LONDON, UK – The ICO composite indicator in October decreased by 8.9% to 105.85 US cents/lb as prices for all group indicators declined, though the largest decrease was for Brazilian Naturals, states the Ico in its monthly coffee market report. Global coffee exports in September increased by 0.9% to 10.16 million bags as increased Robusta shipments offset a decline in Arabica exports. Exports in coffee year 2019/20 fell 4.9% to 126.9 million bags, and the value of these shipments decreased by 3.6% to 17.87 billion USD compared to coffee year 2018/19.

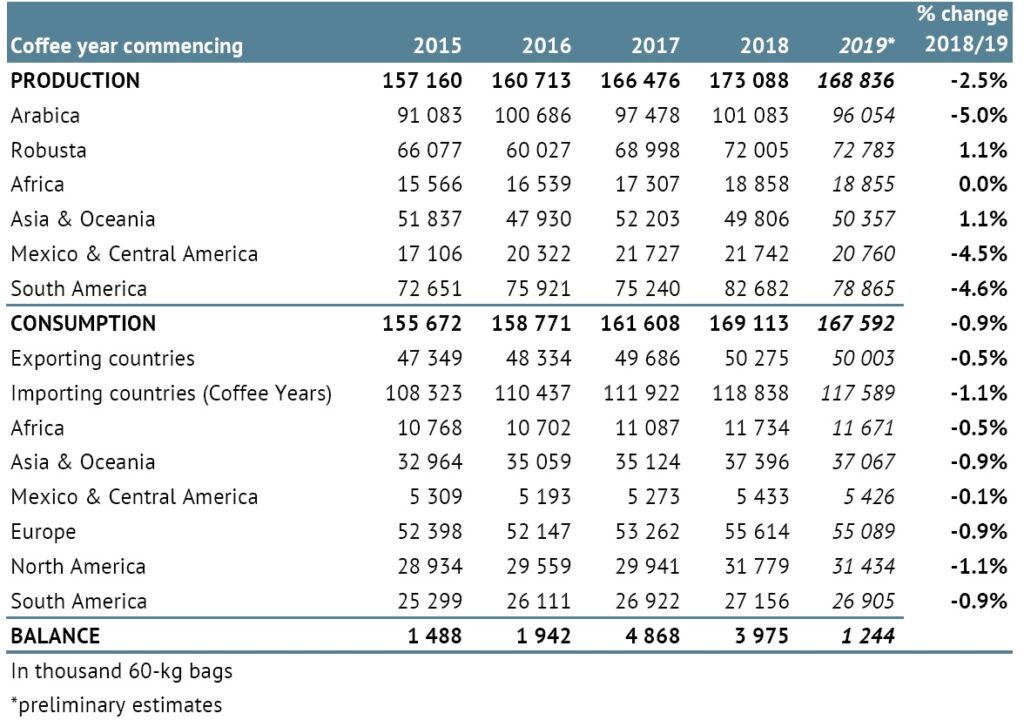

Global coffee production in 2019/20 is estimated at 168.84 million bags, 2.5% lower than last year, while world coffee consumption is estimated to decrease by 0.9% to 167.59 million bags, resulting in a surplus of 1.24 million bags.

The monthly average of the ICO composite indicator fell by 8.9% to 105.85 US cents/lb in October 2020, nearly reversing the gains made in the last two months.

The daily composite indicator continued the descent that began in mid-September, going from a high of 107.94 US cents/lb on 9 October 2020 to a low of 103.3 US cents/lb on 21 October.

In the last seven days of the month it ranged between 104.49 US cents/lb and 106.5 US cents/lb. Increased exports in September, signalling availability of supplies at the end of the crop year, and the larger crop from Brazil are weighing on prices.

Prices for all group indicators declined in September 2020 after three months of increase. The largest decrease occurred in the average price for Brazilian Naturals which fell by 11.8% to 100.37 US cents/lb. The average price for Other Milds decreased by 8.7% to 152.06 US cents/lb while the price for Colombian Milds fell by 8.4% to 154.28 US cents/lb.

As a result, the differential between Colombia Milds and Other Milds grew by 23.3% to an average of 2.22 US cents/lb as the supply of Colombian Milds became relatively scarcer. Robusta prices averaged 68.36 US cents/lb, 6.1% lower than in September 2020.

The average arbitrage in October, as measured on the New York and London futures markets, fell by 12.2% to 51.56 US cents/lb. After falling for eight consecutive months, stocks of certified Arabica increased by 3.2% to 1.3 million bags in October 2020. Certified Robusta stocks amounted to 2.04 million bags, 10.3% higher than in September 2020.

The volatility of the ICO composite indicator price increased by 0.1 percentage points to 8.8% as the volatility for Robusta prices rose by 1.1 percentage points to 9.5%. The volatility for Colombian Milds declined by 0.3 percentage points to 8.2%, and the volatility for Other Milds fell by 0.2 percentage points to 7.8%. Brazilian Naturals volatility declined by 0.1 percentage points to 12.2%.

Global output in 2019/20 is estimated at 168.84 million bags, 2.5% lower than in 2018/19. Arabica output is estimated to decrease by 5% to 96.05 million bags while Robusta output is expected to rise by 1.1% to 72.78 million bags. The decrease in output is attributed primarily to the reduction in Brazil as it was an off-year for its Arabica production. Additionally, the ongoing low prices as well as the effects of covid-19 on labour supply have also contributed to the lower output.

