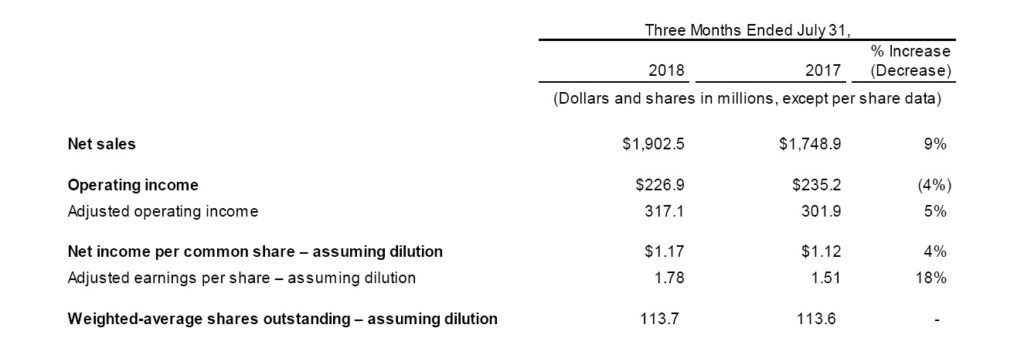

ORRVILLE, Ohio, U.S. – The J. M. Smucker Company has announced results for the first quarter ended July 31, 2018, of its 2019 fiscal year. All comparisons are to the first quarter of the prior fiscal year, unless otherwise noted.

Certain items previously reported in the financial statements have been reclassified to conform with the current year presentation.

Executive Summary

- Net sales increased $153.6 million, or 9 percent, reflecting the acquisition of Ainsworth Pet Nutrition, LLC (“Ainsworth”) on May 14, 2018.

- Net income per diluted share was $1.17. Adjusted earnings per share was $1.78, an increase of 18 percent.

- Both fiscal 2019 first quarter earnings per share measures included an unfavorable $0.07 per share impact from a purchase accounting adjustment attributable to acquired Ainsworth inventory.

- Cash provided by operating activities was $243.0 million and free cash flow was $141.7 million.

- The Company updated its full-year fiscal 2019 outlook reflecting the anticipated impact from the pending divestiture of its U.S. baking business.

Chief Executive Officer Remarks

“Our strong first quarter earnings reflect the execution of our strategy, aligning our portfolio for growth in pet food, coffee, and snacking,” said Mark Smucker, Chief Executive Officer.

“During the first quarter, we completed the Ainsworth acquisition, which drove much of our year-over-year sales growth, and we are making significant progress toward integrating the business. We also announced a planned divestiture of our U.S. baking business, which is expected to close at the end of this month. In addition, we had strong first quarter performance for key growth brands including Dunkin’ Donuts®, Smucker’s® Uncrustables®, Nature’s Recipe®, and Café Bustelo® while continuing to execute our cost reduction programs to enhance margins and provide fuel for investments in future growth.”

First Quarter Consolidated Results

Net Sales

Net Sales

Net sales increased reflecting a $162.8 million contribution from the Ainsworth acquisition. Excluding Ainsworth, net sales declined $9.2 million, or 1 percent, reflecting lower net price realization. This was mostly attributable to the pet food, coffee, and oils categories, partially offset by higher net pricing in the peanut butter category. Volume/mix and foreign currency exchange were both neutral to net sales.

Operating Income

Gross profit increased $16.1 million, or 2 percent, primarily driven by the addition of Ainsworth. This was partially offset by an unfavorable net impact of lower pricing and higher costs, attributable to an unfavourable change in derivative gains and losses. Reflected in gross profit was a $10.9 million fair value purchase accounting adjustment attributable to acquired Ainsworth inventory, which resulted in higher cost of products

sold when the related inventory was sold in the quarter. Selling, distribution, and administrative (“SD&A”) expenses increased $34.5 million, primarily reflecting the addition of Ainsworth. Operating income decreased $8.3 million, due to the higher SD&A expenses and a $9.0 million increase in amortization expense, which was primarily attributable to Ainsworth. A reduction in other special project costs of $19.4 million partially offset these factors.

