VANCOUVER, British Columbia— Swiss Water Decaffeinated Coffee Inc. yesterday reported financial results for the three and six months ended June 30, 2020, representing the second quarter and first half of the Company’s current fiscal year. Swiss Water is a leading specialty coffee company and premium green coffee decaffeinator that employs the proprietary SWISS WATER® Process to decaffeinate green coffee without the use of chemicals such as methylene chloride.

For the three and six months ended June 30, 2020, Swiss Water recorded strong year-over-year increases in gross profit, operating income, net income and EBITDA. Revenues were up in Q2 and flat for the first half. These results were achieved despite a drop in volumes which were down by 2% in the quarter and 9% in the first six months of the year, primarily due to the Covid-19 pandemic, as well as the Q1 impact of a temporary spike in coffee futures. While Swiss Water’s Q2 performance is encouraging, and the Company is well diversified both geographically and by customer base, the on-going impact of the worldwide pandemic has created an uncertain outlook for the balance of the year.

“We are pleased to report that our volumes rebounded better than we’d anticipated in Q2 and that all of our financial metrics during the quarter were very positive,”said Frank Dennis, Swiss Water’s President and CEO. “Given our strong competitive position, the positive trends driving our business and the strength of the Swiss Water brand, we remain confident about the long- term prospects for our business. That said, the continuing negative impacts of the Covid-19 pandemic make the short-term outlook for us impossible to predict with any surety.”

“At the same time, we are moving ahead strategically to prepare the Company for a resumption of the strong growth trajectory we’d established prior to the pandemic. Subsequent to the end of the second quarter, the commissioning of the first new production line at our Delta, BC facility was completed. We expect to begin delivering commercial grade coffee from Delta during the third quarter. As we noted previously, we need to relocate all production from our legacy facility in Burnaby, BC by June 2023 due to the coming expiry of our lease there. Planning for the financing, design, and construction of a second line in Delta is underway with a targeted completion date before the 2023 deadline in Burnaby. Based on engineering reports from a third-party engineering firm, when both are completed, we expect the two new lines in Delta together will have a targeted end capacity at least 40% greater than the current Burnaby facility.”said Dennis.

Below is a summary of Swiss Water’s operational and financial results.

Swiss Water – Operational highlights

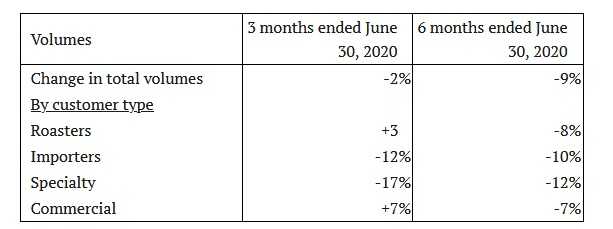

The following table shows changes in volumes shipped during the second quarter and the six months ended June 30, 2020, compared to the same periods in 2019.

- Total volumes shipped in the second quarter of 2020 declined by 2% from the Q2 2019 level. For the first half of the year, volumes were down by 9%, when compared to the first half of 2019 reflecting the initial effect of the Covid-19 pandemic, as well as the negative impact of a temporary spike in the NY’C’ Arabica coffee futures market on this year’s Q1 volumes. Viewed sequentially, Q2 volumes recovered strongly and were up by 24% compared to the first quarter. In each of the 12 quarters prior to the onset of the pandemic, Swiss Water consistently won new business and increased volumes as coffee industry participants migrated away from solvent based decaffeination processes.

- As in the past, the Company’s largest geographical market by volume in Q2 and the first half continued to be the United States. By dollar value, during the six months to June 30, 2020, 52% of sales were to customers in the USA, 27% were to Canada, and the remaining 21% were to other countries.

- The operations of Swiss Water have been deemed essential services during the pandemic and, as such, the Company continues to supply decaffeinated coffee to its customers around the world, while taking all necessary steps to protect the health and safety of its employees. Other than a brief shutdown of one operating line to mitigate the possible risk of a province-wide work stoppage during the early stages of the pandemic, the Company operated both lines at its legacy plant in Burnaby, BC on the normal 24/7 basis throughout the first half. The Seaforth coffee handling subsidiary also remained open and operating normally.

