Strauss Group reported a slight rise in quarterly profit, as cost-cutting measures offset a dip in coffee sales. The company said on Thursday it earned an adjusted 102 million shekels (US$26 million) in the first quarter, up from 99 million a year earlier.

Sales fell 2.1 percent to 1.93 billion shekels (US$498.9 million) but excluding the effect of a strengthening shekel, sales rose 1.8 percent.

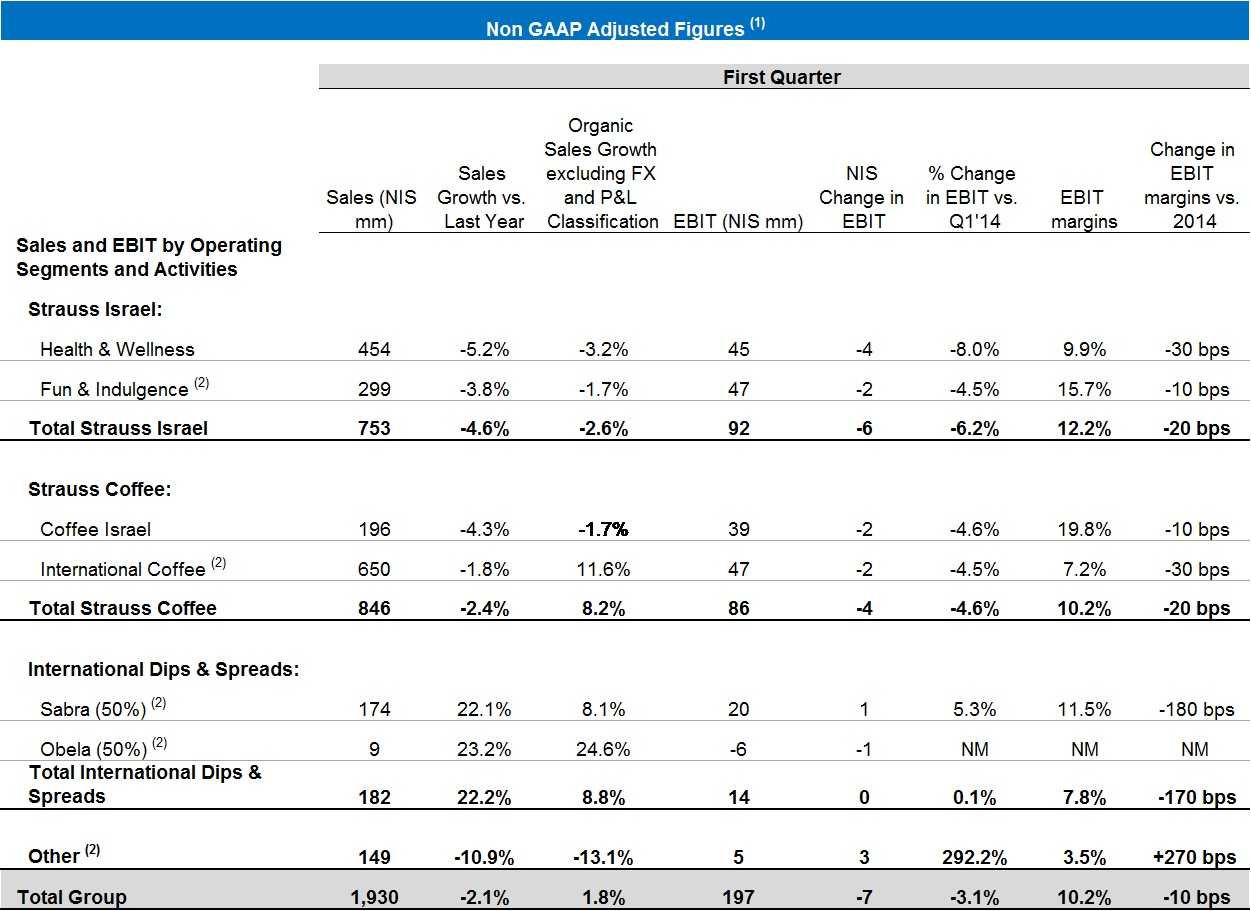

Coffee sales fell 2.4 percent to 846 million shekels (US$ 218.7 million) but excluding currency effects sales were up 8.2 percent.

