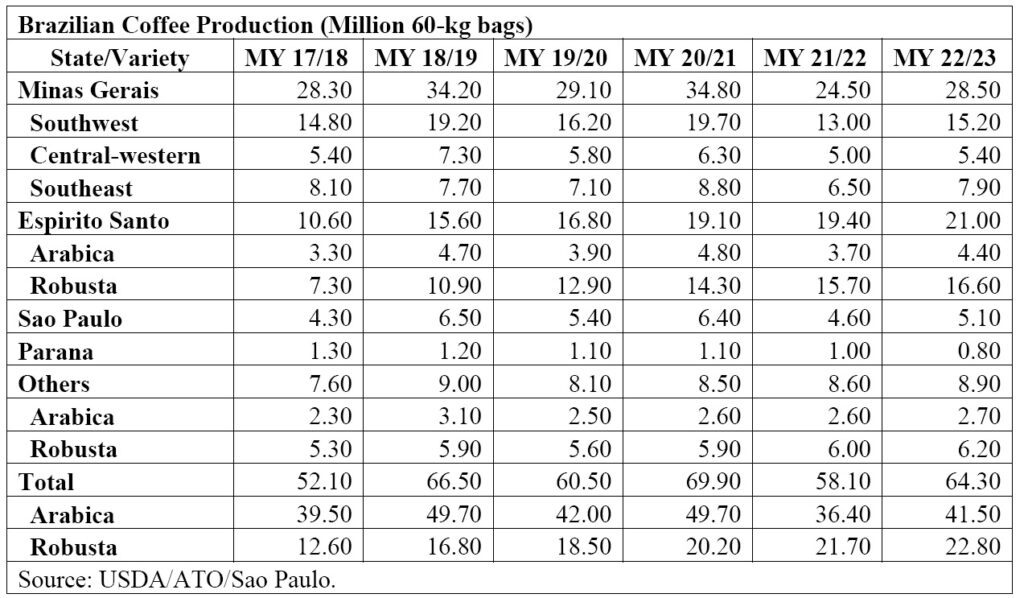

SAO PAULO, Brazil – In its new report, USDA ’s Agricultural Trade Office in Sao Paulo (ATO) forecasts the Brazilian marketing year (MY) 2022/23 (July-June) coffee production at 64.3 million bags (60 kilograms per bag), green equivalent, an increase of 6.2 million bags relative to the revised figure for the previous crop year (58.1 million 60-kg bags).

Post conducted field trips to major coffee-producing areas to evaluate the 2022 crop. Trips were made during the January-May 2022 period to the states of Espirito Santo, Minas Gerais, Parana, and Sao Paulo to observe vegetative development, cherry set, and fruit formation. Information for other producing states was obtained from government sources, state secretariats of agriculture, producers associations, cooperatives, and traders.

Brazilian Arabica coffee production is projected at 41.5 million bags, an increase of 14 percent vis-a-via the previous season. Most of the producing areas are in the on-year of the biennial production cycle and rainfall volumes have been mostly favorable in all growing regions as of October 2021, supporting the development and filling of the fruits.

However, weather-related issues in some areas such as below-average rainfall that prevailed until September 2021 and the severe frosts in June/July 2021 have affected Arabica coffee trees’ first blossoming and fruit setting, thus reducing the production potential for the upcoming crop.

Note that the Arabica crop for 2022/23 is expected to be down 8.2 million bags (16 percent) compared to the 2020/21 Arabica crop (49.7 million bags). The 2020/21 Arabica crop was the latest coffee crop with trees on the on-year of the biennial production cycle and expressing their full production potential.

More recently, light frosts were observed in restricted spots in the states of Sao Paulo, Minas Gerais, and Parana between May 18 and 20, 2022. Coffee growers have been assessing the effects of the frost in the affected areas, but overall, damages for the 2022 coffee crop are reported as very limited.

The Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB) reports that the institution should conduct field trips in the next couple of weeks to assess potential crop damages caused by the frost. CONAB has also emphasized that the intensity of the frost was much weaker than in 2021.

Robusta/Conilon production is forecast at 22.8 million bags, a 1.1-million-bag increase relative to the previous crop season. Above-average weather conditions (rainfall volumes and temperature) and good crop management resulted in good blossoming and fruit setting in most coffee fields. A marginal increase in the harvest area also supports the expected increase in production. Robusta/Conilon harvest started in April in major growing areas.

Although production costs (energy, fertilizers, pesticides, labor, etc) have increased for the upcoming crop, coffee prices have remained steadily high and above historical averages, thus enabling good crop management for both Arabica and Robusta/Conilon coffee fields. The current Russia-Ukraine war has brought no significant impact to the current coffee crop, given that fertilizer purchases/utilization have occurred beforehand. However, if the war persists, fertilizer supply might be an issue for the 2023/24 crop. Brazil imports large amounts of fertilizers from Russia.

USDA ‘s Agricultural Trade Office (ATO)/Sao Paulo estimate for marketing year (MY) 2021/22 (July-June) was revised upward to 58.1 million 60-kg bags, green equivalent, an increase of 1.8 million 60-kg bags

vis-à-vis the last estimate, based on updated supply/demand information from the industry. Arabica production is estimated at 36.4 million bags, whereas the estimate for Robusta/Conilon production is 21.7 million bags.

Post contacts report that producers have already marketed over 90 percent of the 2021/22 crop. The table below shows coffee forecast production by state and variety for MY 2022/23 as well as production estimates from MY 2017/18 to MY 2021/22.

The total area planted for coffee for MY 2022/23 is projected slightly higher at 2.495 million hectares, an increase of one percent relative to the previous season. In contrast, coffee tree inventory is projected at 7.61 billion trees, an increase of 100 million trees vis-à-vis the previous crop year.

The total area planted for coffee for MY 2022/23 is projected slightly higher at 2.495 million hectares, an increase of one percent relative to the previous season. In contrast, coffee tree inventory is projected at 7.61 billion trees, an increase of 100 million trees vis-à-vis the previous crop year.

The Brazilian coffee yield for MY 2022/23 is forecast at 31.83 bags/hectare, up ten percent compared to the revised number for the previous crop (28.91 bags/hectare). The increase is supported by the on-year of the biennial production cycle for Arabica trees (although, limited by adverse weather events) and above weather conditions in Robusta/Conilon production areas.

Brazilian coffee exports

Coffee exports for MY 2022/23 are forecast at 39.045 million 60-kg bags, green beans, an increase of three percent relative to the revised figure for MY 2021/22 (39.992 million bags) due to the expected larger exportable surplus). Despite the significantly higher prices that prevailed in the last couple of years, Brazil remains competitive in the world market and the depreciated local currency (Real) has supported strong exports.

ATO/Sao Paulo has revised the estimate for MY 2021/22 coffee exports upward to 37.992 million 60-kg bags, green beans, an increase of 14 percent relative to the previous figure. The estimate is based on year-to-date export volumes and anticipated May-June loadings. Green bean (Arabica and Robusta/Conilon) exports are estimated at 34 million bags. Major green bean export destinations include the United States, Germany, Italy, Belgium, and Japan.

Soluble coffee exports are estimated at 3.95 million bags. The Russia – Ukraine war has negatively affected soluble coffee imports to those countries. According to the Brazilian Soluble Coffee Industry Association (ABICS), Russia is the second top and Ukraine is the seventh major soluble coffee importer from Brazil and coffee imports to those countries dropped by roughly 61,000 bags from January-April 2022.