MALMÖ, Sweden – Oatly Group AB, the world’s original and largest oat drink company, today announced financial results for the fourth quarter and twelve months ended December 31, 2022. Toni Petersson, Oatly’s CEO, commented, “I am proud of what the Oatly team accomplished in 2022. We took bold actions to strengthen our management team, transition our supply chain to a more asset-light model, and simplify our cost structure. We finished the year with a solid fourth quarter, and we have continued that momentum into 2023 by closing the Ya YA Foods transaction and raising $425 million in financing commitments.”

Petersson continued, “Our supply chain is back on firmer footing, we have clear line of sight to reaching profitability, and we have the liquidity needed to fully fund our growth investments and reach financial self-sufficiency. Therefore, we believe we are well-positioned to start playing offense in 2023.

Our teams will be focused on fully capturing the underlying global demand for our products while continuously improving our supply chain. We expect this focus to enable us to move along our path to profitability, set up fiscal 2024 for positive adjusted EBITDA, and drive sustainable, long-term shareholder value creation.”

Financing Update

As announced in a separate press release today, the Company entered into certain transactions for $425 million in financing. For more information, please refer to Oatly’s Current Report on Form 6-K filed earlier today.

Recent Highlights:

Recent Highlights:

- Revenue of $195.1 million, a 4.9% increase compared to the prior year period, constant currency revenue increased 13.9%.

- Gross margin in the quarter was 15.9%, which is flat compared to the prior year period and an increase of over 13 percentage points compared to the third quarter.

- Net loss attributable to shareholders of the parent was $125.2 million compared to net loss of $79.8 million in the prior year period.

- EBITDA loss of $111.2 million; adjusted EBITDA loss of $60.5 million, which is an improvement of $5.1 million compared to the prior year period and an improvement of $22.2 million compared to the third quarter.

- Subsequent to quarter-end, the Company completed the transaction to partner with Ya YA Foods on a strategic hybrid manufacturing alliance in North America (the “YYF transaction”).

- Subsequent to quarter-end, the Company received commitments for $425 million of capital and has agreed on terms and conditions with lenders to amend its revolving credit facility. The Company expects the new capital to fully fund its growth investments until the company becomes financially self-sufficient.

- The Company provided its 2023 outlook, which calls for 23% to 28% constant currency revenue growth, gross margin to improve sequentially through the year and reach the high-20%s by the fourth quarter. The Company believes this progress will enable full year fiscal 2024 to deliver positive adjusted EBITDA.

Fourth Quarter 2022 Results

Revenue increased $9.1 million, or 4.9% to $195.1 million for the fourth quarter ended December 31, 2022, compared to $185.9 million for the prior year period. Excluding a foreign currency exchange headwind of $16.6 million, revenue for the fourth quarter was $211.7 million, or an increase of 13.9%, using constant exchange rates. The revenue increase was primarily driven by continued sold volume growth for the Company’s products, in addition to price increases implemented in EMEA during the first half of 2022 and the Americas in the third quarter of 2022. Sold volume for the fourth quarter of 2022 amounted to 137 million liters compared to 124 million liters in the fourth quarter of 2021 and 126 million liters in the third quarter of 2022. Produced finished goods volume for the fourth quarter of 2022 amounted to 149 million liters compared to 142 million liters for the same period last year in the fourth quarter of 2021 and 124 million liters in the third quarter of 2022. The increase in produced finished goods volume was primarily driven by a more stable global supply chain network, allowing the Company to improve fill-rates and build inventory.

The Company has continued to experience revenue growth in the retail channel. In the fourth quarter of 2022 and 2021, the retail channel accounted for 56.9% and 56.1% of the Company’s revenue, respectively, the foodservice channel accounted for 38.3% and 38.2% of the Company’s revenue, respectively, and the other channel, comprised primarily of e-commerce sales, accounted for 4.8% and 5.7% of the Company’s revenue, respectively.

Gross profit was $31.1 million for the fourth quarter of 2022 compared to $29.6 million for the fourth quarter of 2021 and $5.0 million for the third quarter of 2022. The gross profit margin of 15.9% in the fourth quarter of 2022 remained consistent with the prior year period, and increased 1,320 basis points compared to the third quarter of 2022, primarily due to:

- Supply chain improvements in Americas and EMEA, including improved absorption and productivity as well as fewer one-off expenses, of 660 basis points,

- COVID-19 restrictions easing in Asia that resulted in better utilization of the Asia facilities and fewer one-off expenses of 430 basis points,

- Pricing actions of 140 basis points,

- Deflationary costs of 60 basis points, mainly driven by lower energy costs,

- Other items, net, of approximately 30 basis points.

