ABIDJAN, Côte d’Ivoire – As at the time of writing, the main cocoa producing zones in the two top producing countries, i.e., Côte d’Ivoire and Ghana are witnessing beneficial rains that are envisaged to support production and assuage fears of supply tightness, reports the International Cocoa Organization in its market report for February 2023.

Notwithstanding that crop output of Côte d’Ivoire is forecast to be higher year-on-year during 2022/23, the latest available data indicated that cumulative arrivals of cocoa beans at Ivorian ports are lower year-on-year, while on the contrary in Ghana, volumes of purchases of graded and sealed cocoa beans are on the increase – moving in the same direction as the anticipated trend for the season under review.

Hence, as at 19 March 2023, cumulative arrivals of cocoa beans in Côte d’Ivoire were seen at 1.727 million tonnes, down by 5.4% compared to 1.825 million tonnes recorded during the corresponding period of the previous cocoa year.

Furthermore, gross exports of cocoa beans from the country during October 2022 – January 2023 were reported at 540,314 tonnes, down year-on-year by 9.3% compared to 595,972 tonnes. The decline in production and exports may be attributed to an early tail-off for the main crop and increase in grinding activities. Based on reported data from GEPEX, from the start of the 2022/23 season to date, total grindings in Côte d’Ivoire are up by 12% to 292,195 tonnes as compared with the same period of the previous season.

Though since the publication in January of a 54% production increase year-on-year, Ghana is yet to report on its current situation. The global volume of sales of chocolate confectionery products is projected to grow by 1% from 7.544 million tonnes in 2022 to 7.610 million tonnes in 2023¹ with North America and Pacific Asia being the regions contributing the most to the increase in demand for chocolate confectionery products over the period.

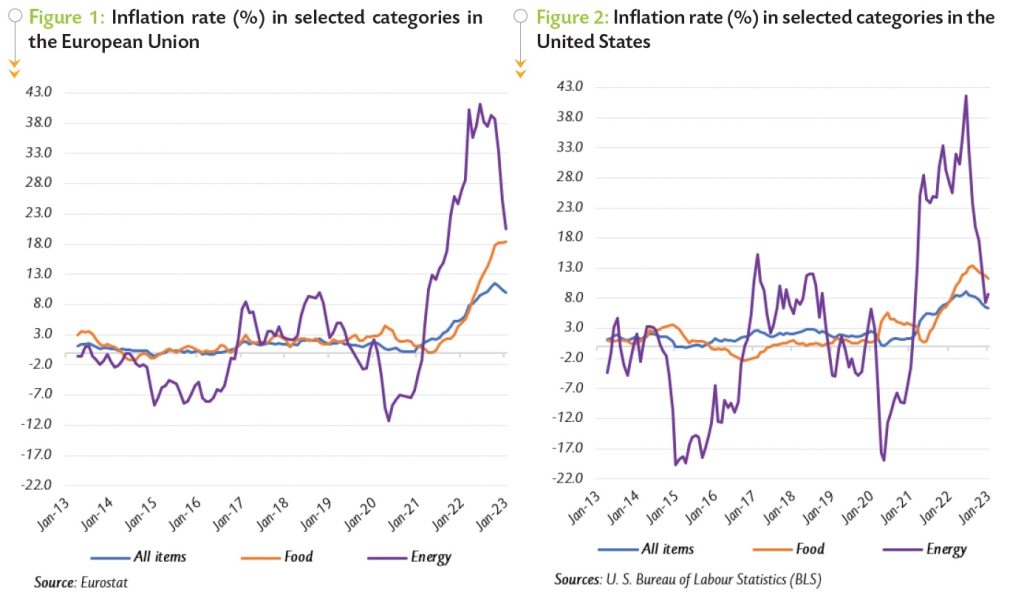

In addition, signs of decreasing inflation are also expected to boost the demand for cocoa products as a lower inflation rate could result in strengthening the purchasing power of consumers. Indeed, although inflation was historically high, as shown in Figure 1 and Figure 2, at the end of January (which is the latest available data as at the time of writing), monthly inflation rates moved slightly down compared to December 2022.

In the European Union, the monthly inflation rate for all items dropped from 10.4% to 10.0% while in the United States, the monthly inflation rate went down from 6.5% to 6.4%. In addition, prices of energy in the two main cocoa-consuming markets were sharply slashed in January 2023 compared to their level seen a year ago or even when compared to the peak attained at the start of the armed conflict in Ukraine.

In the European Union, the monthly inflation rate for all items dropped from 10.4% to 10.0% while in the United States, the monthly inflation rate went down from 6.5% to 6.4%. In addition, prices of energy in the two main cocoa-consuming markets were sharply slashed in January 2023 compared to their level seen a year ago or even when compared to the peak attained at the start of the armed conflict in Ukraine.

The monthly inflation rate of energy strongly declined from 27.0% in January 2022 to 20.6% in January 2023 in the European Union while in the United States, it dropped from 27.0% to 8.7% over the same period.

The reduction in the cost of energy will likely be beneficial to both manufacturers and consumers of cocoa products.

For manufacturers of chocolate products, the reduction in the cost of energy is expected to lower their production costs and therefore make chocolate products more affordable to most consumers under normal market conditions.

