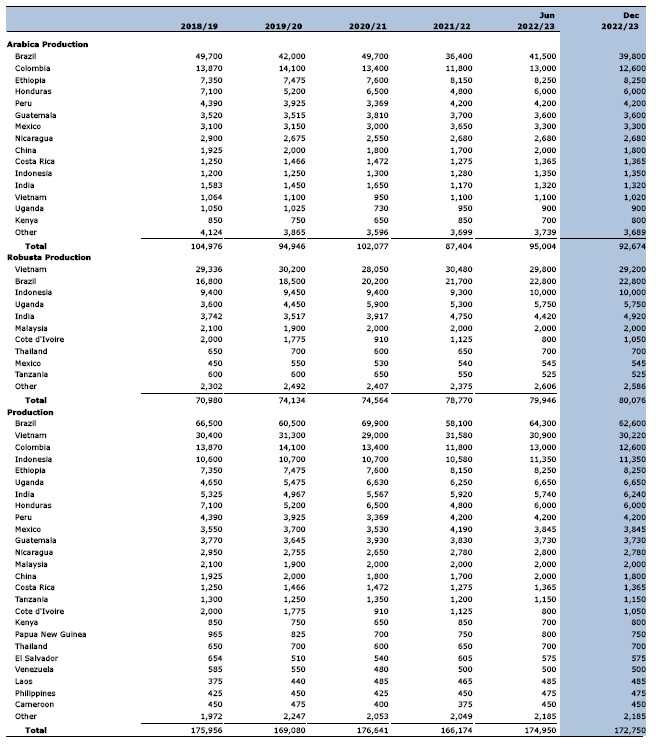

WASHINGTON, USA – The US Department of Agriculture (USDA) issued yesterday “Coffee: World Markets and Trade”, a biannual report that includes data on global trade, production, consumption and stocks, as well as analysis of developments affecting world trade in coffee. The report forecasts world coffee production for 2022/23 to rebound to 6.6 million bags from the previous year to 172.8 million due primarily to Brazil’s Arabica crop entering the on-year of the biennial production cycle.

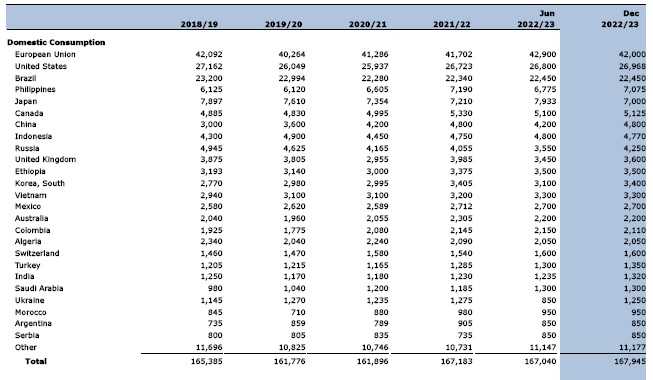

Global consumption is expected to rise 800,000 bags to 167.9 million, with the largest gains in the European Union, the United States, and Brazil.

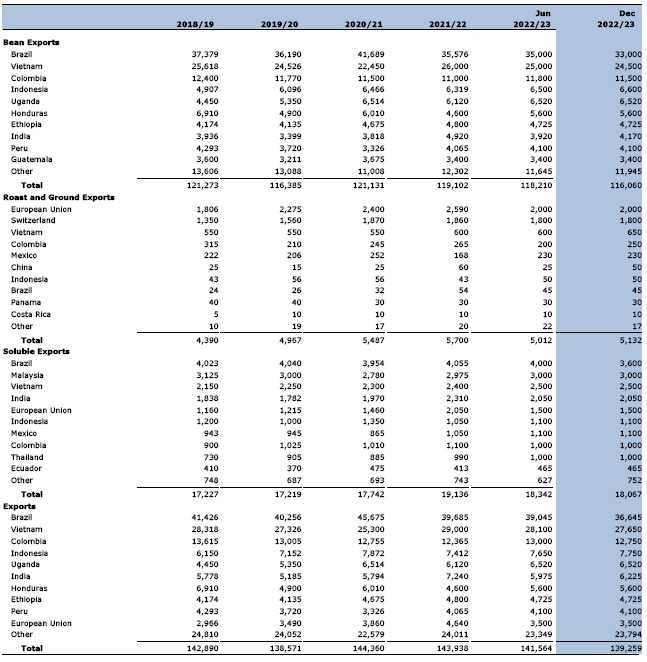

World coffee bean exports are forecast 3.0 million bags lower to 116.1 million as losses in Brazil, Vietnam, and India more than offset gains in Honduras and Colombia. Ending stocks are expected 1.5 million bags higher to 34.1 million.

