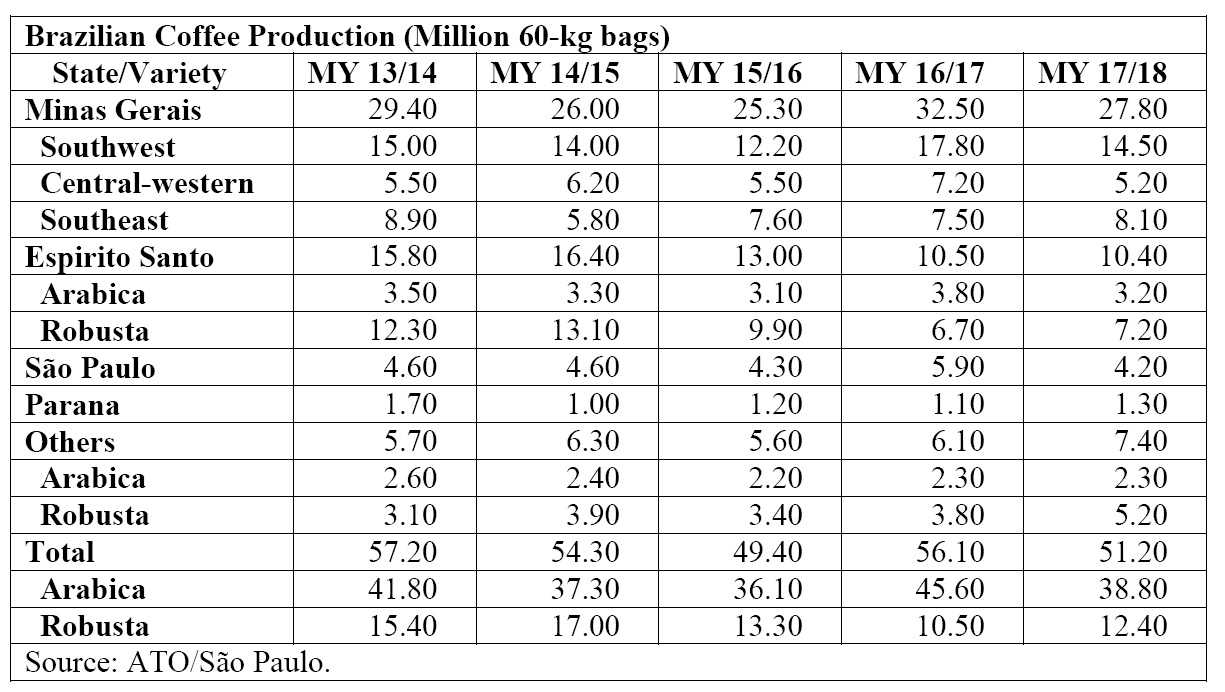

In its semi-annual report on Brazil, USDA’s Foreign Agricultural Service (FAS) has revised its estimate of coffee production for MY 2017/18 down to 51.2 million 60-kg bags.

This includes a 1.7 million-bag reduction in Arabica production, as a result of worse-than-average dehusking yields, which is partially offset by higher Robusta production.

Coffee exports for the current MY have dropped to 30.43 million bags, a decrease of 2.6 million bags from the previous estimate, reflecting dredging issues at the port of Santos and the lower number of containers available to ship the product.

Production

The Agricultural Trade Office (ATO) in São Paulo revised Brazil’s coffee production estimate for marketing year (MY) 2017/18 (July-June) down to 51.2 million 60-kg bags, green equivalent, a decrease of 900,000 60-kg bags compared to the previous estimate in May (52,10 million bags).

Arabica production is estimated at 38.80 million bags, down four percent compared to the previous estimate, due to worse-than-expected dehusking yields in major growing areas like Minas Gerais and São Paulo. Coffee bean sizes (screens) 17 and 18 represent 25 – 30 percent of the total volume of the crop, whereas the average percentage in a normal year is 30 to 35 percent of the total volume.

However, Robusta production is revised up to 12.4 million bags, an increase of seven percent relative to the previous estimate, due to better than initially anticipated yields, especially in the state of Bahia.

The harvest ended in late September and early October in the majority of the coffee growing areas. Area harvested and tree inventory estimates remain unchanged. The table below shows production estimates by state from MY 2013/14 to MY 2017/18. In September 2017, the Brazilian government (GOB), through the National Supply Company (CONAB) of the Ministry of Agriculture, Livestock and Supply (MAPA), released the third official coffee production estimate for MY 2017/18. As reported by CONAB, coffee production is estimated at 44.78 million bags (34.07 million bags for Arabica and 10.71 million for Robusta coffee), down 6.59 million bags compared to MY 2016/17 (51,37 million bags).

In September 2017, the Brazilian government (GOB), through the National Supply Company (CONAB) of the Ministry of Agriculture, Livestock and Supply (MAPA), released the third official coffee production estimate for MY 2017/18. As reported by CONAB, coffee production is estimated at 44.78 million bags (34.07 million bags for Arabica and 10.71 million for Robusta coffee), down 6.59 million bags compared to MY 2016/17 (51,37 million bags).

