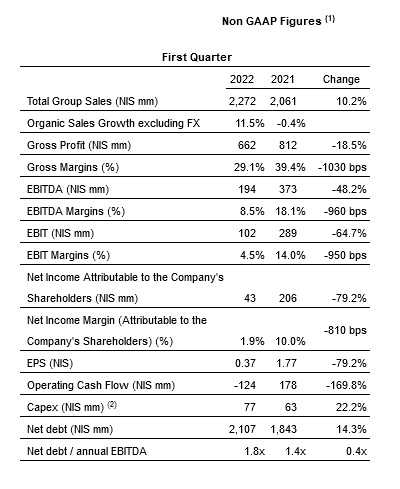

PETAH TIKVA, Israel – This morning, Strauss Group published its financial statements for the first quarter of 2022, which were materially impacted by the Confectionery Division recall made by the Company at the end of April2. The Company reported approximately NIS 2.2 billion (US$655.27 million) in revenue, reflecting approximately 11.5% organic growth excluding FX effects, but recorded an deterioration of approximately 64.7% in operating profit, which totaled approximately NIS 102 million, and a sharp decline of approximately 79.2% in net income attributable to shareholders, which amounted to approximately NIS 43 million in the quarter.

Strauss Group President & CEO, Giora Bardea, commented: “Along with growth in the Group’s international coffee business, including a recovery in business activity in Ukraine, continued growth in the Group’s water company in Israel and in China, and growth in all activities in Israel, the Group is dealing with complex challenges in Sabra and in the confectionery business in Israel. Strauss is a strong group that has experienced difficult times and crises in the past. Its resilience has always enabled it to not only exit these situations successfully, but to grow from them and emerge a better company. The challenge include operational, financial and marketing aspects. I am convinced that the resilience of our brands, finances and people will enable us to successfully overcome and return to activity and growth in the near term.

The process of restoring activities at the Nof Hagalil plant is fully underway. We are making every effort to complete this process well within the timeframe defined by the Ministry of Health, with the aim of resuming the production of our beloved confectionery brands as soon as possible.

At the same time, the Company continues to implement its work plans and to further its strategic priorities, with an emphasis on innovation in our activities in FoodTech through “The Kitchen Hub”. In line with our strategy and after winning the tender for the establishment of a second FoodTech incubator, we are presently launching “The Kitchen Hub 2″ with international partners. As of the date of the report, the fair value of the Group’s holdings in the incubator companies is approximately NIS 412 million, compared to approximately NIS 149 million in the corresponding period last year.”

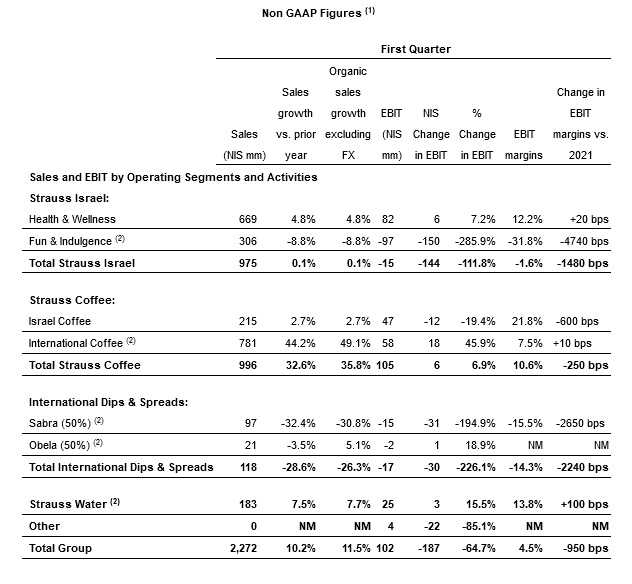

Strauss Israel The impact of the recall in Q1 2022 was reflected in a decrease of approximately NIS 60 million in the Fun & Indulgence segment sales. The Health & Wellness segment, which includes, among others things, the dairies, Yad Mordechai and the Food Division, grew by approximately 4.8% to NIS 669 million. Total sales by Strauss Israel in the quarter, including the negative impact on the Confectionery Division, amounted to c. NIS 975 million, an increase of approximately 0.1% compared to the corresponding period last year, and an operating loss of approximately NIS 15 million.

