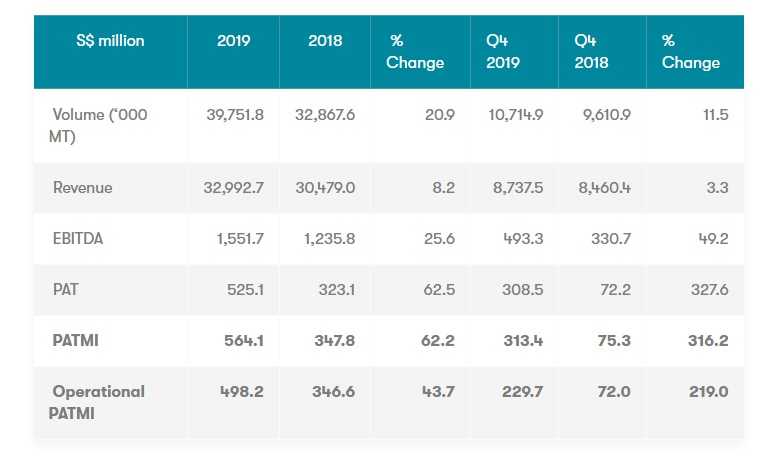

SINGAPORE – Singapore-listed agri-food giant Olam International posted a net profit of S$313.4 million for the fourth quarter ended Dec 31, 2019, more than quadruple the S$75.3 million a year ago. This came on the back of a stronger Ebitda, or earnings before interest, tax, depreciation and amortisation, performance, as well as net exceptional gains of S$83.7 million for the quarter, Olam said in a regulatory filing on Friday.

Earnings per share stood at 9.41 Singapore cents for the quarter, up from 1.92 cents a year ago.

Revenue for Q4 rose 3.3 per cent to S$8.74 billion, from S$8.46 billion in the previous year. This was thanks to higher contribution from its food staples and packaged foods, confectionery and beverage ingredients, as well as industrial raw materials, infrastructure and logistic segments.

Highlights

- Strong operating performance with Q4 2019 and 2019 EBITDA up 49.2% and 25.6%to S$493.3 million and S$1.6 billion respectively, mainly driven by higher contribution from Cocoa, Grains and Animal Feed businesses

- Q4 2019 and 2019 PATMI up 316.2% and 62.2% respectively on higher EBITDA and net exceptional gains, to S$313.4 million and S$564.1 million respectively

- Without exceptional gains and impact of SFRS(I) 161, Q4 2019 PATMI would have increased more than three-fold to S$236.2 million and 2019 PATMI by 51.2% to S$524.2 million.

- Positive Free Cash Flow to Equity of S$134.6 million in 2019 (2018: S$1.1 billion)

- Net gearing of 1.38x versus 1.32x in 2018

- Board recommends final dividend of 4.5 cents per share; total dividend for 2019 would be 8.0 cents per share (2018: 7.5 cents)

Olam ’s Co-Founder and Group CEO, Sunny Verghese said:

“We are pleased to have successfully completed the first year of our 2019-2024 Strategic Plan with all-round improved operational performance, execution of strategic initiatives and release of cash from targeted divestments. Building on our new Strategic Plan, we recently announced our plan to re-organise Olam into two new coherent operating groups – Olam Food Ingredients (OFI) and Olam Global Agri (OGA) to unlock and maximise the Company’s long-term value. Olam International, as the parent company of OFI and OGA, will play a key role in unlocking the full value of the Olam Group by providing stewardship to the new operating groups and building future growth engines.

“Even as we continue to monitor and mitigate the impact from the COVID-19 outbreak, we are confident that we have strong foundations in place to weather any short-term volatility and accelerate profitable growth in line with key consumer trends and market opportunities.”

