PETACH TIKVA, Israel – Strauss Group, the largest food products manufacturer in Israel as well as a leading coffee company in Central and Eastern Europe and one of largest coffee manufacturer in Brazil, reported on Thursday (August,18,2016) strong second quarter results, with significant improvements across the board.

Gadi Lesin, President and Chief Executive Officer of Strauss Group stated: “The Group’s strong results across all business segments and all major countries of operations reflect the implementation of our global strategy, while successfully dealing with the challenges of the past year.

This improvement was achieved thanks to the hard work of our managers and employees in all relevant markets. The diversity of our business, coupled with efficiency enhancements and innovations across the whole value chain, has created a solid infrastructure.

This is enabling us to continually grow our market share and show successful performance in all markets, both today and as we look ahead to the future.

In Israel, our home base, we were able to reduce prices, improve our employee’s conditions as part of our social program and we also gained market share.

All this enabled us to grow, despite the market trend. We believe that our performance so far in 2016 is an expression of Strauss’s ongoing robustness and resilience”.

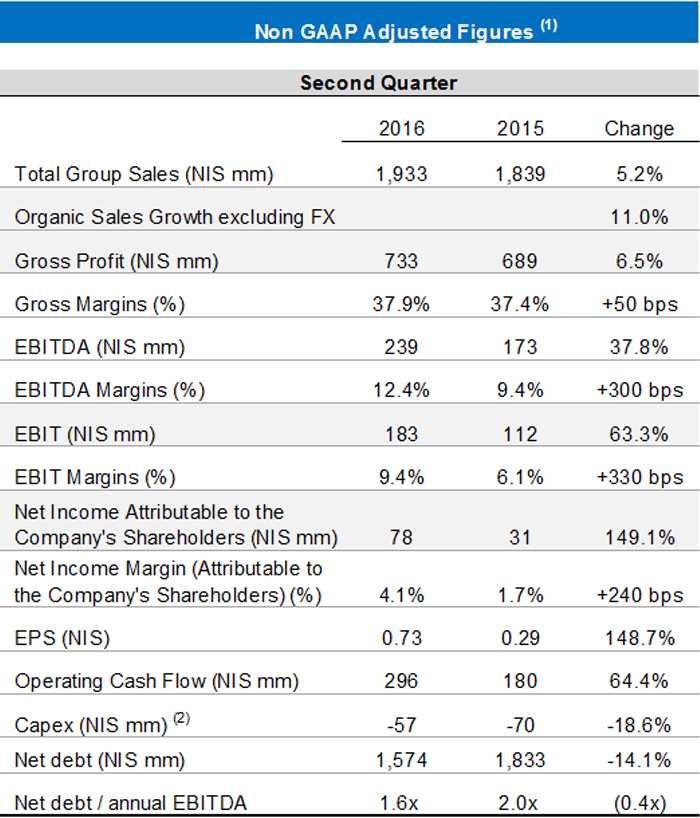

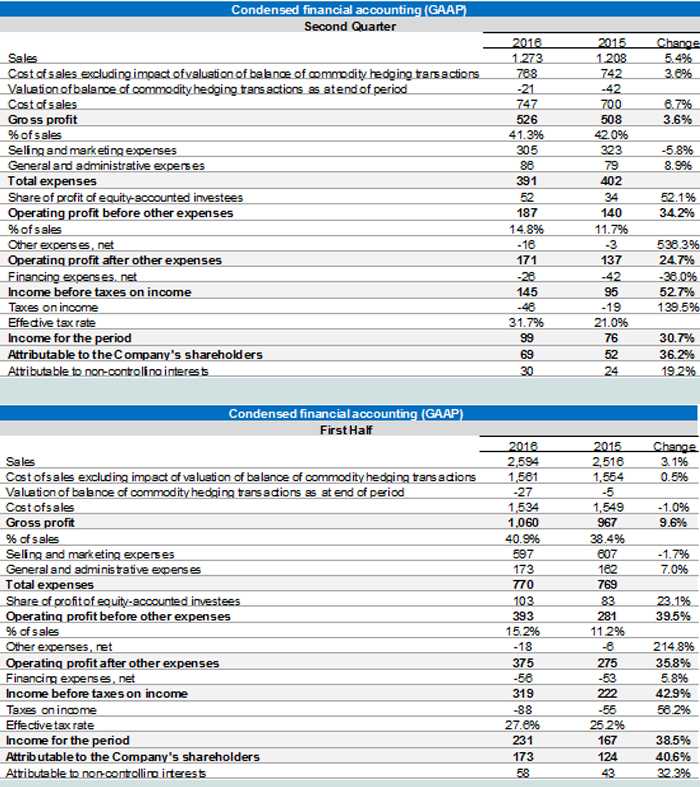

Q2 2016 highlights

