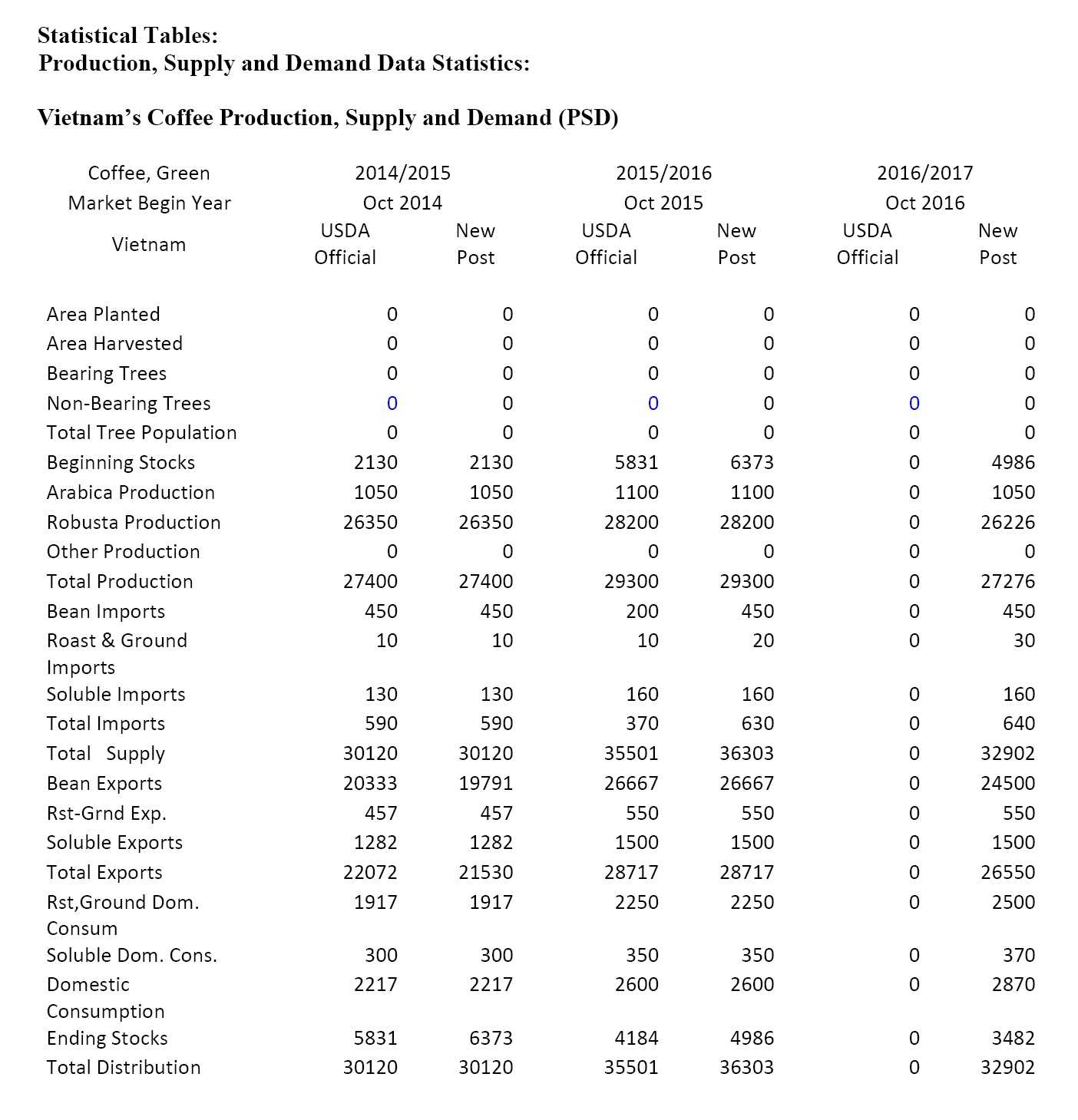

USDA’s GAIN Report on Vietnam sees production for MY2016/17 at 27.3 million bags, down about 7 percent from the previous year, due to adverse weather conditions (El Nino and possibly followed by the La Nina phenomenon). Production for MY2015/16 remains unchanged at 29.3 million bags.

