TORONTO, Canada – Restaurant Brands International Inc., the parent company of Tim Hortons, reported financial results for the first quarter ended March 31, 2021. José E. Cil, Chief Executive Officer of Restaurant Brands International Inc. (“RBI”) commented, “Our first quarter results signal our return to growth with system-wide sales surpassing Q1 2019 and net restaurant growth nearly matching our best-ever Q1 performance in 2018. We are excited by the global growth potential of our brands and are encouraged by this early momentum as we work toward a return to historic levels of unit growth this year.”

“Our home market recovery from the pandemic is well-underway, including at Tim Hortons in Canada where our business fundamentals have continued to improve as we execute on our Back to Basics plan, which included exciting product launches in Q1 like our new dark roast coffee and fresh cracked egg breakfast sandwiches.

Our C$80M investment announced during the quarter to supercharge our advertising and digital platforms is a further indication of our strong confidence in Tim Horton’s market-leading position as the Canadian economy fully reopens later this year,” said Cil.

Cil continued, “The results of long-term investments we are making in digital initiatives, such as loyalty programs and our branded apps, were best demonstrated in Canada during Q1 where digital channels drove nearly one-third of all sales for Tim Hortons in the quarter; almost twice the levels for the same period last year and the largest quarter yet for digital sales for any of our brands in Canada and the U.S. Our digital channels will allow us to drive incrementality for our restaurants as well as a more personalized and valuable experience for our guests.”

“We exited the quarter with confidence knowing that we have the right plan, a motivated corporate team and dedicated, hard-working franchisees to drive long-term growth for 2021 and beyond,” concluded Cil.