- Organic sales growth, excluding foreign exchange effects, was 11.0% (5.2% after foreign currency effects) (1). Shekel denominated sales were NIS 1.9 billion compared to NIS 1.8 billion in the corresponding quarter last year, and reflected an NIS 87 million negative translation difference as a result of the continued strengthening of the NIS versus the other functional currencies of the Group.

- Gross profit was NIS 733 million, up 6.5% compared to the corresponding period last year (37.9% of sales, up 50 basis points).

- Operating profit (EBIT) was NIS 183 million, up 63.3% compared to the corresponding period last year (9.4% of sales, up 330 BPS).

- Net profit attributable to the shareholders of the Company was NIS 78 million, up 149.1% compared to the corresponding period last year.

- Cash flows from operating activities totaled NIS 296 million, compared to NIS 180 million in the corresponding period last year.

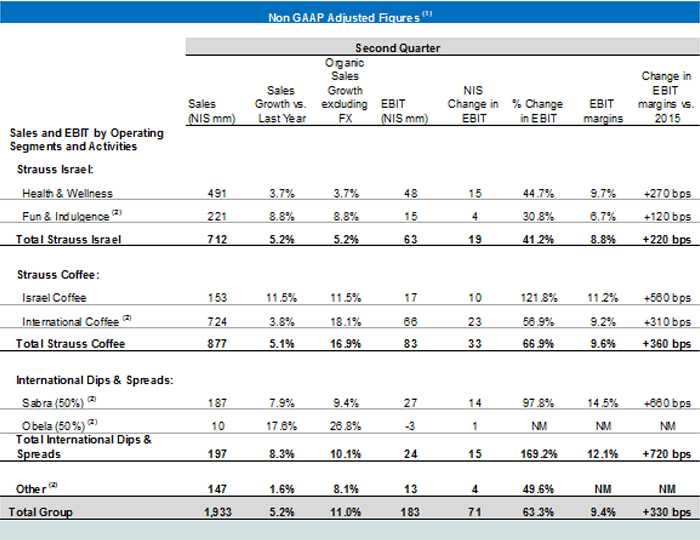

- Strauss Israel grew 5.2% in the second quarter, gaining market share. This was despite a reported decline in the food and beverage market (according to StoreNext).

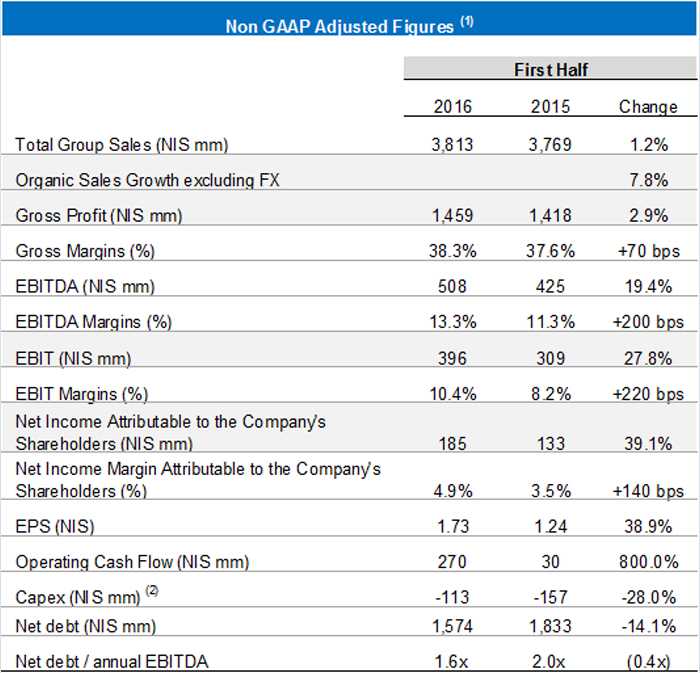

H1 2016 highlights

- Organic sales growth, excluding foreign exchange effects, was 7.8% (1.2% after foreign currency effects) (1). Shekel denominated sales were NIS 3.81 billion compared to NIS 3.77 billion in the corresponding period last year, and reflects a NIS 222 million negative translation difference as a result of the continued strengthening of the NIS versus other functional currencies of the Group.