Based in Petach Tikva, Israel, Strauss, a maker of snacks, fresh foods and coffee, is a market leader in roast and ground coffee in central and eastern Europe and Brazil. It is the second-largest company in the Israeli food and beverage market.

Here is the company’s press release:

Strauss Group posts 1.8% organic sales growth excluding foreign currency effects([1]) and 2.4% net profit growth ([2])

Gadi Lesin, President and Chief Executive Officer of Strauss Group, said today (May 28, 2015): “Thanks to the Group’s international strategy and the robustness of the companies in the various countries of operation, Strauss Group has posted stable results of operations and has even improved the net profit despite dealing with complex economic challenges and political crises.

Strauss Coffee’s companies in Russia and Ukraine, which drew considerable attention in prior quarters, are coping successfully and according to plan with the crisis in those countries while other global growth drivers continue to develop.

Against the backdrop of increasingly fierce competition between market players, Strauss Israel’s operating profit was down by only NIS 6 million. We are investing considerable efforts in product innovation and continue to apply streamlining measures throughout the length of our value chain, which will contribute to Strauss’s ability to contend with the challenges that the market in Israel will continue to pose this year.”

Q1 2015 highlights (2)

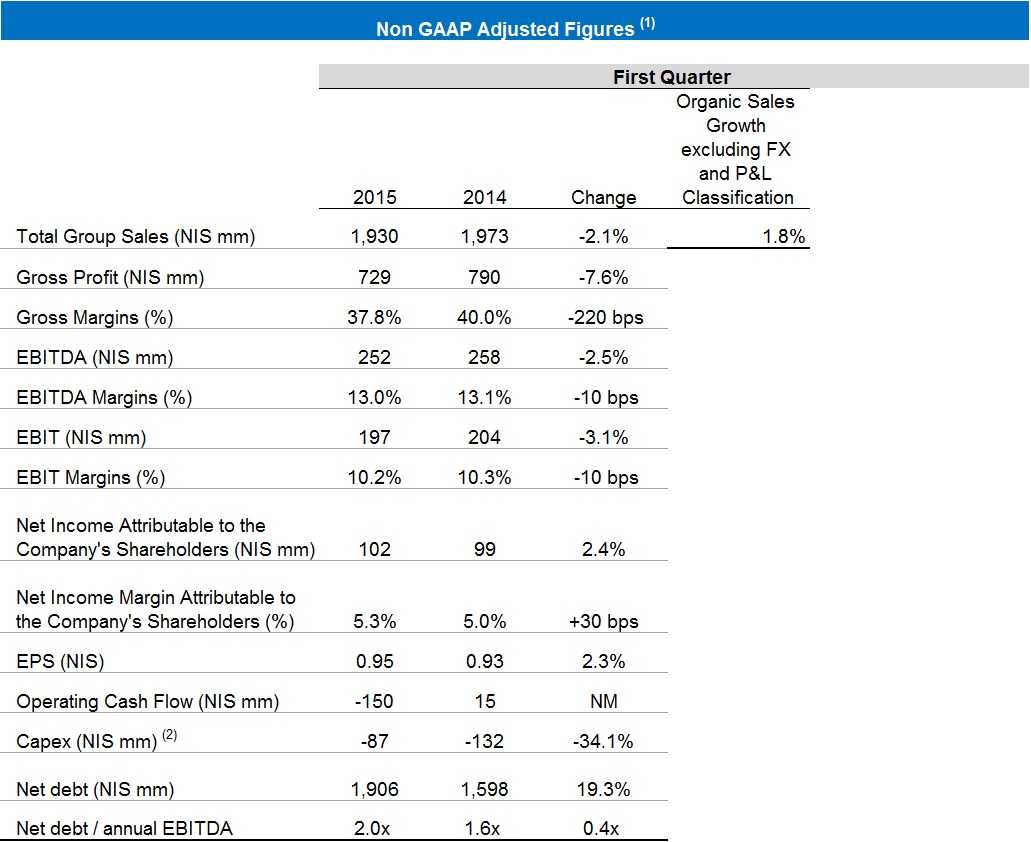

- Organic sales growth, excluding the foreign exchange effects, was 1.8% (1). Shekel sales were NIS 1.9 billion compared to NIS 2.0 billion in the corresponding quarter last year, and reflected NIS 67 million negative translation differences as a result of the continued strengthening of the NIS versus other functional currencies of the Group.