Olam ’s Group CFO, N. Muthukumar said:

“Our proactive management of our capital structure continued to pay off, as we maintained a strong balance sheet and continued to deliver positive free cash flows despite investing

S$1.1 billion of capex to execute our new Strategic Plan. We also continued to diversify our funding sources in 2019 through a mix of traditional and innovative channels, including the world’s first Digital Loan and a second sustainability-linked loan. Our commitment to sustainable financing gives us a clear advantage, builds resilience and enables us to catalyse positive change in our sector.”

Financial Results

Q4 2019

- EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) grew by 49.2% to S$493.3 million (Q4 2018: S$330.7 million) primarily on higher contribution from the Confectionery and Beverage Ingredients, Food Staples and Packaged Foods, and Industrial Raw Materials, Infrastructure and Logistics segments.

- PATMI (Profit After Tax and Minority Interest) surged 316.2% year-on-year (YoY) to S$313.4 million (Q4 2018: S$75.3 million) on the stronger EBITDA performance as well as net exceptional gains of S$83.7 million. Excluding the impact of SFRS(I) 16, PATMI would have been higher at S$319.9 million.

- Operational PATMI, which excludes exceptional items, was 219.0% higher YoY at S$229.7 million (Q4 2018: S$72.0 million). Excluding the impact of SFRS(I) 16, Operational PATMI would have higher at S$236.2 million.

2019

- EBITDA grew 25.6% to S$1.6 billion (2018: S$1.2 billion) on higher contribution from all segments except Industrial Raw Materials, Infrastructure and Logistics. Most of the increase came from Confectionery and Beverage Ingredients, and Food Staples and Packaged Foods, notably Cocoa and Grains and Animal Feed businesses.

- PATMI increased 62.2% YoY to S$564.1 million (2018: S$347.8 million) on higher EBITDA and one-off exceptional gains. Excluding the impact of SFRS(I) 16, PATMI would have been higher at S$590.1 million.

Operational PATMI was higher by 43.7% YoY at S$498.2 million (2018: S$346.6 million). Excluding the impact of SFRS(I) 16, Operational PATMI would have been higher at S$524.2 million.

Cash flow and gearing

- Positive Free Cash Flow to Equity at S$134.6 million (2018: S$1.1 billion) with improved operating cash flow offset by higher deployment of working capital amid peak procurement season for several of its leading products.

- Net gearing as at December 31, 2019 was slightly higher at 1.38 times (2018: 1.32 times) due to increased net debt on the adoption of SFRS(I) 16 and higher working capital.

2019 Segmental Performance

Edible Nuts and Spices

- Revenue increased 2.9% to S$4.4 billion mainly due to due to improved sales realisation for Edible Nuts.

- EBITDA was 0.7% higher at S$342.4 million – While Edible Nuts did better in 2019 on improved performance from cashew, Spices had a lower EBITDA on reduced contribution from onion and garlic.

Confectionery and Beverage Ingredients

- Revenue declined by 6.2% to S$6.7 billion on lower Cocoa volumes and lower coffee prices.

- EBITDA grew by a strong 26.6% to S$562.1 million with stellar performance and improved margins for the Cocoa business in both supply chain and processing operations. Coffee EBITDA also improved.

Food Staples and Packaged Foods

- Revenue rose by 21.5% to S$17.6 billion, mainly driven by the growth in Grains trading volumes and sales from Packaged Foods.

- EBITDA grew by a robust 57.4% to S$454.6 million, led mainly by Grains and Animal Feed and improved contribution from Packaged Foods, Dairy and Edible Oil supply chain businesses.

Industrial Raw Materials, Infrastructure and Logistics

- Revenue decreased by 6.3% to S$4.2 billion mainly due to lower sales volume and lower cotton prices.

- EBITDA declined by 1.5% to S$173.6 million on lower contribution from Cotton, which was partly offset by improved contribution from Infrastructure and Logistics, and Wood Products.

Commodity Financial Services

- The segment reported an EBITDA of S$19.0 million, reversing a S$13.1 million loss in 2018.

* 1 Singapore Dollar = US$0,71941