up by a hipster barista in the cool café of the moment) is having the same effect on instant coffee.

Certainly, over the last few years, the proportion of Australians buying instant coffee has declined, while fresh coffee sales have increased. But is instant coffee really on the way out? Roy Morgan Research data suggests it’s not as simple as that…

Between April 2011 and March 2016, the proportion of Australian grocery-buyers 14+ who bought instant coffee (not decaf) in an average four-week period slipped from 59.1% to 49.4%. Over the same time period, the proportion buying fresh coffee in any given four weeks rose from 28.2% to 30.2%.

Long-time leader Nescafé remains the most popular brand of instant coffee by a hefty margin, with its different varieties being purchased by 49.7% of all instant-coffee buyers in an average four weeks. Indeed, three Nescafé blends — Blend 43, Gold Blend and Espresso — feature among the country’s 10 top-selling instant coffees.

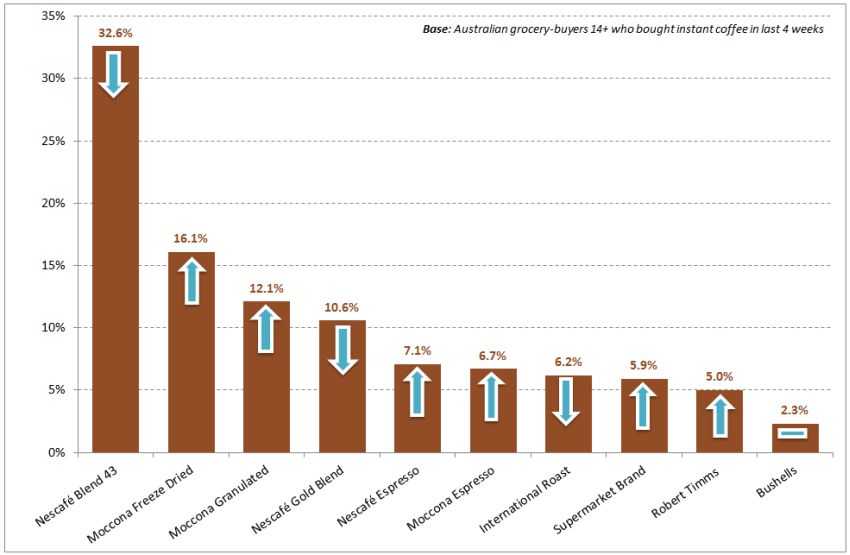

Australia’s 10 best-selling instant coffees

Source: Roy Morgan Single Source (Australia), April 2011-March 2012 (n=9,493); April 2015– March 2016 (n=3,408). NB: direction of arrows indicates whether proportion of grocery buyers has increased or decreased since April 2011-March 2012 period.

However, this represents a substantial decrease from March 2012, when 57.0% of instant-coffee buyers opted for a Nescafé blend. In fact, with the exception of a slight drop in International Roast purchases (from 8.5% of grocery buyers to 6.2%), Nescafe’s downward trajectory appears to be the primary reason for the overall decline in the instant coffee category.

While it remains a distant second, Moccona, purchased by 33.6% of instant-coffee buyers in an average four weeks, is the country’s second-favourite brand, with its range gaining popularity since the 12 months to April 2012 (up from 28.1%). It too has three blends in the Top 10, all of which are on the up-and-up with Australian grocery buyers.

Nescafé’s downturn is driven by declining purchase incidence of its Blend 43 and Gold Blend coffees. While Blend 43 remains Australia’s best-selling instant coffee by far, being purchased by 32.6% of instant-coffee buyers in any given four weeks, it has lost ground since March 2012 (36.1%). Gold Blend has fallen from 14.9% to 10.6%, but Nescafé’s Espresso has inched up, from 6.0% to 7.1%.

Norman Morris, Industry Communications Director, Roy Morgan Research, say:

As we have seen, Australian grocery buyers seem to be turning away from instant coffee, with purchase incidence dropping by 16% over just five years. However, on closer inspection, we find that this decline is not so much category-wide, as the result of Nescafé’s two leading varieties, Blend 43 and Gold Blend, losing popularity. Most of the smaller players have actually experienced moderate growth since April 2011.

“Despite its downturn, Nescafe retains a very comfortable category lead – although with Moccona’s consistent growth, the coffee giant needs to be vigilant, ensuring that it is targeting the most appropriate audience. For example, our data shows that Nescafé buyers are most likely to be aged 50 or older and belong to lower-income brackets. What’s more, the brand’s popularity is far from consistent across all states.

“Although more grocery buyers are purchasing fresh coffee than they were five years ago, this growth hasn’t been steep enough to be responsible for instant coffee’s total decline. The continued rise in café visitation could also be a factor, with an ever-increasing proportion of the population going to cafés for a coffee/tea in any given three months. A growing trend towards coffee pods may also have contributed.

“So while instant coffee looks to be on the wane, the growth of the smaller brands suggests that it’s not all over yet. Perhaps instant coffee could stage a revival akin to that of vinyl records? Certainly, brands wishing to ensure their future success would benefit from Roy Morgan Single Source’s in-depth demographic, attitudinal and behavioural data, which can help them identify and target the consumers most responsive to their product.”