MILAN – Starbucks reported fiscal second quarter results Tuesday. U.S. same-store sales were up 12%, beating expectations, but revenue and earnings per share came in just a bit below expectations.

The Seattle coffee giant suspended its guidance for the rest of its fiscal year as it navigates ongoing inflationary pressures, supply chain disruptions, labor costs, unionization efforts and the search for a permanent CEO to take the helm of the company.

The company welcomed back former CEO and executive chairman Howard Shultz last month as interim CEO, effective April 4, 2022, as the company looks for a permanent successor.

Starbucks said revenue rose 15% to a record $7.6 billion in its 13-week quarter, which ended April 3. That was in line with Wall Street’s estimates, according to analysts polled by FactSet.

But net earnings rose just 2% to $674 million. Starbucks’ adjusted earnings of 59 cents per share fell short of analysts’ forecast of 60 cents.

Sales in China decreased 23%, driven by a 20% decline in comparable transactions and a 4% decline in average ticket sales, said CEO Howard Schultz, who blamed a rise in COVID-19 cases and government shutdowns.

Starbucks noted that it faced higher employment costs during the quarter. Last fall, the company announced a $1 billion investment in employee wages and benefits in an effort to lift U.S. workers’ pay to at least $15 per hour by this summer.

Starbucks: Q2 Fiscal 2022 Highlights

- Global comparable store sales increased 7%, driven by a 4% increase in average ticket and a 3% increase in comparable transactions

- North America and U.S. comparable store sales increased 12%, driven by a 7% increase in average ticket and a 5% increase in comparable transactions

- International comparable store sales decreased 8%, driven by a 5% decline in average ticket and a 3% decline in comparable transactions; China comparable store sales decreased 23%, driven by a 20% decline in comparable transactions and a 4% decline in average ticket

- International and China comparable store sales include the unfavorable impact of approximately 3% and 4%, respectively, from lapping prior-year value-added tax (“VAT”) exemptions in China

- The company opened 313 net new stores in Q2, ending the period with 34,630 stores globally: 51% company-operated and 49% licensed

- At the end of Q2, stores in the U.S. and China comprised 61% of the company’s global portfolio, with 15,544 stores in the U.S and 5,654 stores in China

- Consolidated net revenues up 15% to a Q2 record $7.6 billion

- GAAP operating margin of 12.4% decreased 240 basis points from 14.8% in the prior year, primarily driven by inflationary pressures, mobility restrictions and lockdowns in China and investments in retail store partner wages and benefits, partially offset by pricing in North America and lapping restructuring costs in the prior year

- Non-GAAP operating margin of 13.0% decreased from 16.0% in the prior year

- GAAP earnings per share of $0.58 grew 4% over the prior year

- Non-GAAP earnings per share of $0.59, down from $0.61 in the prior year

- Starbucks® Rewards loyalty program 90-day active members in the U.S. increased to 26.7 million, up 17% year-over-year

“We are single-mindedly focused on enhancing our core U.S. business through our partner, customer and store experiences. Given record demand and changes in customer behavior we are accelerating our store growth plans, primarily adding high-returning drive-thrus, and accelerating renovation programs so we can better meet demand and serve our customers where they are,” said Howard Schultz, interim chief executive officer. “The investments we are making in our people and the company will add the capacity we need in our U.S. stores today and position us ahead of the coming growth curve ahead,” Schultz added.

“We are confident that the investments in our partners, our stores and our brand that we announced today will deliver returns in excess of historic levels and accelerate our growth long into the future,” commented Rachel Ruggeri, chief financial officer.

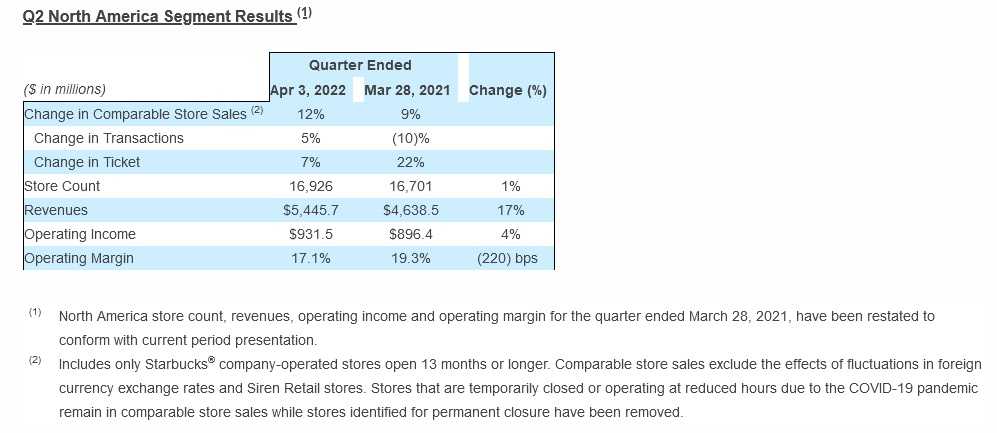

Q2 North America Segment Results

Net revenues for the North America segment grew 17% over Q2 FY21 to $5.4 billion in Q2 FY22, primarily driven by a 12% increase in company-operated comparable store sales, driven by a 7% increase in average ticket and a 5% increase in transactions, performance of new stores over the past 12 months and strength in our licensed store sales.

Operating income increased to $931.5 million in Q2 FY22, up from $896.4 million in Q2 FY21. Operating margin of 17.1% contracted from 19.3% in the prior year, primarily driven by higher supply chain costs due to inflationary pressure, investments in labor including enhanced store partner wages and higher spend on new partner training, onboarding and support costs to address labor market conditions, as well as lapping prior year government subsidies. This contraction was partially offset by pricing, sales leverage and lower restructuring expenses primarily associated with the North America Trade Area Transformation.