Research and development expenses in the fourth quarter of 2022 increased $1.3 million to $7.0 million compared to $5.7 million in the prior year period.

Selling, general and administrative expenses in the fourth quarter of 2022 decreased $11.0 million to $107.9 million compared to $118.9 million in the prior year period. The decrease was primarily due to a decrease of $9.3 million in branding and marketing expenses, $7.6 million in professional fees, $3.1 million in amortization, depreciation, impairment charges and write-downs, and $1.8 million in customer distribution costs. The decrease was offset by increased costs of $9.9 million for employee related expenses, including $3.4 million related to restructuring costs.

Other operating (expenses) and income, net for the fourth quarter of 2022 decreased to an expense of $41.1 million compared to income of $2.3 million in the prior year period, comprised primarily of an asset impairment charge and other expenses related to assets held for sale, as a result of the YYF transaction entered into on December 30, 2022, as well as a net foreign exchange loss. See the Company’s Reports on Form 6-K filed on January 3, 2023 and March 2, 2023 for details on the YYF transaction.

Net loss attributable to shareholders of the parent was $125.2 million for the fourth quarter of 2022 compared to net loss of $79.8 million in the prior year period.

EBITDA loss for the fourth quarter of 2022 was $111.2 million, compared to an EBITDA loss of $81.8 million in the prior year period. The increase in EBITDA loss was primarily a result of higher other operating expenses related to an asset impairment charge and other costs related to assets held for sale from the YYF transaction, offset by lower selling, general and administrative expenses.

Adjusted EBITDA loss for the fourth quarter of 2022 was $60.5 million, compared to a loss of $65.6 million in the prior year period. The decrease in Adjusted EBITDA loss was primarily related to lower selling, general and administrative expenses.

EBITDA, Adjusted EBITDA (Loss), and revenue at constant currency are non-IFRS financial measures defined under “Non-IFRS financial measures.” Please see above revenue at constant currency table and “Reconciliation of IFRS to Non-IFRS Results” at the end of this press release.

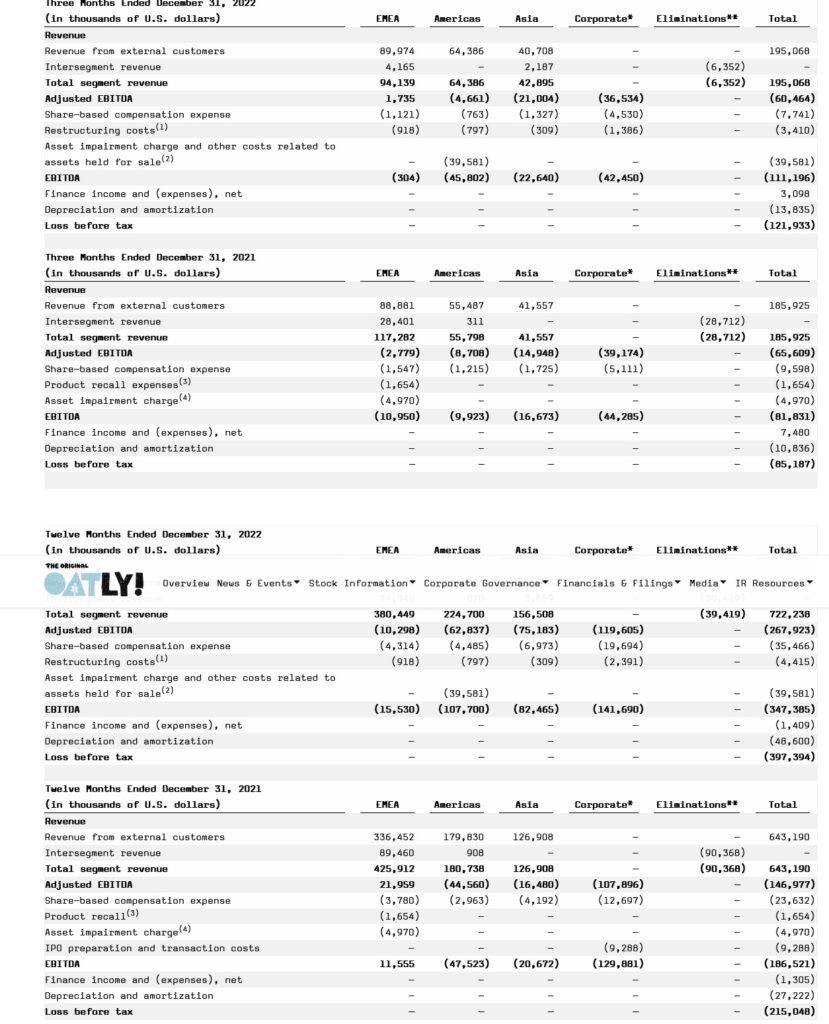

The following tables set forth revenue, Adjusted EBITDA, EBITDA and loss before income tax for the Company’s three reportable segments for the periods presented.

