VANCOUVER, British Columbia, Canada — Swiss Water Decaffeinated Coffee Inc. (“Swiss Water” or “the company”) today reported strong financial results for the second quarter and first half of 2019. Swiss Water is a premium green coffee decaffeinator which employs the proprietary SWISS WATER Process to decaffeinate green coffee without the use of chemicals.

During the first half of 2019, Swiss Water reported a robust growth of 21% in volumes delivered to customers and improved financial performance. The company continues to gain new business as more industry participants and coffee consumers migrate away from chemical decaffeination in favor of chemical free processes.

At the same time, an acceleration of underlying demand from existing customers is fueling organic growth. Through the second quarter, the company has continued to maintain a positive trend toward improved operating margins and manufacturing efficiency, while remaining sharply focused on producing high-quality premium decaffeinated coffee.

“We are pleased that our volumes continue to grow strongly and that we are seeing new business coming from all our geographic markets and customer categories. Our strategic investments in expanding our reach in Europe and in targeting specific customer segments in the U.S. are also yielding growth. For example, since launching our new European subsidiary in January, we’ve seen volumes there grow by 125% in Q2 and by 83% year-to-date”, said Frank Dennis, Swiss Water’s President and CEO.

Below is a summary of Swiss Water’s operational and financial results.

Operational highlights of Swiss Water Decaffeinated Coffee Inc.

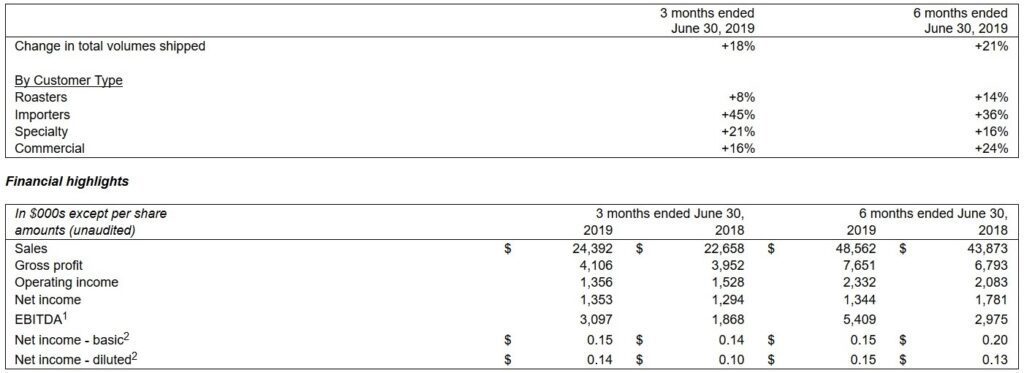

The following table shows changes in volumes shipped during the second quarter and the six months ended June 30, 2019.

1 EBITDA is defined in the ‘Non-IFRS Measures’ section of the MD&A and is a “Non-GAAP Financial Measure” as defined by CSA Staff Notice 52-306.

1 EBITDA is defined in the ‘Non-IFRS Measures’ section of the MD&A and is a “Non-GAAP Financial Measure” as defined by CSA Staff Notice 52-306.

2 Per-share calculations are based on the weighted average number of shares outstanding during the period.

- Second quarter revenue was $24.4 million, an increase of 8% over Q2 of 2018. Six-month revenue was $48.6 million, an 11% year-over-year improvement. The increase in revenue in both periods was due to growth in volumes and a higher average US dollar (“US$”) exchange rate, partially offset by a lower coffee futures price (“NY’C’”).

- Quarterly gross profit was $4.1 million (17% gross margin), compared to $4.0 million (17% gross margin) in Q2 2018. Looked at sequentially, Q2 gross profit was up by $0.6 million from $3.5 million (15% gross margin) in Q1 of this year. First half gross profit increased to $7.7 million (16% gross margin) from $6.8 million (15% gross margin) in the first six months of last year. The improvement in year-to-date gross profit was a result of higher volumes and supply chain efficiencies, as well as management’s ongoing efforts to control operating costs. These positive factors were partially offset by the impact of higher toll volumes in Swiss Water’s sales mix, labour inflation and the introduction of the BC Employer Health Tax this year. Six-month gross profit was also negatively impacted by a spike in natural gas costs during the first quarter due to a gas pipeline explosion in October 2018. This significantly reduced energy supply and increased prices in British Columbia. Going forward, the company remains tightly focused on margins and continues to seek ways to manage variable and fixed costs across all of its operations, without compromising product quality.

- Operating expenses were $2.8 million in Q2 and $5.3 million for the first half, an increase of 13% in both periods compared to the 2018 levels. Year-to-date expenses were the result of higher full year staffing and staff-related expenses, as well as increased research and development activity during the second quarter.

- For the second quarter, Swiss Water reported net income of $1.4 million, compared to net income of $1.3 million in Q2 2018. Year-to-date net income was $1.3 million, compared to $1.8 million in the first half of last year. This year’s improved gross profit was offset by increases in both operating and non-operating expenses. The increase in non-operating expenses was partially driven by the revaluation of an embedded derivative. Higher finance expense in relation to interest on leases, as a result of the adoption of IFRS 16 Leases, and on a construction loan also had a negative impact.

- EBITDA for the second quarter was $3.1 million, up by $1.2 million, or 66%, over Q2 2018. First half EBITDA was $5.4 million, up by $2.4 million, or 82% over the same period last year. In both periods, the significant increase in EBITDA was largely due to new accounting standards related to leases. Operationally, EBITDA was enhanced by the strong growth in volumes, ongoing efforts to enhance cost recovery, and an increased financial contribution from Seaforth, the company’s supply chain subsidiary.

Construction of Swiss Water’s new decaffeination facility, which is located in Delta, BC, is nearing completion. The new production line is expected to be commissioned in the fourth quarter of this year.

Quarterly Dividends

Subsequent to the end of the second quarter, on July 15, 2019, the company paid an eligible dividend in the amount of $0.6 million ($0.0625 per share) to shareholders of record on June 28, 2019.