Share your coffee stories with us by writing to info@comunicaffe.com.

SINGAPORE – Olam has released financial results for 2Q an 1H 2018. Co-Founder & Group CEO, Sunny Verghese said: “While our first half results were lower than the previous corresponding period, we expect stronger prospects for our business for the rest of the year.

Our investments in improving operational excellence (stronger cash, cost and capital focus), launch of AtSource, and digitalisation initiatives have progressed well and will strengthen our business going forward.”

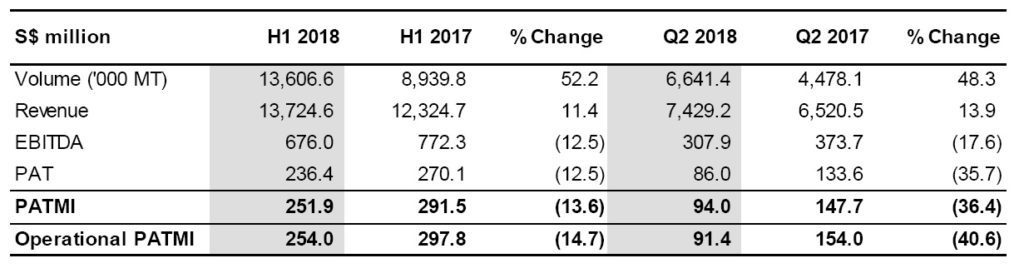

The report shows lower financial results against strong performance in previous corresponding period, with Q2 2018 PATMI down 36.4% to S$94.0 million; Operational PATMI down 40.6% to S$91.4 million

H1 2018 PATMI is down 13.6% to S$251.9 million; Operational PATMI is down 14.7% to S$254.0 million

Significant improvement was reported in net gearing (Jun 30, 2018: 1.46x; Jun 30, 2017: 1.97x).

Free Cash Flow to Equity (FCFE) in Q2 2018 improved significantly to S$242.1 million (Q2 2017: S$28.7 million).

FCFE in H1 2018 was negative S$167.0 million (H1 2017: -S$12.8 million)

The Board of Directors declared interim dividends of 3.5 cents per share for H1 2018 (H1 2017: 3.5 cents).

Executive Director and Group COO, A. Shekhar said:

“Our performance was satisfactory across the business, and must be seen against the particularly strong performance in the same period last year. Our Q2 2018 results were impacted by the continued down cycle in Coffee, unprecedented weather conditions in peanut farming in Argentina and lower contribution from Edible Oils.

“We continue to take proactive action to strengthen our balance sheet. We have significantly reduced net debt, lowered finance costs and diversified our funding sources with initiatives including undertaking Asia’ first sustainability-linked club loan and issuing private placements.”

Financial Results

Q2 2018

- PATMI (Profit After Tax and Minority Interest) down 36.4% year-on-year (YoY) to S$94.0 million against a strong Q2 2017 performance (Q2 2017: S$147.7 million) led by continued down cycle in Coffee, unprecedented weather conditions in peanut farming in Argentina and lower contribution from Edible Oils.

- Operational PATMI, which excludes exceptional items, fell 40.6% YoY to S$91.4 million (Q2 2017: S$154.0 million).

- EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) was down 17.6% at S$307.9 million (Q2 2017: S$373.7 million)

H1 2018

- PATMI decreased 13.6% YoY to S$251.9 million compared with a strong H1 2017 performance (H1 2017: S$291.5 million) led by continued down cycle in Coffee, unprecedented weather conditions in peanut farming in Argentina and lower contribution from Edible Oils.

- Operational PATMI was lower by 14.7% YoY at S$254.0 million (H1 2017: S$297.8 million).

- EBITDA was down 12.5% at S$676.0 million due to lower contribution from all segments when compared against a strong H1 2017 (H1 2017: S$772.3 million).

Cash flow and gearing

- Net gearing as at June 30, 2018 was lower at 1.46 times, versus 1.97 times as at June 30, 2017, as net debt came down with the reduction in working capital, lower gross capital expenditure (Capex), divestments and the conversion of warrants into equity.

- Free Cash Flow to Equity (FCFE) for Q2 2018 improved significantly from S$28.7 million to S$242.1 million on lower working capital usage and Capex.

- FCFE was negative S$167.0 million for H1 2018 (H1 2017: -S$12.8 million) due to higher working capital usage, partly offset by reduced capital spending, divestments and lower interest paid.

H1 2018 Segmental Performance

Edible Nuts, Spices & Vegetable Ingredients (SVI)

- Revenue grew marginally by 0.2% to S$2.1 billion, in line with volume growth.

- EBITDA fell by 7.2% to S$236.7 million, when compared with strong results in H1 2017. Edible Nuts reported a lower EBITDA as improved performance from cashew, almonds and hazelnuts was offset by peanut farming in Argentina, while SVI, excluding tomato processing, had a steady performance.

Confectionery & Beverage Ingredients

- Revenue decreased 17.9% to S$3.6 billion on lower volumes and lower coffee prices.

- EBITDA declined 4.5% to S$178.3 million against a strong H1 2017. The period recorded weaker results from Coffee, which continued to face difficult market conditions that started in Q4 2017, although this was partly compensated by better results from Cocoa supply chain and processing.

Food Staples & Packaged Foods

- Revenue was up 50.7% to S$6.0 billion on significant volume growth.

- EBITDA declined 23.2% to S$167.3 million against a very strong H1 2017. The segment was mainly impacted by Edible Oils platform, which experienced volatile trading conditions, higher period costs in Olam Palm Gabon and reduced share of income from Nauvu Investments after it was sold in March 2018.

Industrial Raw Materials, Ag Logistics & Infrastructure

- Revenue grew 8.6% to S$2.2 billion on higher sales volumes and higher cotton prices.

- EBITDA fell 11.6% to S$94.1 million on lower contribution from Nauvu and GSEZ, which offset growth from Wood Products.

Commodity Financial Services

- The segment reported an EBITDA loss of S$0.4 million (H1 2017: S$6.3 million).

Outlook

While global markets are experiencing heightened political and economic uncertainties, Olam believes its diversified and well-balanced portfolio provides a resilient platform to navigate the challenges in both the global economy and commodity markets.

Olam will continue to execute on its 2016-2018 Strategic Plan in H2 2018 and pursue growth in its prioritised platforms.

It remains focused on turning around underperforming businesses, ensuring gestating businesses reach full potential and delivering positive free cash flow.