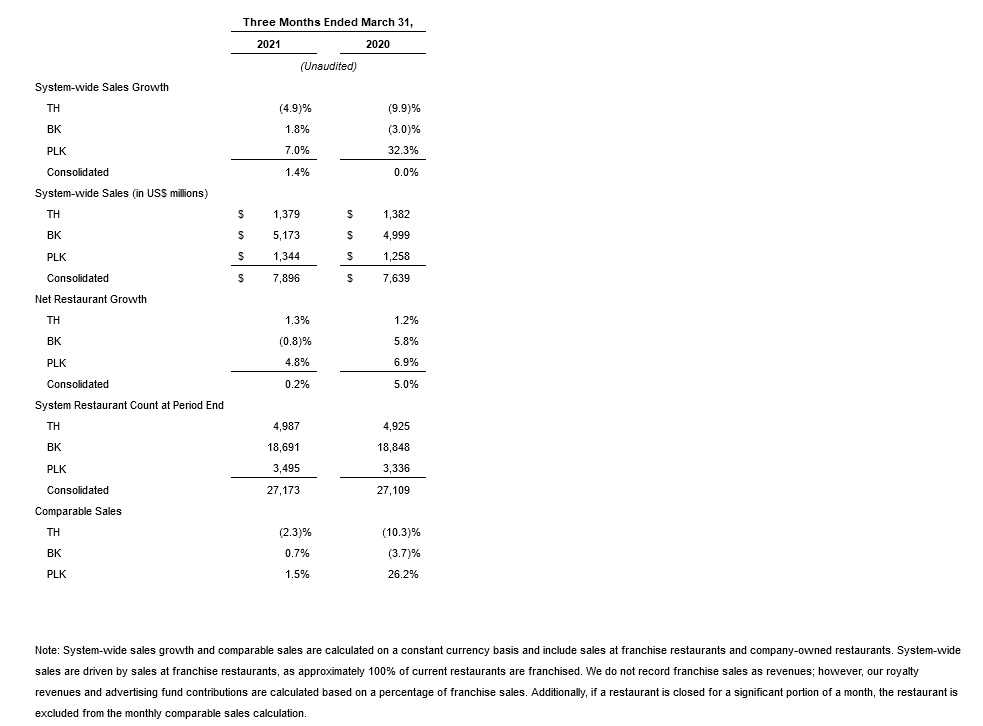

Consolidated Operational Highlights

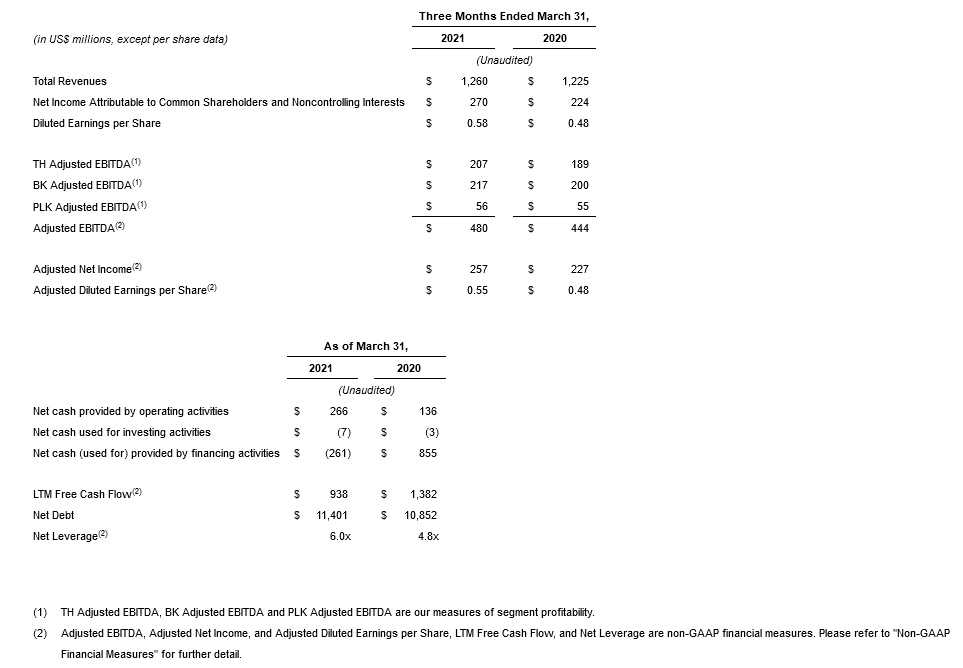

Consolidated Financial Highlights

Consolidated Financial Highlights

The year-over-year increase in Total Revenues on an as reported basis was primarily driven by favorable FX movements. On an organic basis, the year-over-year decrease in Total Revenues was primarily driven by a decrease in system-wide sales at Tim Hortons, partially offset by an increase in retail sales at Tim Hortons and an increase in system-wide sales at Burger King and Popeyes.

The year-over-year increase in Total Revenues on an as reported basis was primarily driven by favorable FX movements. On an organic basis, the year-over-year decrease in Total Revenues was primarily driven by a decrease in system-wide sales at Tim Hortons, partially offset by an increase in retail sales at Tim Hortons and an increase in system-wide sales at Burger King and Popeyes.

The increase in Net Income Attributable to Common Shareholders and Noncontrolling Interests for the first quarter was primarily driven by a favorable change in the results from other operating expenses (income), net, and an increase in segment income in all of our segments, partially offset by an increase in share-based compensation and non-cash incentive compensation expenses, an increase in interest expense, net, an increase in depreciation and amortization, and an increase in income tax expense.

The year-over-year increase in Adjusted EBITDA on an as reported and on an organic basis was driven by an increase in Tim Hortons, Burger King and Popeyes Adjusted EBITDA.

Covid-19

The global crisis resulting from the spread of coronavirus (“COVID-19“) had a substantial impact on our global restaurant operations for the three months ended March 31, 2021 and 2020. While the impact of COVID-19 on system-wide sales growth, system-wide sales, comparable sales and net restaurant growth was severe for the last few weeks of the quarter ended March 31, 2020, in the 2021 period these metrics were affected to a lesser extent for the entire period, with variations among brands and regions.

As of the end of March 2021, 95% of our restaurants were open worldwide, including substantially all of our restaurants in North America and Asia Pacific and approximately 92% and 84% of our restaurants in Europe, Middle East and Africa and Latin America, respectively. Certain jurisdictions, such as Canada, Europe, and Brazil, that had eased restrictions during 2020, re-imposed lockdowns and curfews in the quarter ended March 31, 2021. In March 2020, a number of markets required temporary complete closures while implementing lock-down orders, while others adopted limited operations, such as drive-thru, takeout and delivery (where applicable), reduced if any dine-in capacity, and/or restrictions on hours of operation. We expect local conditions to continue to dictate limitations on operations, capacity, and hours of restaurants.

While we do not know the future impact COVID-19 will have on our business, or when our business will fully return to normal operations, we expect to see a continued impact from COVID-19 on our results in 2021.