There is concern about the severity and impact of dry weather on the conditions of the coffee crop in key producing provinces in the Central Highlands of Vietnam, namely Dak Lak, Dak Nong, Gia Lai, and Lam Dong. Because of El Nino, which began in 2015 and continued into 2016, the first months of 2016 were the hottest on record.

There have been less rain, lower water levels, higher temperatures, and less humidity across the Central Highlands. The first rains of moderate intensity occurred over the Central Highlands the last week of April, providing water and improving soil moisture significantly for coffee trees.

In Kon Tum province in the Northern Central Highlands to the Southern Highlands, rains were well distributed among coffee regions. Monthly rainfall in the first half of April was slightly lower than the same period last year.

But annual rainfall by April of both calendar 2016 and 2015 were much lower than the average of the last 10 years.

Overall, the weather was still hot and sunny with slight winds during daytime, but turned cloudy with moderate showers in the late afternoon. Most water reservoirs are storing about 30% to 50% of their designed capacity. Average relative humidity was 6.4% lower compared to the same period in past 5 years.

In MY2015/16, there was an increase in production of about 7%, compared to MY2014/15 when there was also a dry weather conditions. In MY2016/17, despite limited rainfall, the weather was dry, windy, and sunny during the crucial flowering and fruit-setting process (from January to early March 2016) which created good conditions for flowering and fruit setting.

Where rainfall was very low, farmers still had access to enough surface and underground water sources to irrigate their plantations during the critical February-March period.

According to coffee observer, despite the dryness, damage to the MY2016-17 crop during the flowering and fruit-setting stage has been minimal.

In some areas where farmers rely only on rains and surface water from streams, the dry weather has caused some damage. The plants affected only received one or two watering so far in calendar year 2016, insufficient to sustain flowering and cherry formation.

In the first half of May, most coffee areas received light to heavy rains. This not only brought cool weather but also helped improve soil moisture and helped farmers apply fertilizer to coffee trees.

However, May rainfall (during the first half of May) has been much lower than the same period in the last 5 years. The lack of May rain is adding stress to coffee trees. Current forecast models indicate rainfall will reduce sharply and weather will be hot and dry again by end of May. If the lack of rains continues in June coffee crops will face additional losses.

The high probability of La Nina in August-October of 2016 will bring a lot of rain to coffee areas. However, the timing of the rains might not be useful for the coffee tree growing cycle. Too much rain is unfavorable as high air humidity will reduce root efficiency, reduce photosynthesis, and result in fruit dropping.

Among the 3 main regions for Arabica production in Vietnam: Lam Dong, Quang Tri, Dien Bien / Son La; Lam Dong, the largest Arabica producers with 16,000 hectares, is likely the only area affected by the drought conditions.

However, Post estimates Arabica crop received less damage since the flowering stage is a month earlier than Robusta. The estimate for the damage is about 4.5 percent of the total Arabica area compared to MY2015/16.

In MY 2016/17, Post estimates a production reduction up to 7 percent compared to the MY2015/16 crop. It should be noted, however, that should La Nina materialize during the second half of 2016 and affect the Central Highlands, the reduction could be greater.

Post estimates total coffee area at about 662,250 ha in MY 2015/16, and forecasts MY2016/17 coffee area at about 668,200 hectares.

During the past five years coffee production faced strong competition from black pepper production due higher income per hectare. However, black pepper’s higher income potential is partially offset by very high start-up and input costs and very high risk of loss from plant diseases. Recently, growth in pepper production area has become flat.

Analysts have noticed that coffee producers are planting small amounts of black pepper to supplement farm income. With higher income, coffee farmers can hold their coffee longer in anticipation of higher prices.

Consumption

Post revises the estimate for domestic consumption for roasted and ground coffee at 2.25 million bags for the MY2015/16 and 2.5 million bags for the MY2016/17, due to the continued expansion of coffee shops and cafes.

Some new local products utilizing roasted coffee: filter bag coffee, collagen coffee designed for women, and durian or ginseng coffee are introduced into the market to satisfy customer preference and demand.