– Gross profit was NIS 729 million (37.8% of sales), down 7.6% compared to the corresponding period last year. Gross margins were down 2.2%. - Operating profit (EBIT) was NIS 197 million (10.2% of sales), down 3.1% compared to the corresponding quarter last year. EBIT margins were down 0.1%.

- EPS for shareholders of the company was NIS 0.95 per share, up 2.3% compared to the corresponding period.

- Negative cash flows from operating activities totaled NIS 150 million, compared to positive cash flows of NIS 15 million last year.

([1]) Also excluding the impact of classification of costs following the introduction of the Food Law, as explained in the Board of Directors Report.

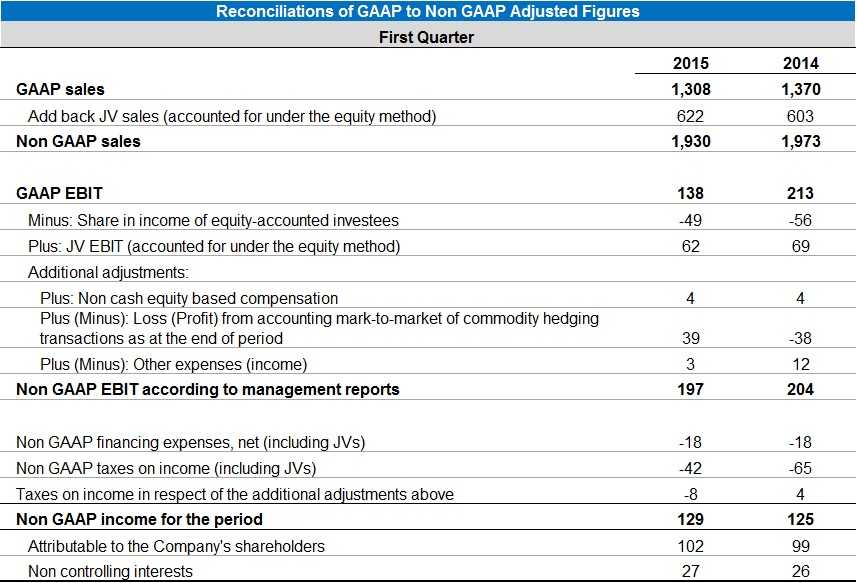

(2) Based on non-GAAP data, which include the proportionate consolidation of jointly-held partnerships (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

(1) Based on non-GAAP data, which include the proportionate consolidation of jointly-held partnerships (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

(2) Investments include the acquisition of fixed assets and investment in intangibles and deferred expenses.

Note: Financial data were rounded off to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

(1) Based on non-GAAP data, which include the proportionate consolidation of jointly-held partnerships (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period and other income and expenses, unless stated otherwise.

(2) Fun & Indulgence figures include Strauss 50% share in the salty snacks business. International Coffee figures include Strauss 50% share in Três Corações Joint Venture (3C) – Brazil – a company jointly held by the Group (50%) and by the São Miguel Group (50%). International D&S figures reflect Strauss 50% share in Sabra and Obela. Other includes Strauss share in Strauss Water China.

Note: Financial data were rounded off to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.