NEW YORK, US – StoneX Group Inc. (formerly INTL FCStone Inc.), a diversified global brokerage and financial services firm providing execution, risk management and advisory services, market intelligence and clearing services across multiple asset classes and markets around the world, today announced its financial results for the fiscal year 2021 third quarter ended June 30, 2021.

Sean M. O’Connor, CEO of StoneX Group Inc., stated, “We continued to deliver strong financial results in our fiscal third quarter with a 34% increase in operating revenues and an ROE in excess of our 15% target. I am especially pleased that our year-to-date earnings are up 18% versus last year’s exceptional results which were buoyed by the extreme market volatility resulting from the onset of the COVID-19 pandemic in early 2020.

The continued growth in our trading volumes across nearly all of our platforms, as well as the increase in our client equity, which now stands at nearly $6 billion, reflect the expansion of our customer footprint and their deeper engagement with StoneX.”

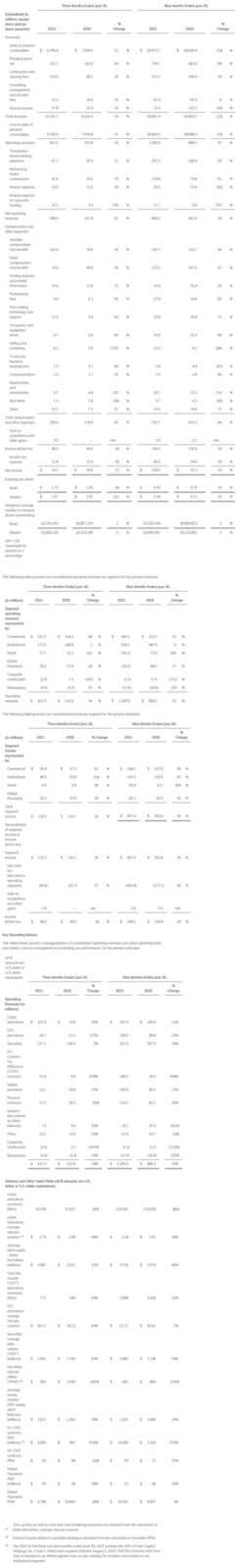

StoneX Group Inc. Summary Financials

Consolidated financial statements for the Company will be included in our Quarterly Report on Form 10-Q to be filed with the SEC. The Quarterly Report on Form 10-Q will also be made available on the Company’s website at www.stonex.com (click to enlarge).

Operating Revenues

Operating Revenues

Operating revenues increased $108.9 million, or 34%, to $431.5 million in the three months ended June 30, 2021 compared to $322.6 million in the three months ended June 30, 2020. The table above displays operating revenues disaggregated across the key products we provide to our clients.

Operating revenues derived from listed derivatives increased $26.2 million, or 35%, to $101.8 million in the three months ended June 30, 2021 compared to $75.6 in the three months ended June 30, 2020. This growth was primarily driven by a 46% increase in the average rate per contract, principally due to an increase in volume from commercial customers, which was partially offset by an overall 5% decline in listed derivative contract volumes.

Operating revenues derived from OTC transactions increased $28.3 million, or 132%, to $49.7 million in the three months ended June 30, 2021 compared to $21.4 million in the three months ended June 30, 2020. This was the result of growth in OTC contract volumes and the average rate per contract of 43% and 64%, respectively in the three months ended June 30, 2021. This growth was principally driven by increased volatility in both grain and energy markets.

Operating revenue derived from securities transactions increased $0.9 million, or 1%, to $137.1 million in the three months ended June 30, 2021 compared to $136.2 million in the three months ended June 30, 2020. This growth was principally due to a 64% increase in ADV, which was partially offset by a 42% decline in the RPM as the prior year period benefited from wider spreads due to volatility driven by the onset of the COVID-19 pandemic.

Operating revenues derived from FX/CFD contracts increased $47.0 million, or 979% to $51.8 million in the three months ended June 30, 2021 compared to $4.8 million in the three months ended June 30, 2020, as a result of an incremental $48.1 million in FX/CFD contracts operating revenues in our Retail segment resulting from the acquisition of Gain which was partially offset by lower FX operating revenues in our Institutional FX prime brokerage business.

Operating revenues from global payments increased $7.3 million, or 27%, to $34.1 million in the three months ended June 30, 2021 compared to $26.8 million in the three months ended June 30, 2020, principally driven by a 38% increase in ADV.

Operating revenues derived from physical contracts declined $2.1 million, or 5%, to $37.2 million in the three months ended June 30, 2021 compared to $39.3 million in the three months ended June 30, 2020. This decline was principally due to a decline in precious metals operating revenues, which was partially offset by an increase in agricultural and energy commodity revenues. The three months ended June 30, 2021 and 2020 include unrealized losses on derivative positions held against physical inventories carried at the lower of cost or net realizable value of $2.1 million and $2.5 million, respectively.

Interest and fee income earned on client balances, which is associated with our listed and OTC derivative, correspondent clearing, and independent wealth management product offerings, increased $2.4 million, or 52%, to $7.0 million in the three months ended June 30, 2021 compared to $4.6 million in the three months ended June 30, 2020. This was principally driven by an increase in average client equity and average FDIC sweep client balances of 31% and 28%, respectively.