CONAB estimates are 12-percent lower than Post’s revised estimate. The October 2016 coffee production estimate for MY 2017/18 released by the Brazilian Institute of Geography and Statistics (IBGE) shows the production of 2.78 million metric tons of coffee, or 46.3.

million 60-kg bags (34.9 million bags for Arabica and 11.4 million for Robusta coffee), a decrease of eight percent compared to MY 2016/17 (50.3 million bags). No official forecast has been announced for MY 2017/18. IBGE estimates are 4.9 million 60-kg bags lower than Post’s revised estimate.

Consumption

Domestic coffee consumption for MY 2017/18 is estimated at 22.195 million 60-kg coffee bags (21.05 million bags of roast/ground coffee and 1.145 million bags of soluble coffee, respectively), an increase of three percent from Post’s revised estimate for MY 2016/17 (21.525 million 60-kg bags).

Post has also revised the estimate for domestic coffee consumption for MY 2015/16 to 20.855 million coffee bags. This change reflects updated information from Brazilian Coffee Industry Association (ABIC) that was also validated by Euromonitor and Nielsen. ABIC has not yet released the November 2016-October 2017 coffee consumption survey.

According to ABIC, the coffee industry has consistently grown around 3 – 3.5 percent the past few years, in spite of the economic turmoil in the Brazilian economy. ABIC reports that drinking “cafezinho” (a small cup of coffee) is part of the Brazilian tradition and consumers have not abandoned the habit even during the recession.

The main reasons include: low income consumers have changed to lower priced coffee, the upward trend for consumption of high quality coffee such as coffee capsules (an increase from 7 to 10 thousand metric tons from 2015 to 2016), and food service has slowly increased as a channel for coffee sales/consumption as opposed to only the retail channel.

Trade

ATO/São Paulo’s estimate for Brazil’s coffee exports for MY 2017/18 is revised down to 30.43 million bags, a decrease of 2.6 million bags from the previous estimate, reflecting the slower export pace during the initial months of the current marketing year.

Green bean exports are expected to contribute 27.2 million bags, while soluble coffee exports remain unchanged at 3.2 million bags. Industry contacts report that the main reason for the slow in exports is that the Port of Santos, the main Brazilian port for coffee exports, has faced dredging issues and difficulties obtaining environmental permits.

In addition, the number of ship owners with access to the port was recently consolidated, resulting in an insufficient number of containers available, and thus reducing the number of shipping lines arriving at the port.

Coffee exports for MY 2016/17 were slightly revised upward to 33.081 million 60-kg bags, green beans, to reflect updated information from the Brazilian Green Coffee Association (CECAFE). Green bean (Arabica and Robusta) exports are estimated at 29.325 million bags, whereas soluble coffee exports are estimated at 3.725 million bags.

Stocks

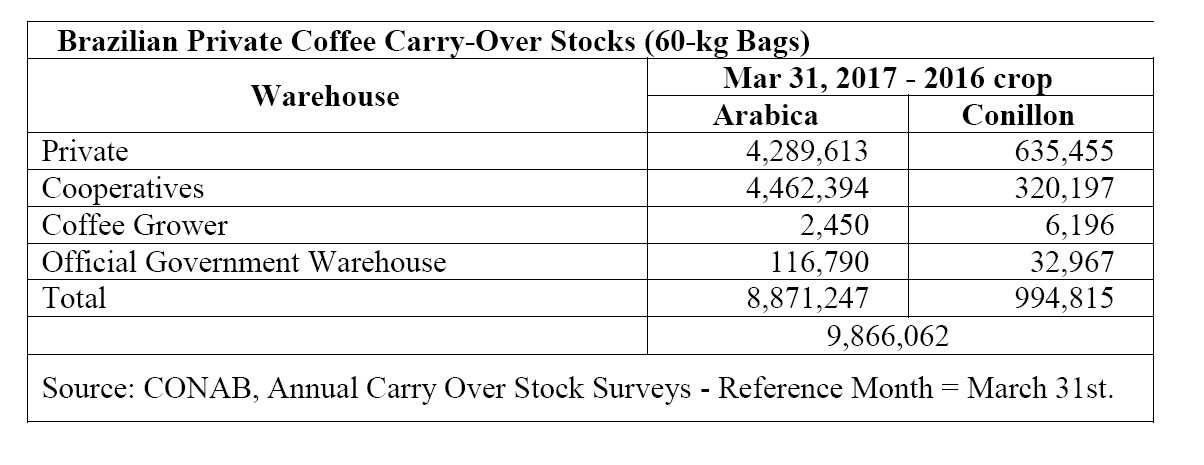

Ending stocks for MY 2017/18 are estimated at 2.568 million bags, down 1.36 million bags compared to MY 2016/17, the result of updated figures for exports and production. On March 31, CONAB released the 2017 private stocks survey, including stocks held by growers, coffee cooperatives, exporters, roasters, and the soluble industry.

Private stocks are estimated at 9.87 million bags, down 27 percent relative to the previous crop (13.59 million bags). CONAB has changed the methodology on how it reports the different industry agents from last year.

The table below shows the results of the last private stock survey.

Government owned stocks held by CONAB on March 31, 2017 are reported at 255,344 60-kg bags.