PETACH TIKVA, Israel – Gadi Lesin, President and CEO of Strauss Group: “The Group continues to post excellent financial results in all key metrics.

The third quarter perpetuates the trend of prior quarters and demonstrates a strong performance by Strauss Israel and noteworthy results achieved by the Group’s global growth drivers in the coffee and water companies, along with continued focus on efforts to improve Sabra’s results.

The results of our operations in key countries, including Brazil, Russia, China, Australia and Israel – combined with the initial deliverables of implementing our strategy of focusing on our core businesses – have generated robustness and stability the Group can continue to build on in the future.”

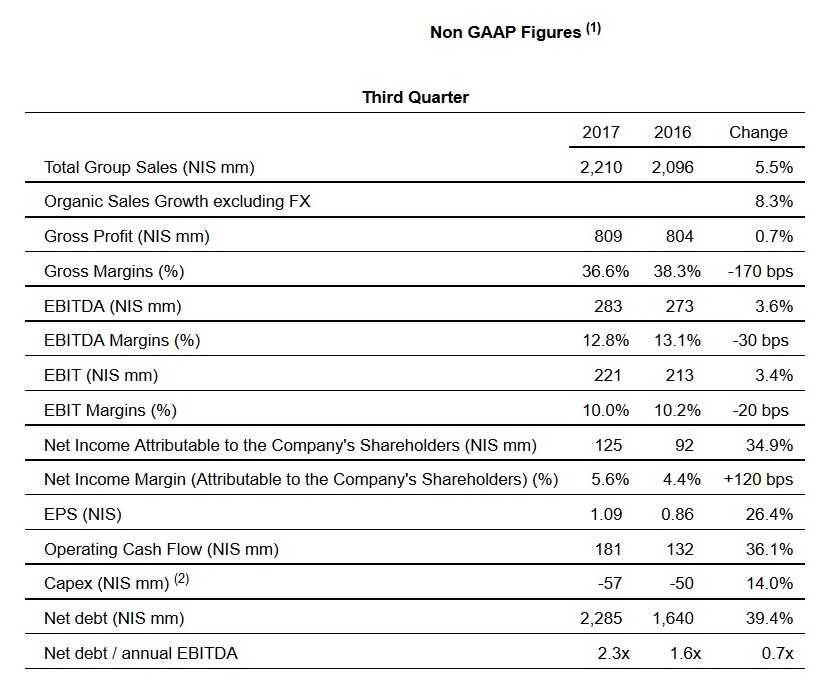

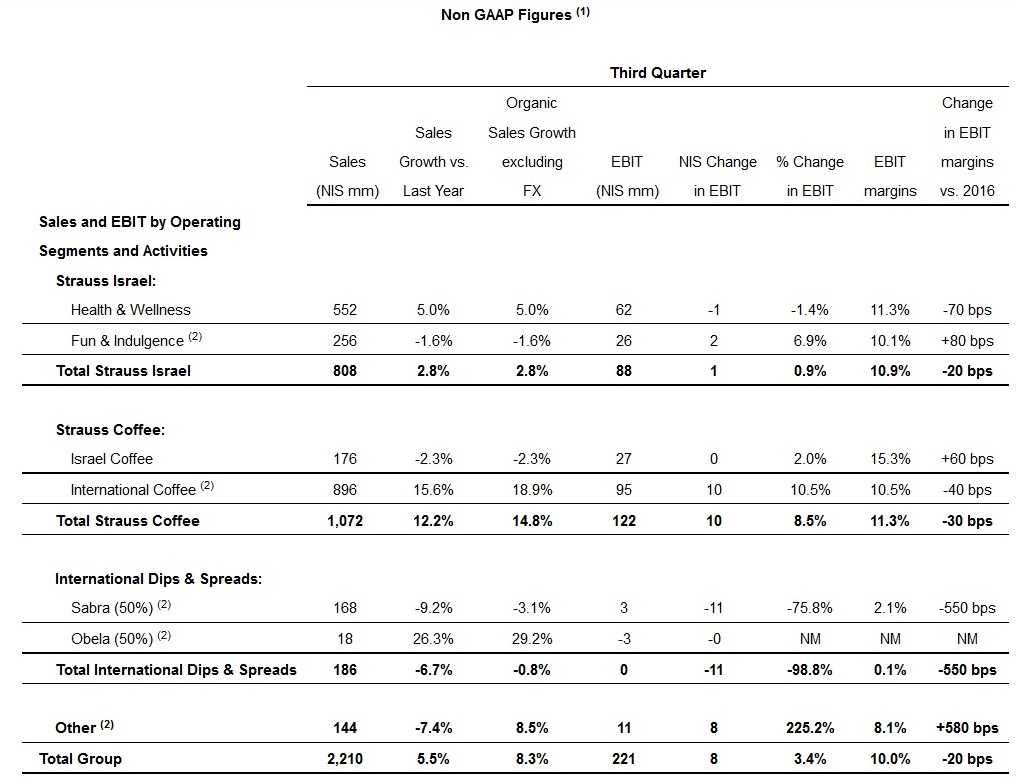

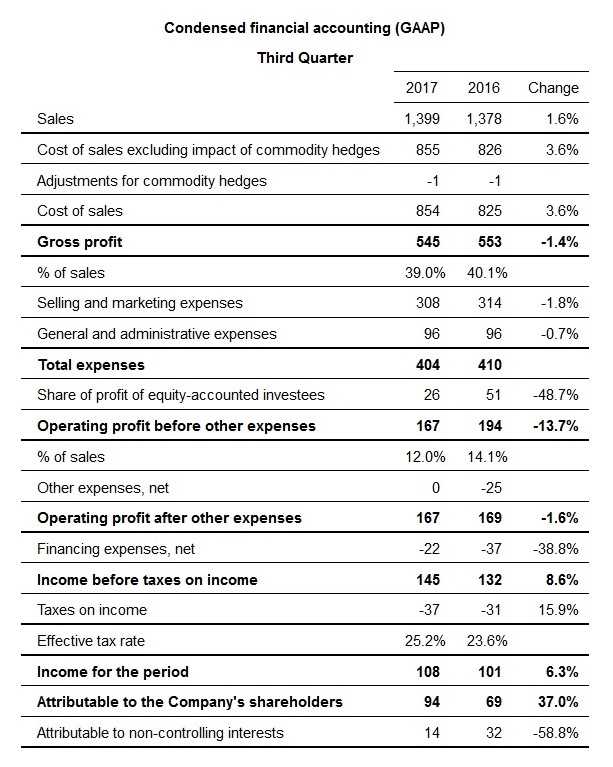

Q3 2017 highlights(1)

- Strong organic sales growth, excluding foreign exchange effects, was c8.3%. Shekel sales were NIS c2.2 billion compared to NIS 2.1 billion in the corresponding prior-year period; sales were impacted by negative foreign currency translation amounting to NIS c34 million, mainly as a result of the weakening of the BRL against the NIS compared to the corresponding period.

- Gross profit was NIS c809 million (c36.6% of sales), up c0.7% compared to the corresponding prior-year period. Gross margins were down c1.7%.

- Operating profit (EBIT) was NIS c221 million (c10% of sales), up c3.4% compared to last year. EBIT margins were down c0.2%.

- EPS for shareholders of the Company was NIS c1.09, up c26.4% compared to the corresponding prior-year period.

- Positive cash flows from operating activities totaled NIS c181 million, compared to NIS c132 million in 2016.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