Revenue, Adjusted EBITDA and EBITDA

* Corporate consists of general overhead costs not allocated to the segments.

** Eliminations in 2022 refer to intersegment revenue for sales of products from EMEA to Americas and Asia, from Americas to Asia and from Asia to EMEA. Eliminations in 2021 and 2020 refer to intersegment revenue for sales of products from EMEA to Americas and Asia, and from Americas to Asia.

(1) Relates to accrued severance payments as the Company reviews its organizational structure to adjust the fixed cost base globally.

(2) The 2022 asset impairment charge relates to the YYF transaction. See the Company’s Form 6-K filed on January 3, 2023 and March 2, 2023 for details on the YYF transaction.

(3) Relates to the recall of products in Sweden as communicated on November 17, 2021. See the Company’s Form 6-K filed on November 17, 2021.

(4) The 2021 asset impairment charge related to production equipment at our Landskrona production facility in Sweden for which we had no alternative use.

EMEA

EMEA revenue increased $1.1 million, or 1.2%, to $90.0 million for the fourth quarter of 2022, compared to $88.9 million in the prior year period. Excluding a significant foreign currency exchange headwind of $12.6 million, EMEA revenue for the fourth quarter was $102.6 million, or an increase of 15.4%, using constant exchange rates. This increase using constant exchange rates was driven by growth across all our markets and channels, primarily driven by our oat drink portfolio, especially the Barista offering, as well as price increases, which were introduced in the first and second quarter of 2022. Approximately 82% of EMEA revenue was from the retail channel for the fourth quarter of 2022. The sold finished goods volume for the three months ended December 31, 2022 and 2021 amounted to 74 million and 66 million liters, respectively.

EMEA EBITDA loss decreased $10.6 million to a loss of $0.3 million for the fourth quarter of 2022 compared to a loss of $11.0 million in the prior year period. This decrease in EMEA EBITDA loss was primarily driven by lower operating expenses, namely branding and advertising spend. Adjusted EBITDA was a profit of $1.7 million compared to a loss of $2.8 million in the prior year period.

Americas

Americas revenue increased $8.9 million, or 16.0%, to $64.4 million for the fourth quarter of 2022, compared to $55.5 million in the prior year period. This increase was primarily due to implemented price increases, primarily on oat drink products. Approximately 51% of Americas revenue was from the retail channel in the fourth quarter of 2022. The sold finished goods volume for the three months ended December 31, 2022 and 2021 amounted to 36 million liters in both periods.

Americas EBITDA loss increased $35.9 million to a loss of $45.8 million for the fourth quarter of 2022 compared to a loss of $9.9 million in the prior year period. The decrease in Americas EBITDA resulted largely from one-time charges related to the YYF transaction, including impairment charges and costs related to professional fees, as well as restructuring charges. Adjusted EBITDA loss was $4.7 million compared to $8.7 million in the prior year period.

Asia

Asia revenue continued to be impacted by COVID-19 variants in China in the fourth quarter 2022. Despite this, Asia revenue only decreased $0.8 million, or 2.0%, to $40.7 million for the fourth quarter of 2022, compared to $41.6 million in the prior year period. Excluding a foreign currency exchange headwind of $4.0 million, Asia revenue for the fourth quarter was $44.7 million, or an increase of 7.6%, using constant exchange rates. Approximately 69% of Asia revenue was from the foodservice channel for the fourth quarter of 2022, with a significant contribution coming from the e-commerce channel. The sold finished goods volume for the three months ended December 31, 2022 and 2021 amounted to 27 million and 22 million liters, respectively.

Asia EBITDA loss increased $6.0 million to a loss of $22.6 million for the fourth quarter of 2022 compared to a loss of $16.7 million in the prior year period. The decrease in Asia EBITDA was primarily due to higher operating expenses to scale operations and promote sales for future growth, and lower gross profit margin driven by higher costs of production. Adjusted EBITDA loss was $21.0 million compared to $14.9 million in the prior year period.