ORRVILLE, Ohio, US – The JM Smucker Co., the leading company in the U.S. at-home retail coffee category, announced results for the first quarter ended July 31, 2021, of its 2022 fiscal year. Financial results for the first quarter of fiscal year 2022 reflect the divestiture of the Crisco business on December 1, 2020, and the divestiture of the Natural Balance® business on January 29, 2021. All comparisons are to the first quarter of the prior fiscal year, unless otherwise noted.

Executive Summary

- Net sales decreased $113.8 million, or 6 percent. Net sales excluding divestitures and foreign currency exchange increased 1 percent.

- Net income per diluted share was $1.42. Adjusted earnings per share was $1.90, a decrease of 20 percent.

- Cash from operations was $137.8 million, a decrease of 66 percent. Free cash flow was $69.8 million, compared to $332.4 million in the prior year.

- The Company updated its full-year fiscal 2022 financial outlook.

“Our first quarter results reflected organic net sales growth, while lapping double-digit growth in the prior year, and continued to demonstrate consumers’ desire for our brands, while earnings were in line with our expectations,” said Mark Smucker, President and Chief Executive Officer. “The progress we have made against our strategy and executional priorities has made us a stronger company, positioning our iconic brands for continued growth in market share.”

“Our industry continues to navigate a period of significant supply chain volatility, disruption, and cost inflation. In the near term, we expect to experience higher raw material and logistics cost increases. However, we are optimistic in managing these challenges and remain confident in the momentum of our business, the talent and commitment of our people, and our strengthened financial position to deliver balanced top- and bottom-line growth and long-term shareholder value.”

The JM Smucker Company: First Quarter Consolidated Results

U.S. Retail Coffee

U.S. Retail Coffee

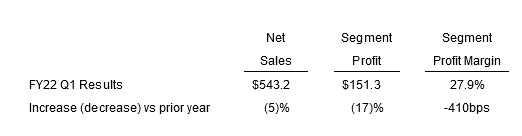

Net sales decreased $27.7 million. Net price realization reduced net sales by 3 percentage points, reflecting increased trade spend related to the lapping of suspended promotions in the prior year. Volume/mix reduced net sales by 2 percentage points, reflecting the lapping of retailer inventory re-stocking in the prior year, driven by the Folgers® brand, partially offset by increases for the Dunkin’™ and Café Bustelo® brands.

Net sales decreased $27.7 million. Net price realization reduced net sales by 3 percentage points, reflecting increased trade spend related to the lapping of suspended promotions in the prior year. Volume/mix reduced net sales by 2 percentage points, reflecting the lapping of retailer inventory re-stocking in the prior year, driven by the Folgers® brand, partially offset by increases for the Dunkin’™ and Café Bustelo® brands.

Segment profit decreased $31.3 million, reflecting lower net pricing, higher commodity costs, and the reduced contribution from volume/mix, partially offset by decreased marketing expense.