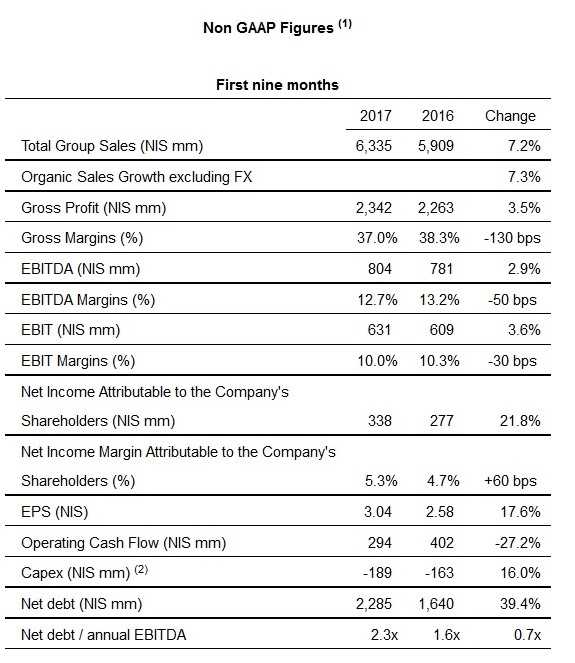

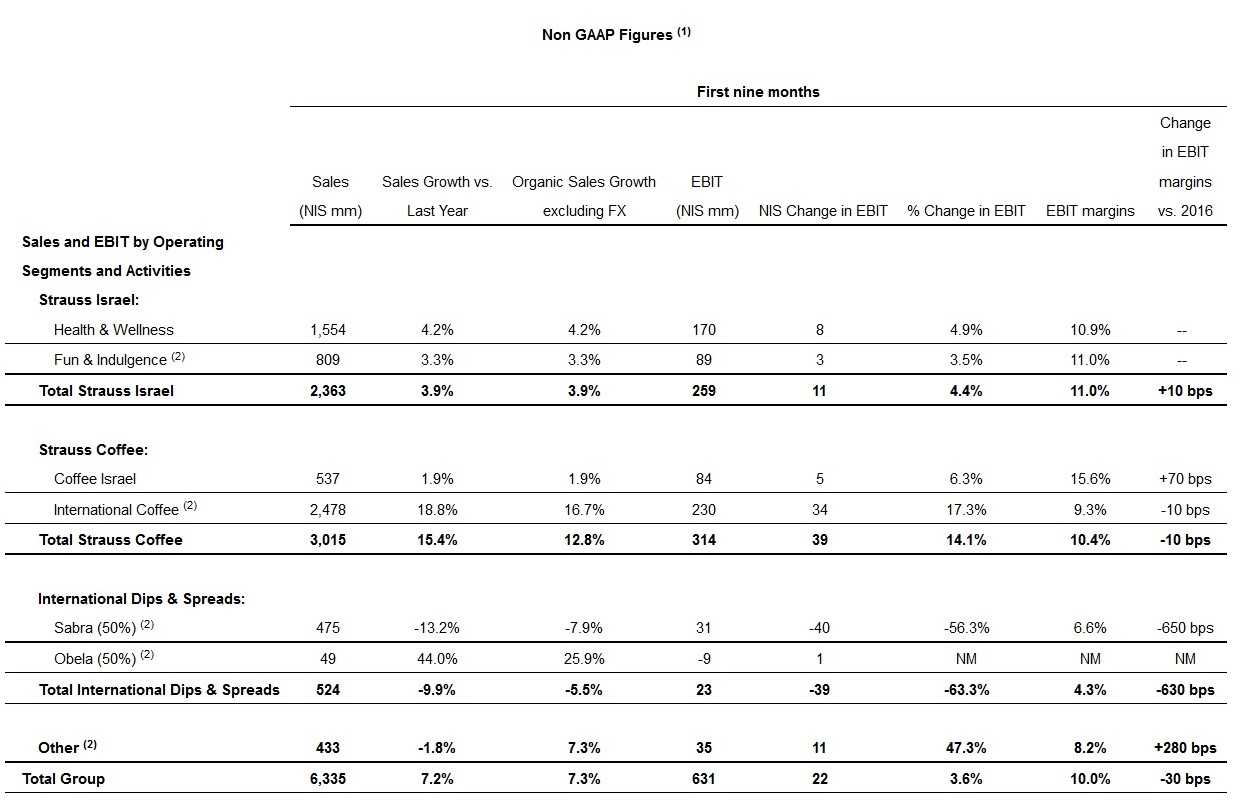

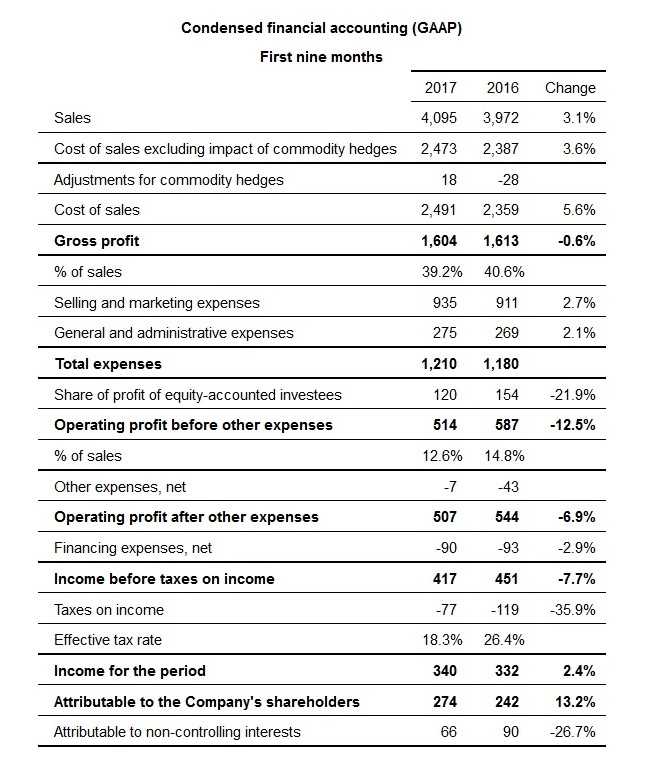

First nine months 2017 highlights(1)

- Organic sales growth, excluding foreign exchange effects, was c7.3%. Shekel sales were NIS c6.3 billion compared to NIS 5.9 billion in the corresponding prior-year period; sales were impacted by positive foreign currency translation of NIS c4 million, mainly as a result of continued gains by the BRL against the NIS compared to the corresponding period.

- Gross profit was NIS c2,342 million (c37.0% of sales), up c3.5% compared to the corresponding prior-year period. Gross margins were down c1.3%.

- Operating profit (EBIT) was NIS c631 million (c10% of sales), up c3.6% compared to last year. EBIT margins were down c0.3%.

- EPS for shareholders of the Company was NIS c3.04, up c17.6% compared to the corresponding prior-year period.

- Positive cash flows from operating activities totaled NIS c294 million, compared to NIS c402 million in 2016.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(2) Investments include the acquisition of fixed assets and investment in intangibles.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(2) Fun & Indulgence figures include Strauss’s 50% share in the salty snacks business. International Coffee figures include Strauss’s 50% share in the Três Corações joint venture (3C) – Brazil – a company jointly held by the Group (50%) and by the local São Miguel Group (50%). International D&S figures reflect Strauss’s 50% share in Sabra and Obela. Other Operations figures include Strauss’s share in the joint venture in China, Haier Strauss Water (HSW). Until August the Company held a 34% stake in the joint venture, and commencing in September, its percentage holding increased to 49% following the acquisition of an additional 15%.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands. Total figures for International Dips & Spreads were calculated on the basis of the exact figures for Sabra and Obela in NIS thousands.