Strauss Coffee benefited from a strong first quarter, with approximately 32.6% growth following increased sales by the International Coffee segment as well as the Israel Coffee segment, and operating profit increase of approximately. 7% to approximately. NIS 105 million. The coffee business in Brazil, Poland, Romania and Serbia experienced double-digit growth in the quarter in local currency, and the business in Israel grew by approximately 2.7%.

Sales in Russia and Ukraine declined by approximately. 13.3% in local currency as a result of the war between the two countries. In March, business operations in Ukraine were partially resumed and have steadily increased in the second quarter.

Sabra, which produces and markets refrigerated dips and spreads in North America, concluded the first quarter with a drop of approximately 32.4% in sales, which amounted to approximately NIS 97 million (reflecting 50% ownership), and an operating loss of approximately NIS 15 million (50%) due to disruptions in its manufacturing operations arising from the plant’s adjustment plan. As products were not supplied to the market, Sabra (leader of the hummus market in the US) lost market share, which declined from approximately 61.7% to 45.8% in the first quarter of 2022 compared to the corresponding period last year. In the past few weeks, the company resumed partial production and sales. The company estimates that full production capacity will be restored in the second half of 2022 and estimates that the operating loss in the second quarter will amount to approximately USD 15 to 17 million (for 50% ownership), of which approximately USD 6 to 8 million is nonrecurring.

Strauss Water finished the first quarter with approximately NIS 183 million in revenue and an increase of approximately 7.5% compared to last year, due to growth in the customer base and sales of new appliances in Israel. The company’s operating profit was approximately NIS 25 million, an increase of approximately 15.5% following sales growth in Israel and an improvement in net profit in the water company in China, which grew by approximately 47.6%.

In Q1 2022, two FoodTech incubator companies from “The Kitchen” completed funding rounds, following which the Group recognized a profit of approximately NIS 20 million. On March 31, 2022, the fair value of the investments in incubator investees was approximately NIS 412 million, compared to approximately NIS 149 million on March 31, 2021.

(1) The data in this document are based on the company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses and do not include share-based payment, mark-to-market at end-of-period of open positions in the Group in respect of financial derivatives used to hedge commodity prices and all adjustments necessary to delay recognition of gains and losses arising from commodity derivatives until the date when the inventory is sold to outside parties, other income and expenses, net, and the tax effect of excluding those items, unless stated otherwise.

(1) The data in this document are based on the company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses and do not include share-based payment, mark-to-market at end-of-period of open positions in the Group in respect of financial derivatives used to hedge commodity prices and all adjustments necessary to delay recognition of gains and losses arising from commodity derivatives until the date when the inventory is sold to outside parties, other income and expenses, net, and the tax effect of excluding those items, unless stated otherwise.

(2) Investments include the acquisition of fixed assets, investment in intangible assets and proceeds from the sale of fixed assets.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

(1) The data in this document are based on the company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses and do not include share-based payment, mark-to-market at end-of-period of open positions in the Group in respect of financial derivatives used to hedge commodity prices and all adjustments necessary to delay recognition of gains and losses arising from commodity derivatives until the date when the inventory is sold to outside parties, other income and expenses, net, and the tax effect of excluding those items, unless stated otherwise.

(1) The data in this document are based on the company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses and do not include share-based payment, mark-to-market at end-of-period of open positions in the Group in respect of financial derivatives used to hedge commodity prices and all adjustments necessary to delay recognition of gains and losses arising from commodity derivatives until the date when the inventory is sold to outside parties, other income and expenses, net, and the tax effect of excluding those items, unless stated otherwise.

(2) Fun & Indulgence figures include Strauss’s 50% share in the salty snacks business. International Coffee figures include Strauss’s 50% share in the Três Corações joint venture (3C) – Brazil – a company jointly held by the Group (50%) and by the local São Miguel Group (50%). International Dips & Spreads figures reflect Strauss’s 50% share in Sabra and Obela. Strauss Water EBIT figures include Strauss’s share in Haier Strauss Water (HSW) in China (49%).

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands. Total figures for International Dips & Spreads were calculated on the basis of the exact figures for Sabra and Obela in NIS thousands.

NIS10 = US$2.97