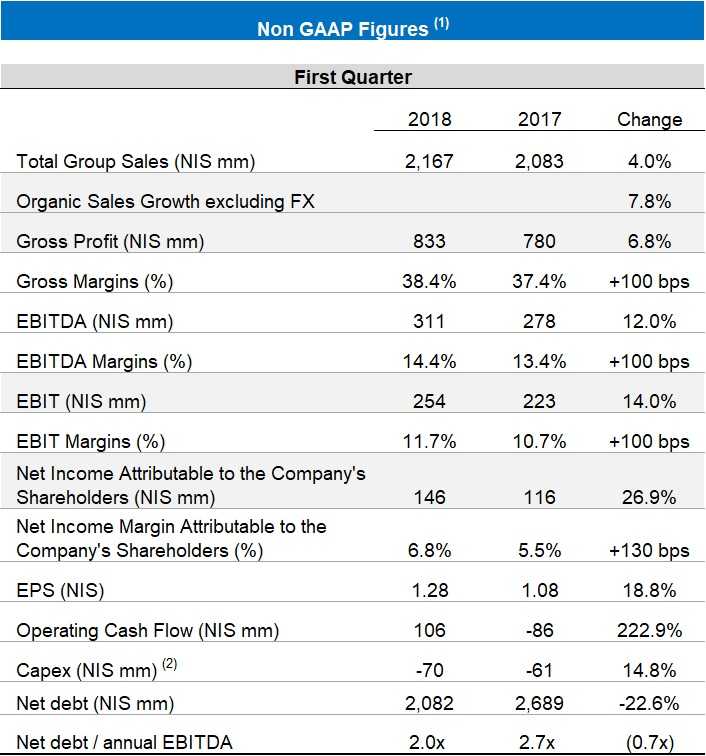

PETACH TIKVA, Israel – Israel’s Strauss Group Limited continues to deliver excellent results in sales, profit and cash flow, with sales up 4 percent during the first quarter 2018 (7.8 percent organic growth excluding foreign exchange effects) and net profit rising 29.6 percent to 146 million Shekel (NIS) – the Group said in a news release this week.

“Strauss Group continues to grow at an impressive rate, delivering excellent results in sales and profit” stated Giora Bardea, Interim CEO of Strauss Group on May 23rd, 2018, commenting the company’s results for first quarter 2018.

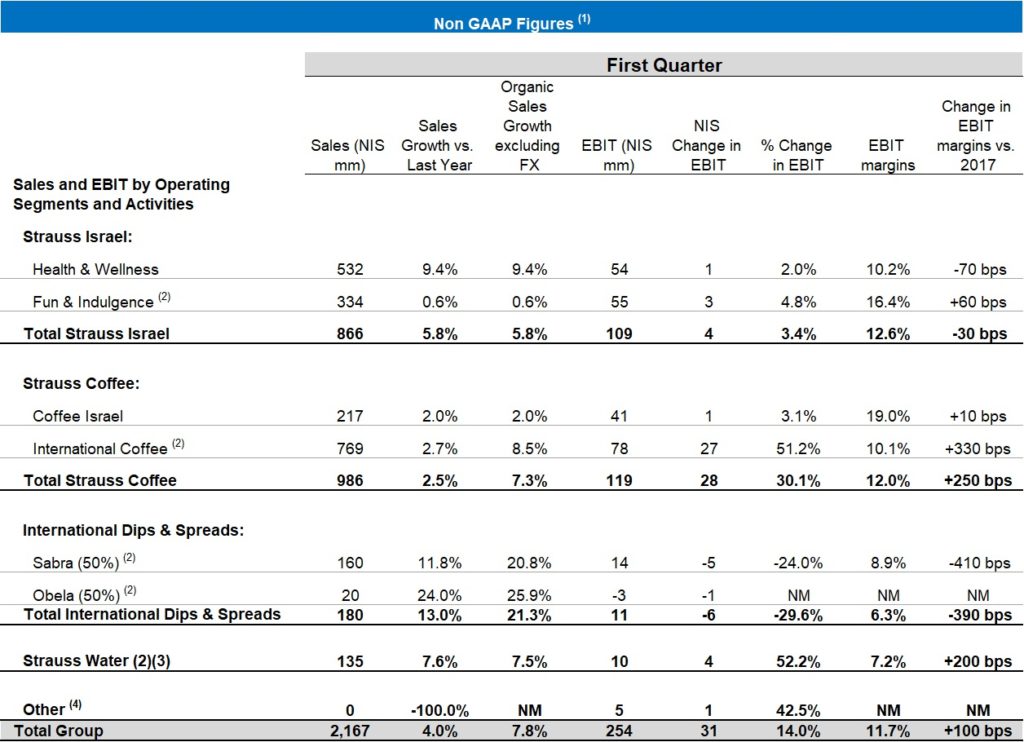

“Income rose 7.8% in the quarter excluding FX translation, and performance has generated positive growth across all segments. Strauss Israel’s income rose 5.8% compared to the corresponding period as the company increased its market share in food & beverages to 12.2%. The coffee operation grew organically 7.3% in the quarter excluding FX translation. Sabra-Obela’s dips and spreads business grew 21.3% excluding foreign exchange effects, with Sabra’s market share in hummus in the US reaching 59.4%. Strauss Water revenues rose 7.6%, primarily thanks to strong growth in its operations in Israel. Net income in for quarter was NIS 146 million, up 26.9% compared to last year”.