On a non-GAAP basis, adjusted gross profit increased $50.0 million, or 8 percent, with the primary difference from GAAP results being the exclusion of the $34.6 million unfavorable change in unallocated derivative gains and losses. After factoring in the increase in SD&A expenses, adjusted operating income increased $15.2 million, or 5 percent.

Other

Net interest expense increased $11.6 million, due to increased debt associated with the Ainsworth acquisition. The Company’s effective tax rate was 23.2 percent compared to 32.9 percent in the prior year.

The decrease reflected the benefit of a lower U.S. federal statutory tax rate as a result of U.S. income tax reform.

Cash provided by operating activities was $243.0 million, compared to $304.3 million in the prior year, with the decline reflecting an increase in working capital requirements, primarily attributable to accounts receivable. Free cash flow was $141.7 million, compared to $234.7 million in the prior year with the decrease further reflecting a $31.7 million increase in capital expenditures.

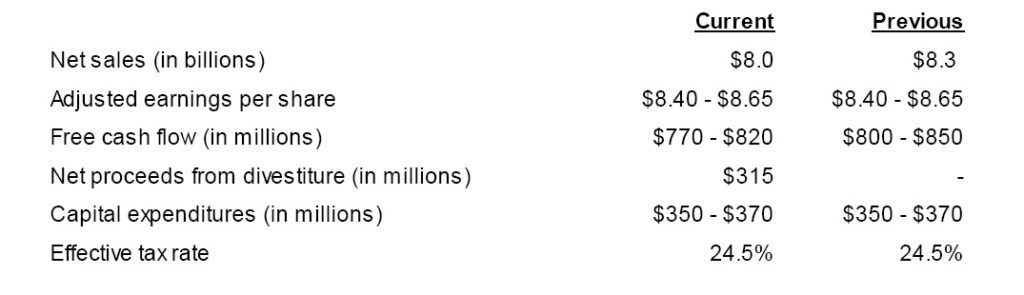

Full-Year Outlook

The Company updated its full-year fiscal 2019 guidance as summarized below:

On July 9, 2018, the Company announced the signing of a definitive agreement to divest its U.S. baking business. Full-year projections for this business were included in the Company’s previous fiscal 2019 guidance. The Company has now updated its full-year outlook to reflect the anticipated impact of the divestiture, based on an expected transaction close date of August 31, 2018. In addition, the net sales guidance also reflects lower than anticipated net sales in the first quarter.

On July 9, 2018, the Company announced the signing of a definitive agreement to divest its U.S. baking business. Full-year projections for this business were included in the Company’s previous fiscal 2019 guidance. The Company has now updated its full-year outlook to reflect the anticipated impact of the divestiture, based on an expected transaction close date of August 31, 2018. In addition, the net sales guidance also reflects lower than anticipated net sales in the first quarter.

The adjusted earnings per share guidance range now reflects the estimated impact from the divestiture, including the following factors: (1) foregone profit related to the U.S. baking business for the last 8 months of fiscal 2019; (2) an anticipated gain related to the transaction; and (3) a benefit from the use of net proceeds from the divestiture.

The reduction in the free cash flow guidance range primarily reflects the forgone profit related to the divestiture. In addition to free cash flow of $770 millon to $820 million, the Company anticipates net proceeds from the divestiture of $315 million, after transaction costs and taxes.

U.S. Retail Coffee

Segment net sales increased $10.1 million. Favorable volume/mix contributed 2 percentage points, driven by the Dunkin’ Donuts®, 1850TM, and Café Bustelo® brands, partially offset by declines in Folgers® roast and ground coffee. The favorable volume/mix was slightly offset by lower net price realization, driven by the Folgers® brand. Segment profit increased $24.6 million primarily due to lower input costs, which more than offset an increase in marketing expense.

Segment net sales increased $10.1 million. Favorable volume/mix contributed 2 percentage points, driven by the Dunkin’ Donuts®, 1850TM, and Café Bustelo® brands, partially offset by declines in Folgers® roast and ground coffee. The favorable volume/mix was slightly offset by lower net price realization, driven by the Folgers® brand. Segment profit increased $24.6 million primarily due to lower input costs, which more than offset an increase in marketing expense.