In 2019/20, global coffee consumption is estimated to fall by 0.9% to 167.59 million bags following an increase of 4.6% in 2018/19 to 169.11 million bags. Demand is estimated downwards due to ongoing pressure from a global economic downturn and limited recovery in out-of-home consumption as social distancing measures remain in place globally.

Although both production and consumption decreased, 2019/20 is seen in surplus, with global output exceeding consumption by 1.24 million bags. The ICO composite indicator reached 107.25 US cents/lb in coffee year 2019/20. This compares to an average of 100.47 US cents/lb in 2018/19 when the surplus reached nearly 4 million bags. Further recovery in prices over the next few months will likely be limited by this surplus and the prospects of more coffee reaching the market, particularly Brazil’s 2020/21 crop, an on-year of the biennial Arabica production cycle.

In September 2020, world coffee exports rose by 0.9% to 10.16 million bags compared to September 2019. Shipments of Arabica fell by 4.1% to 6.17 million bags, but Robusta exports offset this fall, rising by 9.6% to 4 million bags. Colombian Milds recorded the largest decrease in September, falling by 12.5% to 953,000 bags. Exports of Other Milds fell by 6.9% to 1.82 million bags, while Brazilian Naturals rose by 0.2% to 3.39 million bags.

In coffee year 2019/20, global coffee shipments fell by 4.9% to 126.9 million bags compared with coffee year 2018/19. In October 2019 to September 2020, Robusta exports recorded the smallest decrease, declining by 1.4% to 48.68 million bags. Shipments of Other Milds fell by 9.8% to 25.15 million bags, Colombian Milds by 7.2% to 13.88 million bags and Brazilian Naturals by 4.9% to 39.18 million bags. The total value of coffee exports fell by 3.6% to 17.87 billion USD compared to coffee year 2018/19 while the average unit value per pound of green bean equivalent decreased to 148.66 US cents compared to 177.50 US cents in 2018/19.

Green Arabica exports fell by 7.7% to 71.98 million bags in 2019/20. Shipments from four of the five largest green Arabica exporters, which represent 78% of total green Arabica exports, fell in 2019/20. Brazil’s exports of green Arabica declined by 8.1% to 31.84 million bags, Colombia’s by 7.2% to 11.59 million bags, and Honduras’ by 19.1% to 5.51 million bags.

However, Ethiopia’s shipments of green Arabica rose by 1.3% to 3.85 million bags while Peru’s exports decreased by 9.5% to 3.63 million bags. The total value of green Arabica exports fell by 2.8% to 12 billion USD from 12.35 billion USD in 2018/19 and 13.48 billion USD in 2017/18. The average unit value grew by 5.3% to 126.07 US cents/lb.

In 2019/20, green Robusta shipments fell by 1.6% to 42.65 million bags, due largely to the decrease in exports from Viet Nam, which accounts for 56% of all green Robusta exports. Viet Nam’s shipments fell by 8.6% to 24.05 million bags. However, Brazil’s green Robusta exports rose by 21.2% to 4.63 million bags, Uganda’s by 25.9% to 4.39 million bags, and Indonesia’s by 31% to 3.93 million bags.

On the other hand, India’s shipments of green Robusta fell by 14.3% to 2.78 million bags. The total value of green Robusta exports declined by 8% to 3.93 billion USD from 4.27 billion USD in 2018/19 and 4.77 billion USD in 2017/18. The average unit value fell by 6.5% to 69.6 US cents/lb.

Shipments of roasted coffee have grown in each consecutive year from 370,000 bags in 2014/15 to 788,000 bags in 2018/19. However, roasted coffee exports fell by 15% to 669,000 bags in 2019/20. Colombia is the largest exporter of roasted coffee, and its shipments grew by 15% to 198,000 bags.

Shipments of roasted coffee have grown in each consecutive year from 370,000 bags in 2014/15 to 788,000 bags in 2018/19. However, roasted coffee exports fell by 15% to 669,000 bags in 2019/20. Colombia is the largest exporter of roasted coffee, and its shipments grew by 15% to 198,000 bags.

However, Mexico’s exports fell by 12.7% to 194,000 bags. Indonesia’s roasted shipments more than doubled to 48,500 bags while Brazil’s shipments fell by 11.2% to 23,000 bags. While the volume of roasted coffee exports declined in 2019/20, the total value rose by 7.8% to 176.36 million USD. Additionally, the average unit value of roasted coffee increased by 26.8% to 199.18 US cents/lb.

In the previous five years, soluble coffee exports have grown by an annual average rate of 5% from 9.01 million bags in 2014/15 to 11.34 million bags in 2018/19. In coffee year 2019/20, shipments of soluble coffee rose by 2.3% 11.60 million bags. Brazil is the largest exporter of soluble coffee, and in 2019/20, Brazil shipped 3.94 million bags, 2.1% lower than in 2018/19.

Indonesia’s exports of soluble coffee rose by 36.1% to 1.81 million bags while India’s fell by 7.8% to 1.8 million bags, which is the third year of decrease for India. Viet Nam’s shipment of soluble coffee decreased by 3.2% to 1.32 million bags. However, Mexico’s soluble coffee exports grew by 8.8% to 861,000 bags. The total value of soluble coffee exports rose by 0.3% to 1.76 million USD in 2019/20, and the average unit value decreased by 2% 114.81 US cents/lb.