Q1 2018 highlights(1)

- Organic sales growth, excluding foreign exchange effects, was c7.8%. Shekel sales were NIS c2.2 billion compared to NIS c2.1 billion in the corresponding period in 2017; sales were impacted by a negative currency translation amounting to NIS c51 million as a result of the depreciation of the BRL against the NIS compared to last year.

- Gross profit was NIS c833 million (c38.4% of sales), up c6.8% compared to the corresponding period last year. Gross margins were up c1%.

- Operating profit (EBIT) was NIS c254 million (c11.7% of sales), up c14.0% compared to the corresponding period last year. EBIT margins were up c1%.

- EPS for shareholders of the Company was NIS c1.28, up c18.8% compared to the corresponding period.

- Positive cash flows from operating activities totaled NIS c106 million, compared to negative cash flows of NIS c86 million in 2017.

(1) Data represent the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, unless stated otherwise.

(1) Data represent the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, unless stated otherwise.

(2) Investments include the acquisition of fixed assets and investment in intangibles.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

1) Data represent the Company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses (without implementation of IFRS 11) and do not include share-based payment, valuation of the balance of commodity hedging transactions as at end-of-period, including adjustments required for deferral of profit or loss from commodity derivatives until the inventory is sold to external parties, and other income and expenses, unless stated otherwise.

(2) Fun & Indulgence figures include Strauss’s 50% share in the salty snacks business. International Coffee figures include Strauss’s 50% share in the Três Corações joint venture (3C) – Brazil – a company jointly held by the Group (50%) and by the local São Miguel Group (50%). International D&S figures reflect Strauss’s 50% share in Sabra and Obela. Strauss Water figures include Strauss’s share in the joint venture in China, Haier Strauss Water (HSW). Until August 2017 the Company held a 34% stake in the joint venture, and commencing in September 2017, its percentage holding increased to 49% following the acquisition of an additional 15%.

(3) Commencing in the current quarter, Company Management has elected to report the results of the Strauss Water segment separately.

(4) In the second quarter of 2017 the Company realized the Max Brenner operation.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands. Total figures for International Dips & Spreads were calculated on the basis of the exact figures for Sabra and Obela in NIS thousands. Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

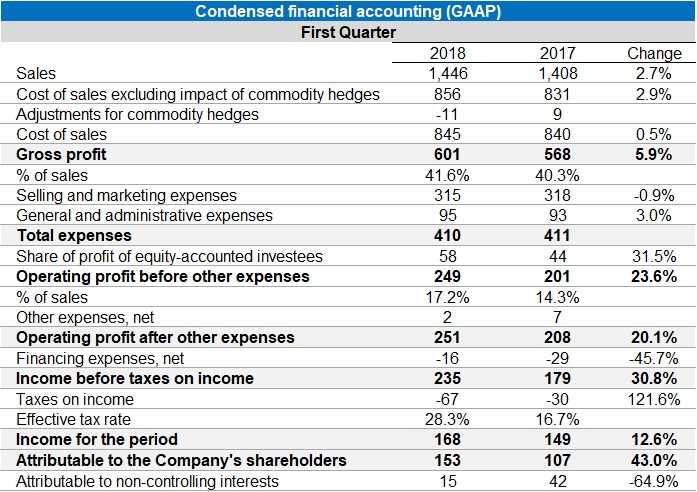

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.

Investor Conference Calls

Strauss Group will host an Investor Conference call in Hebrew on Wednesday, May 23, 2018 at 14:00 Israel time to review the Financial Statements of the Company for the first quarter.

To join the conference call in Hebrew, please dial: 03-9180610.

Strauss Group will also host an Investor Conference call in English on Wednesday, May 23, 2018 at 15:30 local Israel time (13:30 UK, 08:30 Eastern Standard Time) to review the Financial Statements of the Company for the first quarter.

To join the conference call in English, please dial one of the following numbers:

UK: 0-800-917-5108

US: 1-888-407-2553

Israel: 03-9180644

The Financial Statements for the first quarter of 2018 and Investors Presentation are posted on the Group’s Investor Relations website at:

http://ir.strauss-group.com/phoenix.zhtml?c=92539&p=irol-irhome