- Gross profit was NIS 1,459 million, up 2.9% compared to the corresponding period last year. Simultaneously the gross margins were up to 38.3% compared to 37.6% in the corresponding period last year.

- Operating profit (EBIT) was NIS 396 million, up 27.8% compared to the corresponding period last year (10.4% of sales, up 220 BPS).

- Net profit attributable to the shareholders of the Company was NIS 185 million, up 39.1% compared to the corresponding period last year.

- Cash flow from operating activities totaled NIS 270 million, compared to NIS 30 million in the corresponding period last year.

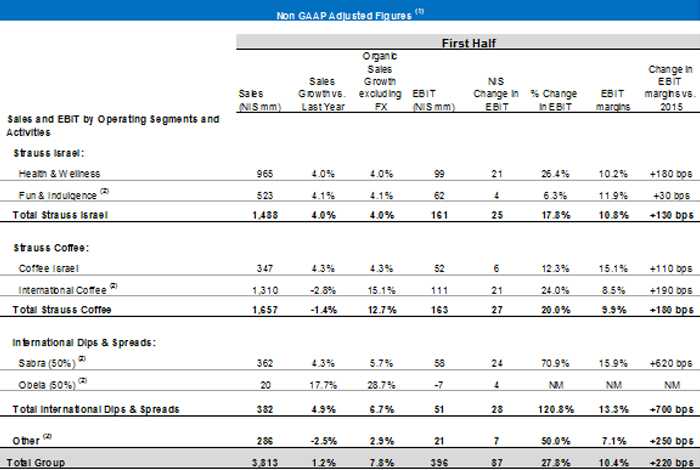

- Strauss Israel’s sales grew by approximately 4%, demonstrating an increase in market share, despite a drop of 0.7% in the Israeli food and beverage market (according to StoreNext).

- Data represents the Company’s non-GAAP measures, which include the proportionate consolidation of jointly controlled investees (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

- Data represents the Company’s non-GAAP measures, which include the proportionate consolidation of jointly controlled investees (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

- Investments include the acquisition of fixed assets and investment in intangibles.

Note: Financial data were rounded off to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

- Data represent the Company’s non-GAAP measures, which include the proportionate consolidation of jointly controlled investees (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

- Fun & Indulgence figures include Strauss 50% share in the salty snacks business. International Coffee figures include Strauss 50% share in Três Corações Joint Venture (3C) – Brazil – a company jointly held by the Group (50%) and by the São Miguel Group (50%). International D&S figures reflect Strauss 50% share in Sabra and Obela. Other Operations includes Strauss’s share in Strauss Water China (50%) until June 30, 2015.

Note: Financial data were rounded off to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

- Data represent the Company’s non-GAAP measures, which include the proportionate consolidation of jointly controlled investees (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

- Investments include the acquisition of fixed assets and investment in intangibles.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

- Data represent the Company’s non-GAAP measures, which include the proportionate consolidation of jointly controlled investees (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

- Fun & Indulgence figures include Strauss 50% share in the salty snacks business. International Coffee figures include Strauss 50% share in Três Corações Joint Venture (3C) – Brazil – a company jointly held by the Group (50%) and by the São Miguel Group (50%). International D&S figures reflect Strauss 50% share in Sabra and Obela. Other Operations includes Strauss’s share in Strauss Water China (50%) until June 30, 2015.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

Appendix

Conference Call details

Strauss Group will host an investor conference call, Thursday, August 18th, 2016, at 17:30 pm local Israel time (15:30 pm UK, 10:30 am Eastern time) to discuss the Company’s financial results for the second quarter 2016. To participate please dial: 1-888-668-9141 (U.S. Toll-Free), 0-800-917-5108 (UK), 03-918-0644 (Israel), +972-3-918-0644 (International).

The conference call will be accompanied by a presentation which can be downloaded from the Investor Relations section of our website: http://ir.strauss-group.com/phoenix.zhtml?c=92539&p=irol-presentations

* NIS1,000 = US$265.8

CAPS: the new proprietary system using capsules made of 85% recycled aluminium

CAPS: the new proprietary system using capsules made of 85% recycled aluminium