For soluble/instant coffee, according to the Vietnam Coffee and Cocoa Association, Vietnam’s total targeted capacity for soluble coffee production is about 2.67 million bags. However, the actual production is probably only about 50 percent of capacity. Given the strong demand for soluble coffee products domestically and growing demand for export, Post estimates soluble coffee consumption at about 350,000 bags in MY2015/16 and 370,000 bags in MY2016/17.

According to Euromonitor, the prominent presence of specialist coffee chains allows consumers to have easy access to high-quality, freshly brewed coffee at affordable prices. Consumers can also easily prepare instant coffee for consumption at their offices or homes. Domestic consumption is forecast to continue to grow, reflecting the expanding retail coffee shops and robust growth of other retail food service subsectors serving coffee in Vietnam. The expanding coffee retail sector will contribute to stronger consumption for the foreseeable future.

Exports

Post revises the estimate for Vietnam’s MY 2014/15 total coffee exports, including green beans, roasted and ground, and instant coffee, down from 26.43 million bags to 21.53 million bags due mainly to lower green bean coffee exports. For MY 2015/16, Post estimates total coffee exports at 28.07 million bags, an increase of approximately 31 percent over the previous MY due to Vietnamese green bean Robusta reemerging as a major supply source and the increased export of soluble and roasted coffee.

Green Bean Exports

According to trade data, over the first half of MY2015/16, October 2015 to March 2016, Vietnam exported about 14.11 million bags of green coffee beans, an increase of about 25 percent compared to the first six months of the MY 2014/15.

According to traders, the Brazilian Conilon crop situation together with the unexpected low sea freight from Vietnam to European Union has boosted the exports of Vietnamese Robusta during the first half of MY2015/16.

Vietnam exported over 203,000 tons (over 3.38 million bags) of coffee in April, up about 13 percent from the previous month, according to the Customs Department, which was a monthly record.

April shipments brought Vietnam’s total coffee exports for the first seven months of the MY2015/16 to about 17.62 million bags, or an increase of 25 percent from MY2014/15.

Soluble and Roasted Exports

Post maintains exports of roasted and ground and soluble coffee in MY2015/16 at 550,000 bags for roasted and 1.5 million bags for soluble coffee GBE (Green Bean Equivalent). Post forecasts the same volume for MY2016/17 due to the flat growth of these sectors.

Imports

Vietnam continues to import small quantities of green coffee beans, as well as roasted and instant coffee, from countries such as Laos, Indonesia, Brazil, Cote d’Ivoire and the United States.

Vietnam’s import of roasted/ground coffee from the United States has increased in the past couple of years due to the expanding coffee retail sector. U.S. brands such as Starbucks, McCafé, and Dunkin Donuts have become established operations in Vietnam in recent years.

According to data from GTA, total coffee imports in MY 2015/16 are estimated at 630,000 bags GBE. Of that total, about 160,000 bags GBE is soluble coffee, 20,000 bags GBE is roast and ground, and 450,000 bags is green bean imports. Post’s forecast for MY 2016/17 total coffee imports is 640,000 bags.

Export Prices

The monthly export price of common ungraded green bean Robusta in MY 2015/16 (FOB HCMC) decline to the lowest level of the last five MYs during the January to March 2016 period. The price went up in March 2016 due to drought situation in both Vietnam and Brazil.

Domestic Prices

The domestic price for Robusta common ungraded coffee beans in the first eight months of MY 2015/16 declined to very low levels, VND 32,000 /kg in Lam Dong in January 2016, compared to VND 39,600 /kg in Lam Dong at the same time in 2015.

Prices bottomed out during February and March 2016, and have rebounded steadily in April-May due the news of the unfavorable harvest in Brazil and drought situation in parts of Vietnam.

Stocks

In the absence of an official number for Vietnamese coffee stocks, Post estimates the MY 2015/16 ending stocks at about 4.99 million bags, or about 21.66 percent lower than MY2014/15 ending stocks, due to higher export volume.

Post’s forecast for MY 2016/17 ending stocks is about 3.48 million bags, due to lower coffee production caused by dry weather and only a slight decline in forecasted total coffee exports.