- The commissioning of the initial production line at Swiss Water’s new facility in Delta, BC was complete in mid-July after some temporary delays in getting equipment and technical personnel across the USA/Canada border during the early stages of the pandemic were resolved using local resources or remote assistance. The Company is currently creating green coffee extract, the initial step of production prior to bringing customer bound product into the process for final sale. This should occur during the third quarter.

Financial highlights

¹ EBITDA is defined in the ‘Non-IFRS Measures’ section of the MD&A and is a “Non-GAAP Financial Measure” as defined by CSA Staff Notice 52-306.

¹ EBITDA is defined in the ‘Non-IFRS Measures’ section of the MD&A and is a “Non-GAAP Financial Measure” as defined by CSA Staff Notice 52-306.

² EBITDA excluding the impact of IFRS 16 – Leases is defined as EBITDA, less lease payments made during the year.

3Per-share calculations are based on the weighted average number of shares outstanding during the periods.

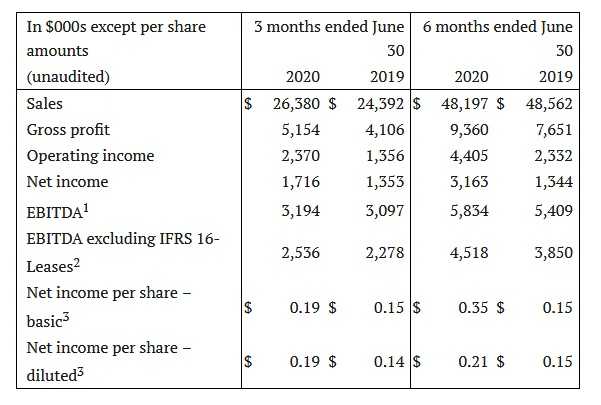

- Second quarter revenue was $26.4 million, an increase of 8% over Q2 of 2019. Six-month revenue was relatively constant at $48.2 million, a decrease of 1% from the first half of last year. Revenues remained strong despite the decrease in processing volumes because of the positive effects of customer mix, higher coffee quality differentials, and a higher average US dollar exchange rate.

- Quarterly gross profit was $5.2 million, an increase of $1.0 million from Q2 2019. First half gross profit of $9.4 million was up by $1.7 million, or 22%, from the 2019 level. This year’s improvement in gross profit was due to a variety of factors including positive changes in the Company’s sales mix, margin gains due to higher coffee quality differentials, enhanced supply chain efficiencies, including consolidation of warehouses by its Seaforth subsidiary, and lower natural gas prices. These positive effects were partially offset by the decrease in volumes shipped during the first half of this year and by higher annual inflationary labour costs.

- Second quarter operating expenses were $2.8 million, the same as in Q2 last year. For the six months of 2020, however, operating expenses were down by 7% year-over-year to $5.0 million. The first half reduction resulted from lower than budgeted travel and recruitment expenses due to the pandemic, as well as a recovery of stock-based compensation costs as a result of the Company’s lower stock price during the period.

- Q2 operating income was $2.4 million, an increase of 75%, from the same period last year. For the first half, operating income was up even more, growing by 89% to $4.4 million.

- For the second quarter, Swiss Water reported a net income of $1.7 million, compared to $1.4 million in Q2 2019. Year-to-date net income was $3.2 million, up by $1.9 million from the $1.3 million reported in the first half of last year. This year’s increase in gross profit, combined with decreases in both operating and non-operating expenses were the key drivers in the improvement in net income. Non-operating expenses were down significantly due to the revaluation of an embedded derivative linked to the Company’s share price, offset by a small loss on risk management activities.

- EBITDA for the second quarter was $3.2 million, up by $0.1 million, or 3%, over Q2 2019. First half EBITDA was $5.8 million, up by $0.4 million, or 7% over the same period last year. EBITDA, excluding the impact of IFRS 16, increased by $0.3 million, or 11% to $2.5 million for the quarter, and by $0.7 million, or 17%, to $4.5 million for the first half. The improvement in EBITDA was the result of the higher revenues, improved short-term green coffee differential margins, lower natural gas costs and tight control of operating expenses, as well as an increased financial contribution from Seaforth, the Company’s supply chain subsidiary.