Against this backdrop of an improving supply situation, coffee prices as measured by the International Coffee Organization (ICO) monthly composite price index have dropped over 25 percent since February 2022. http://www.ico.org/coffee_prices.asp

Vietnam production is forecast by USDA at 30.2 million bags, down 1.4 million from last year’s record harvest due to reduced yields. Cultivated area is forecast unchanged from last year, with over 95 percent of total output remaining as Robusta.

The rainy season started earlier than previous years, which supported good flowering and cherry development. Wetter-than-normal conditions reduced irrigation needs and costs.

However, fertilizer prices skyrocketed as much as 70 percent in the last year.

Farmers responded by reducing fertilizer use which is expected to lower yields and output from the previous year. Bean exports are forecast to decline 1.5 million bags to 24.5 million on lower available supplies, and ending stocks are expected to slip 200,000 bags to 3.1 million bags.

Brazil Arabica output is forecast by USDA to rebound 3.4 million bags to 39.8 million. The majority of producing areas are in the on-year of the biennial production cycle, resulting in higher production potential for the upcoming crop; however, this quantity is well below recent onyear crops that peaked at nearly 50 million bags.

Arabica trees in many growing regions continued to recover from severe frosts in June and July 2021 as well as high temperatures and below-average rainfall that prevailed until September 2021.

The Robusta harvest is forecast to continue expanding to reach a record 22.8 million bags, up 1.1 million, as favorable weather conditions and good crop management aided fruit settings and development in the main growing region of Espirito Santo.

A marginal increase in harvested area also supports the expected gains. The combined Arabica and Robusta harvest is forecast up 4.5 million bags to 62.6 million. Output gains are expected to rebuild stocks, resulting in bean exports dropping 2.6 million bags to 33.0 million.

Colombia Arabica coffee production is forecast up 800,000 bags to 12.6 million bags on improving growing conditions. Last year’s output was hampered by excessive rains and cloud cover that disrupted the flowering process. Bean exports, mostly to the United States and European Union, are forecast 500,000 bags higher to 11.5 million bags on increased supplies.

Indonesia production is forecast to rise nearly 800,000 bags to 11.4 million. Robusta output is expected to reach 10.0 million bags on favorable growing conditions in the lowland areas of Southern Sumatra and Java where approximately 75 percent is grown.

The main harvest season in southern Sumatra began on time in March and ended in July 2022. Arabica production is also expected to rise slightly to 1.4 million bags. Bean exports are forecast to gain 300,000 bags to 6.6 million on increased supplies.

European Union imports are forecast down 2.1 million bags to 44.5 million and account for 40 percent of the world’s coffee bean imports. Top suppliers include Brazil (40 percent), Vietnam (20 percent), Uganda (8 percent), and Honduras (7 percent). Ending stocks are expected to drop 1.0 million bags to 13.0 million to support a modest increase in consumption.

The United States imports the second-largest amount of coffee beans and is forecast down 500,000 bags to 24.8 million. Top suppliers include Brazil (30 percent), Colombia (19 percent), Vietnam (10 percent), and Honduras (7 percent). Ending stocks are forecast down slightly to 6.1 million bags.

USDA revised 2021/22 estimates

World production is lowered 1.0 million bags from the June 2022 estimate to 166.2 million.

- Colombia is 1.2 million bags lower to 11.8 million due to excessive rain and cloud cover which lowered yields.

- Honduras is revised 600,000 bags lower to 4.8 million as leaf rust lowered yields more than

expected. - India is raised 400,000 bags to 5.9 million due to greater area harvested.

- Cote d’Ivoire is up 300,000 bags to 1.1 million bags due to higher yields.

World bean exports are revised up 1.8 million bags to 119.1 million.

- Brazil is up 1.6 million bags to 35.6 million as logistical bottlenecks slowed trade less than was previously expected.

- India is raised 1.1 million bags to 4.9 million on higher-than-anticipated stocks drawdown as well as improved output.

- Honduras is lowered 600,000 bags to 4.6 million on reduced exportable supplies.

- Colombia is down 800,000 bags to 11.0 million on reduced exportable supplies.

World bean imports are revised up 4.3 million bags to 117.0 million.

- European Union is raised 1.6 million bags to 46.6 million on a higher build-up of stocks.

- China is up 400,000 bags to 1.7 million bags on rising consumption.

- Colombia is 400,000 bags higher to 2.0 million on stronger shipments from Peru and Honduras.

World ending stocks are revised down 100,000 bags to 32.6 million.

- European Union is up 1.2 million bags to 14.0 million.

- The United States is up 200,000 bags to 6.4 million bags.

- Brazil is down 1.7 million bags to 500,000.