MILAN – Bittersweet results for Olam Group, which ended FY2024 with revenues of S$56.1 billion (+16%) but net profit down 52.8% to S$216.3 million, amid global market headwinds. Last week, the company announced the sale of its remaining stake in Olam Agri to SALIC, or Saudi Agriculture & Livestock Investment Company, a state-owned Saudi investment firm: a deal which is expected to significantly improve its overall financial position.

Importantly, Olam Food Ingredients (ofi) – the raw materials and ingredients platform that includes coffee, cocoa, dairy and spices – posted double-digit EBIT growth (+29.1%).

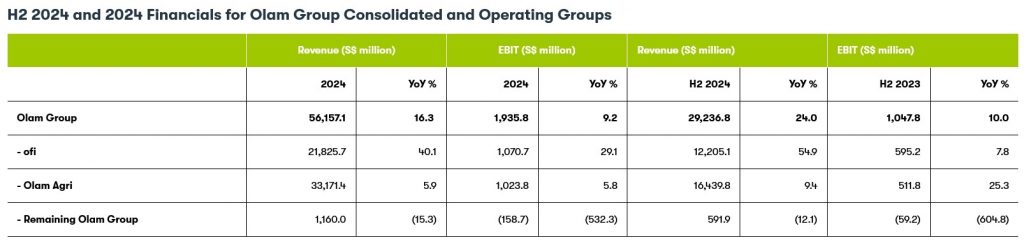

Group operating profit (“EBIT”) up 9.2% in 2024, on growth at both ofi and Olam Agri. Olam Agri: EBIT grew 5.8% YoY led by 32.2% YoY growth in Fibre, Agri-industrials & Ag Services. Board recommends a second and final dividend of 3.0 cents per share, taking total dividends to 6.0 cents per share for 2024 (2023: 7.0 cents).

The company noted that market volatility continues to have a significant impact on the business, but but diversification and scaling moves had been to its benefit. Below are the highlights of the company’s press release.

Olam Group Financial Performance

H2 2024

- EBIT grew 10.0% to S$1,047.8 million led by 25.3% growth from Olam Agri, and 7.8% growth from ofi, which offset higher losses from Remaining Olam Group.

- PATMI declined as EBIT growth was offset by a significant increase in net finance costs and higher net exceptional losses mainly from temporary cessation of operations at ofi’s onion and parsley processing plant and the lease surrender and exit of two non-strategic almond orchards in the US.

- Excluding exceptional items, Operational PATMI decreased 47.9% to S$142.8 million.

2024

- EBIT rose 9.2% mainly on 29.1% growth from ofi and 5.8% growth from Olam Agri, which offset higher losses from Remaining Olam Group.

- PATMI declined 69.0% YoY to S$86.4 million as EBIT growth was offset by the significant increase in net finance costs of S$445.7 million.

- Operational PATMI decreased by 52.8% to S$216.3 million.

- Free Cash Flow to Equity (FCFE) ended at negative S$5.9 billion (2023: -S$914.8 million) on significantly increased working capital – predominantly from higher cocoa and coffee prices – and higher interest costs over the period.

- Net gearing as at December 31, 2024 was higher at 2.79 times (2023: 1.73 times). As most of this increase was reflected in higher readily marketable inventories and secured receivables, adjusted net gearing was stable at 0.68 times as at end-2024 (end-2023: 0.65 times).

2024 Performance by Operating Group

ofi¹

EBIT grew 29.1% to S$1,070.7 million led by higher Ingredients & Solutions segment margins which compensated for the increased working capital cost and elevated risk levels, as well as continued progress on various strategic initiatives.

Olam Agri²

EBIT increased 5.8% to S$1,023.8 million, led by the 32.2% YoY growth in Fibre, Agri-Industrials & Ag Services.

Remaining Olam Group³

EBIT losses increased to S$158.7 million, mainly due to non-cash foreign exchange revaluation losses on Euro denominated parent loans to Olam Palm Gabon, which was partially offset by the growth in EBIT from Rusmolco, Packaged Foods and Mindsprint. Incubating Businesses saw reduced losses in the same period.

Re-organisation update

Olam Group to sell 44.58% in Olam Agri to SALIC for approximately US$1.78 billion, at an implied 100% equity valuation for Olam Agri of US$4.00 billion;

Olam Group to sell its remaining 19.99% stake in Olam Agri to SALIC at the end of three years from completion of the above sale at the Closing Valuation1 plus 6% IRR

The Group will focus on seeking strategic options to unlock value for the Remaining Olam Group businesses and ofi, including the pursuit of an ofi IPO.

Olam Group: Outlook and Prospects

The Group expects 2025 to experience continued uncertainty due to various geopolitical and macroeconomic factors, such as impacts from US trade policies, potentially more tense US-China trade relations, sluggish economic growth in China, political uncertainties around the Ukraine-Russia war and the Middle East conflicts. Inflation outlook also remains uncertain.

ofi expects continued near-term volatility for some of its input raw materials like cocoa and coffee. The company will stay focused on supporting its customers and suppliers, while balancing and optimising between risk, return, and cash flow to navigate through the current market volatility, while aiming to protect risk-adjusted margins and returns. It will continue to execute its strategy and invest for the future and maintain its existing guidance for low- to mid-single digit total volume growth and high single-digit adjusted EBIT growth over the medium-term.

Olam Agri continues to profitably grow its three segments – Origination & Merchandising, Processing & Value-added and Fibre, Agri-industrials & Ag Services. SALIC as a strategic and future majority shareholder is expected to support and catalyse its growth.

The Remaining Olam Group businesses will focus on narrowing their losses while the Group reviews strategic options for these businesses to unlock and realise value for shareholders.

S$1= $0.74