SINGAPORE – Olam International Limited (“Olam”, “the Company” or the “Group”) is announcing a renounceable, fully underwritten rights issue as it positions itself for future growth. Priced at S$1.25 on a basis of 3 rights shares for every 20 existing ordinary shares, the rights issue price represents a 26.9% discount to the last traded price per share of S$1.71 on June 21, 2021 and a 24.2% discount to the theoretical ex-rights price per share of S$1.65. The rights issue is expected to raise gross proceeds of S$601.7 million.

Group CEO and Co-founder of Olam International Sunny Verghese said:

“This rights issue, which is fully sub-underwritten by our major shareholder Temasek, provides shareholders who have supported us all these years an opportunity to further participate in Olam’s Strategic Plan for future growth. Having completed the recent acquisition of Olde Thompson1 (“OT”), a leading US private label spices and seasonings manufacturer, this is a key next step, in line with our re-organisation plan, that will bolster our balance sheet and position us well to unlock long-term value for our stakeholders.”

Proceeds from the rights issue will be primarily used to partially repay the debt used to fund the acquisition of OT

which was completed on May 17, 2021 at an enterprise value of US$950 million. This acquisition is immediately accretive and provides multiple synergies, combining OFI’s strengths in global origination and sustainable supply chains with OT’s customer base and expertise in product formulation and private labels. It also builds on OFI’s two recent acquisitions in the North American spices sector of a US-based chilli pepper business2 and the onion ingredients business, Cascade Specialties.

The rights issue proceeds will also strengthen Olam’s balance sheet, enhance its credit profile and provide financial flexibility to capture future growth in line with its Strategic Plan.

Group CFO of Olam International N. Muthukumar said:

“Following the acquisition of Olde Thompson, undertaking this rights issue is the next logical step that will enable us to optimise our capital structure, thereby providing us with the readiness to capture opportunities as they arise.”

Entitled shareholders who choose not to subscribe to the rights issue can also realise value by selling their “nil-paid” rights in the market. They will also be able to subscribe for excess rights shares in addition to their pro rata entitlements. The rights issue is fully sub-underwritten by Breedens Investments Pte. Ltd., a wholly-owned subsidiary of Temasek Holdings (Private) Limited, which has agreed to subscribe to any rights shares that are not taken up by other existing shareholders, with no sub-underwriting fees paid.

The rights issue does not require shareholders’ approval as it is within the share issue mandate approved by shareholders at the Annual General Meeting held on April 23, 2021.

The Company has appointed BNP Paribas, acting through its Singapore Branch, Credit Suisse (Singapore) Limited, DBS Bank Ltd. and The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch as joint issue managers, who together with Mizuho Securities (Singapore) Pte. Ltd. are appointed as joint underwriters for the rights issue.

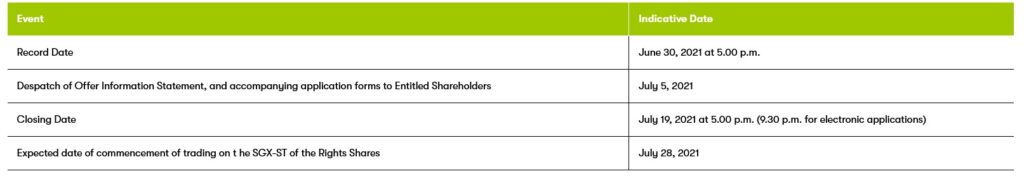

Key dates