For consumers, the reduction in the cost of energy, which is an essential good in the daily life of households, will lead to positive externalities. As such, a reduction in energy costs will increase the disposable income of households and thereby provide support for purchases and consumption of non-essential goods including chocolate confectionery products.

Futures Price Movements

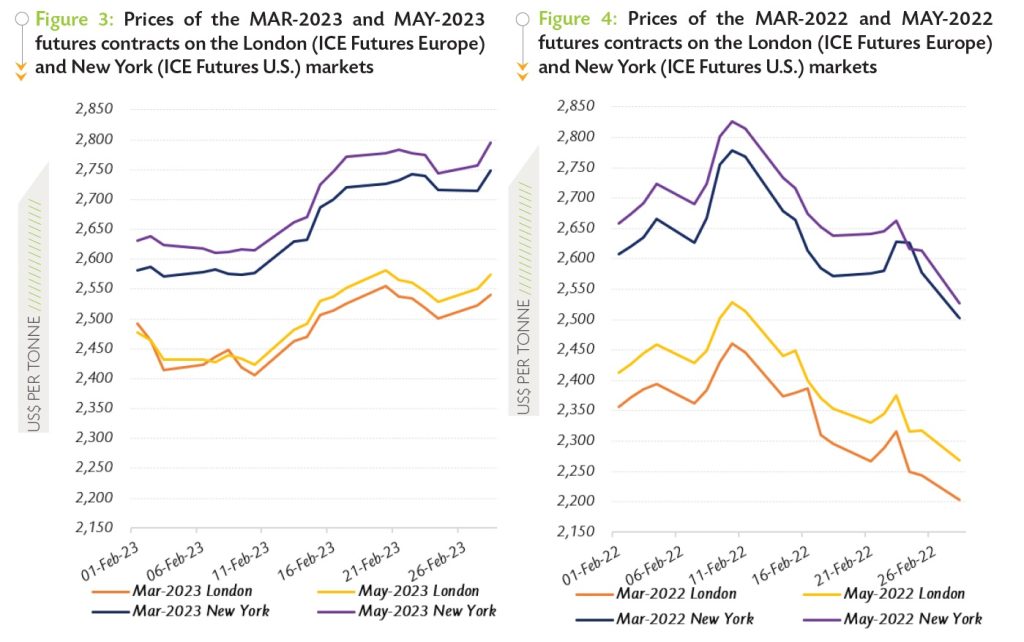

In February 2023, prices of the first position of cocoa futures contract ranged between US$2,406 and US$2,556 per tonne in London and averaged US$2,484 per tonne, up by 6% compared to the average price of US$2,345 per tonne for the nearby contract recorded at the same period of the 2021/22 cocoa year.

In New York, the average price of the MAR-23 contract settled at US$2,656 per tonne, up by 1% from US$2,636 per tonne recorded in February 2022 and oscillated between US$2,571 and US$2,778 per tonne. Figure 3 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in February 2023, while Figure 4 presents similar information for the previous year.

Both the London and New York markets were in normal contango during February 2023 (Figure 3). Indeed, the MAR-23 contract was priced lower by US$16 per tonne on average compared to the MAY-23 one in London.

Both the London and New York markets were in normal contango during February 2023 (Figure 3). Indeed, the MAR-23 contract was priced lower by US$16 per tonne on average compared to the MAY-23 one in London.

In New York, the front-month cocoa futures contract was discounted by US$40 per tonne on average vis-à-vis the second position of cocoa future contracts.

Back in February 2022 (Figure 4), both markets were also in a normal contango with the MAR-22 contract pricing lower compared to the MAY-22 one, down on average by US$58 per tonne and US$47 per tonne in London and New York respectively.

During the first ten (10) days of February, prices of the front-month cocoa contract generally traded within a range averaging US$2,578 per tonne and oscillating between US$2,571 and US$2,587 per tonne in New York. Meanwhile, they plunged by 3% from US$2,491 to US$2,406 per tonne in London. At the time, conducive climate conditions were recorded in West Africa and thoughts about weak demand for cocoa were prevailing.

However, moving on to the remaining part of the month under review, the global cocoa market was bullish, and prices of the nearby cocoa futures contract were reinvigorated on both sides of the Atlantic. In London, prices of the MAR-23 contract rallied by 3% from US$2,463 to US$2,541 per tonne while a hike of 4% from US$2,629 to US$2,748 per tonne was recorded in prices of the first position cocoa contract in New York.

During this period, information on the improvement of the global macroeconomic outlook made the headlines². In addition, market participants were of the view that despite an anticipated increase in the global crop, the current market conditions signalled a supply deficit for the ongoing cocoa year.

Furthermore, there were concerns that some exporters in Côte d’Ivoire could default in fulfilling their commitments in terms of volumes of cocoa exports given the current year-on-year low level of arrivals of cocoa beans in the country. It is worth mentioning that the curb in the arrivals in Côte d’Ivoire was partly triggered by the detrimental effects of cocoa-related diseases like the Cocoa Swollen Shoot Virus Disease (CSSVD).

¹ Source : Euromonitor International

² https://www.imf.org/en/News/Articles/2023/01/31/tr-13123-world-economic-outlook-update