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(2) Investments include the acquisition of fixed assets and investment in intangibles.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(1) Based on the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, net, unless stated otherwise.

(2) Fun & Indulgence figures include Strauss’s 50% share in the salty snacks business. International Coffee figures include Strauss’s 50% share in the Três Corações joint venture (3C) – Brazil – a company jointly held by the Group (50%) and by the local São Miguel Group (50%). International D&S figures reflect Strauss’s 50% share in Sabra and Obela. Other Operations figures include Strauss’s share in the joint venture in China, Haier Strauss Water (HSW). Until August the Company held a 34% stake in the joint venture, and commencing in September, its percentage holding increased to 49% following the acquisition of an additional 15%.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands. Total figures for International Dips & Spreads were calculated on the basis of the exact figures for Sabra and Obela in NIS thousands.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

Investor Conference

Strauss Group will host an Investor Conference in Hebrew on Thursday, November 16, 2017 at 14:00 (Israel time) to review the Financial Statements of the Company for the third quarter.

To join the conference in Hebrew, please call 03-9180610.

Strauss Group will also host an Investor Conference in English on Thursday, November 16, 2017 at 17:30 Israel time (UK – 15:30, US Eastern Standard Time – 10:30) to review the Financial Statements of the Company for the third quarter.

To join the conference in English, please call:

UK: 0-800-917-9141

US: 1-888-407-2553

Israel: 03-918-0644

The Financial Statements for the third quarter of 2017 and Investors Presentation are posted on the Group’s Investor Relations website at:

http://ir.strauss-group.com/phoenix.zhtml?c=92539&p=irol-irhome

NIS100 = EUR24.14