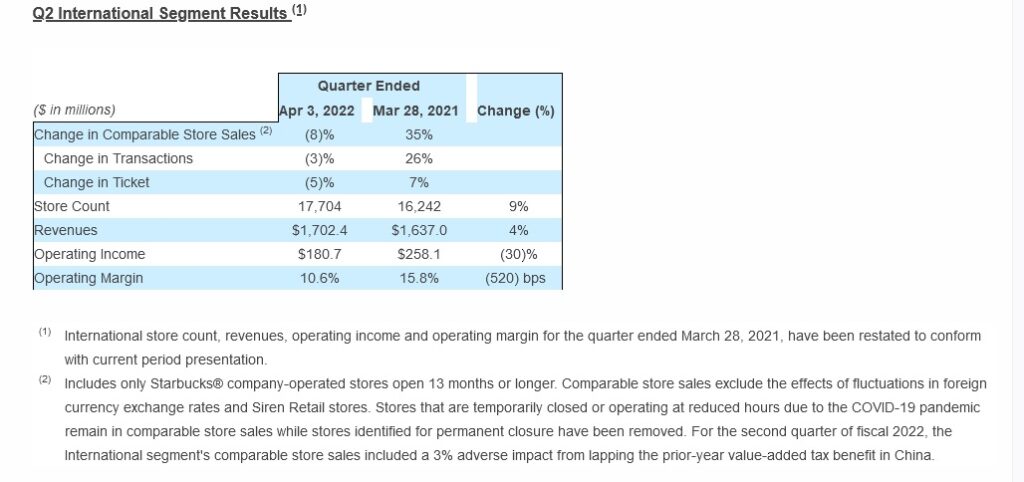

Starbucks: Q2 International Segment Results

Net revenues for the International segment grew 4% over Q2 FY21 to $1.7 billion in Q2 FY22, driven by 1,462 net new store openings, or 9% store growth, over the past 12 months, higher product sales to and royalty revenues from our licensees and the conversion of the Korea market from a joint venture to a fully licensed market in Q4 FY21. These increases were partially offset by an 8% decline in comparable store sales, primarily attributable to COVID-19 related restrictions in China and lapping the prior-year VAT benefit in China, as well as the impact of unfavorable foreign currency translation.

Operating income decreased to $180.7 million in Q2 FY22 compared to $258.1 million in Q2 FY21. Operating margin of 10.6% contracted from 15.8% in the prior year, primarily driven by investments in strategic initiatives and store partner wages, lower government subsidies as well as higher product and distribution costs from a sales mix shift and inflation. This contraction was partially offset by lower amortization expense.

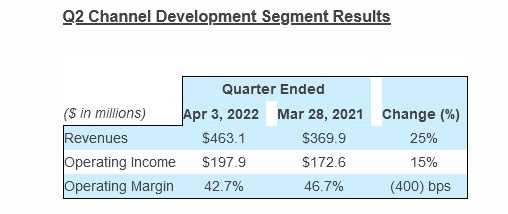

Q2 Channel Development Segment Results

Net revenues for the Channel Development segment of $463.1 million in Q2 FY22 were 25% higher relative to Q2 FY21. The increase was primarily driven by growth in the Global Coffee Alliance and the International ready-to-drink businesses.

Operating income increased to $197.9 million in Q2 FY22, up from $172.6 million in Q2 FY21. Operating margin of 42.7% decreased from 46.7% in the prior year, primarily due to business mix shift driven by growth in the Global Coffee Alliance.

Starbucks: Fiscal 2022 Financial Targets

The company will discuss fiscal year 2022 financial targets during its Q2 FY22 earnings conference call starting today at 2:00 p.m. Pacific Time. These items can be accessed on the company’s Investor Relations website during and after the call. The company uses its website as a tool to disclose important information about the company and comply with its disclosure obligations under Regulation Fair Disclosure.

Company Updates

In February, the company executed a $1.5 billion bond issuance. The company intends to use the net proceeds from the sale of the securities for general corporate purposes, including repayment of upcoming debt maturities.

In February, the company announced expanded hometown efforts in the greater Seattle area to support chronic homelessness, including a nearly $500,000 commitment in programming and partnerships throughout 2022.

In March, the company hosted its 30th Annual Meeting of Shareholders. During the virtual meeting, senior leadership and partners from around the world recognized and celebrated the resilience of green apron partners who have continued to serve communities throughout the COVID-19 pandemic.

As a part of the Annual Meeting of Shareholders, the company highlighted new sustainability innovations including efforts to reduce waste through innovative reusable cup programs, a new waste and recycling app to help partners navigate complex and unique store recycling guidelines and a pilot program with Volvo Cars to electrify the driving route from the Colorado Rockies to Seattle.

In March, also as a part of the Annual Meeting of Shareholders, the company announced that Kevin Johnson, former president and chief executive officer, would retire from his position effective April 4, 2022. The Board appointed founder Howard Schultz as interim chief executive officer, effective April 4, 2022, with Schultz rejoining the company’s Board of Directors. Johnson continues to serve as a Starbucks partner and consultant to the company and Board of Directors through the end of fiscal 2022.

In April, the company published its 2021 Global Environmental and Social Impact report for the 20th consecutive year.

The Board of Directors declared a cash dividend of $0.49 per share, payable on May 27, 2022, to shareholders of record as of May 13, 2022.

In April, the company announced a suspension of its share repurchase program. Prior to the announcement, 5.2 million shares of common stock were repurchased in Q2 FY22; approximately 52.6 million shares remain available for purchase under the current authorization.