WASHINGTON, U.S. – In USDA’s semi-annual report on the Vietnamese coffee sector, overall coffee production for MY2015/16 is slightly revised down from about 29.3 million bags to 28.9 million bags reflecting a slightly smaller production of Robusta.

The forecast for MY2016/17 production is revised down from about 27.3 million bags to 26.6 million bags, about an 8 percent drop compared to that of MY2015/16 due to dry weather conditions caused by El Nino.

MY2015/16 crop

Vietnam’s MY2015/16 overall coffee production is slightly revised down from about 29.3 million bags to 28.9 million bags, mainly as a result of a smaller Robusta crop.

MY2016/17 crop

The forecast for MY2016/17 production is revised down from about 27.3 million bags to 26.6 million bags, which is about an 8 percent drop compared to MY2015/16 due to dry weather conditions caused by El Nino and late rains by the end of 2016.

El Nino caused a 7 percent drop in production while the late rains further reduced production by another 1 percent. The average yield for coffee, therefore, is expected to decrease from 2.45 ton per hectare to 2.41 tons per hectare.

Dry and Hot Weather

In the Central Highlands, which is the main coffee growing area, the rainy season is normally from May to October. However, occasional rain from March to May is very important for growing coffee.

El Nino is a natural phenomenon that causes dry and hot weather, less rain and reduces annual rainfall.

The rain returned after the El Nino conditions. However, the rain was unable to help the coffee trees recover more quickly.

It started raining in May 2016 in the Central Highlands and the May-June rainfall was adequate.

However, July rainfall was the lowest in the last four years. In 2016, the total rainfall from January to August was about 81 percent of the 15-year average. The recent El Nino heavily impacted coffee production in Vietnam – one of the hardest hit areas was the Central Highlands.

The weather conditions were extremely harsh leaving numerous coffee farms suffering from water shortages.

The harsh weather conditions left many coffee trees weak and resulted in trees producing fewer cherries. In small areas producing Arabica in Lam Dong province, the hot weather conditions had a negative impact on production due to increased pest and disease incidence.

Farmers had to replace Arabica trees with new Robusta varieties. The MY2016/17 production of Arabica coffee is revised down to 1.045 million bags down from 1.1 million bags of MY206/17.

Change in Coffee Area – Strong Competition from Other Better Cash Crop

Change in Coffee Area – Strong Competition from Other Better Cash Crop

There is some new planted areas in Dak Nong, Lam Dong and Kon Tum provinces in MY2016/17, the total new planted area, however, does not have any significant change compared to MY2015/16.

In Lam Dong, farmers are replanting old trees by grafting the old stems with sprouts of new varieties.

The latter are naturally selected in coffee farms in the province, mostly in Bao Loc and Bao Lam districts. Currently, Vietnam is the world’s leading producer and exporter of black pepper. Farmers are earning higher income from growing black pepper.

This situation is luring farmers to switch sizeable parts of their farms to growing pepper. The expansion could pose a threat to coffee production in the Central Highlands.

Consumption

Post revises the estimate for domestic consumption for roasted and ground coffee slightly up from 2.25 million bags to 2.28 million bags for the MY2015/16, due to the continuing growth of coffee shops and cafes.

Vietnamese coffee drinkers prefer roasted and ground coffee because of its full-bodied and original flavors.

The domestic coffee market remains fierce with strong competition coming from well-known foreign coffee brands such as Dunkin Donuts, Coffee Beans and Tea Leaves, Gloria Jeans, My Life Coffee, McCafe, PJ’s including several Korean coffee chains like Coffee Bene, The Coffee House, and The Urban Station.

Additionally, the coffee-to-go concept is also booming in the big cities where coffee vendors sell coffee on the roadside from their motorbikes – ready to travel to several places in cities serving coffee drinker on their way to work.

Exports

Post revises the estimate for Vietnam’s MY 2015/16 total coffee exports, including green beans, roasted and ground, and instant coffee, up from 28.05 million bags to 29.50 million bags due mainly to the increase of green bean coffee exports. Total export for MY 2016/17 is forecast at about 25.1 million bags, or about 1.5 million tons.

Green Bean Exports

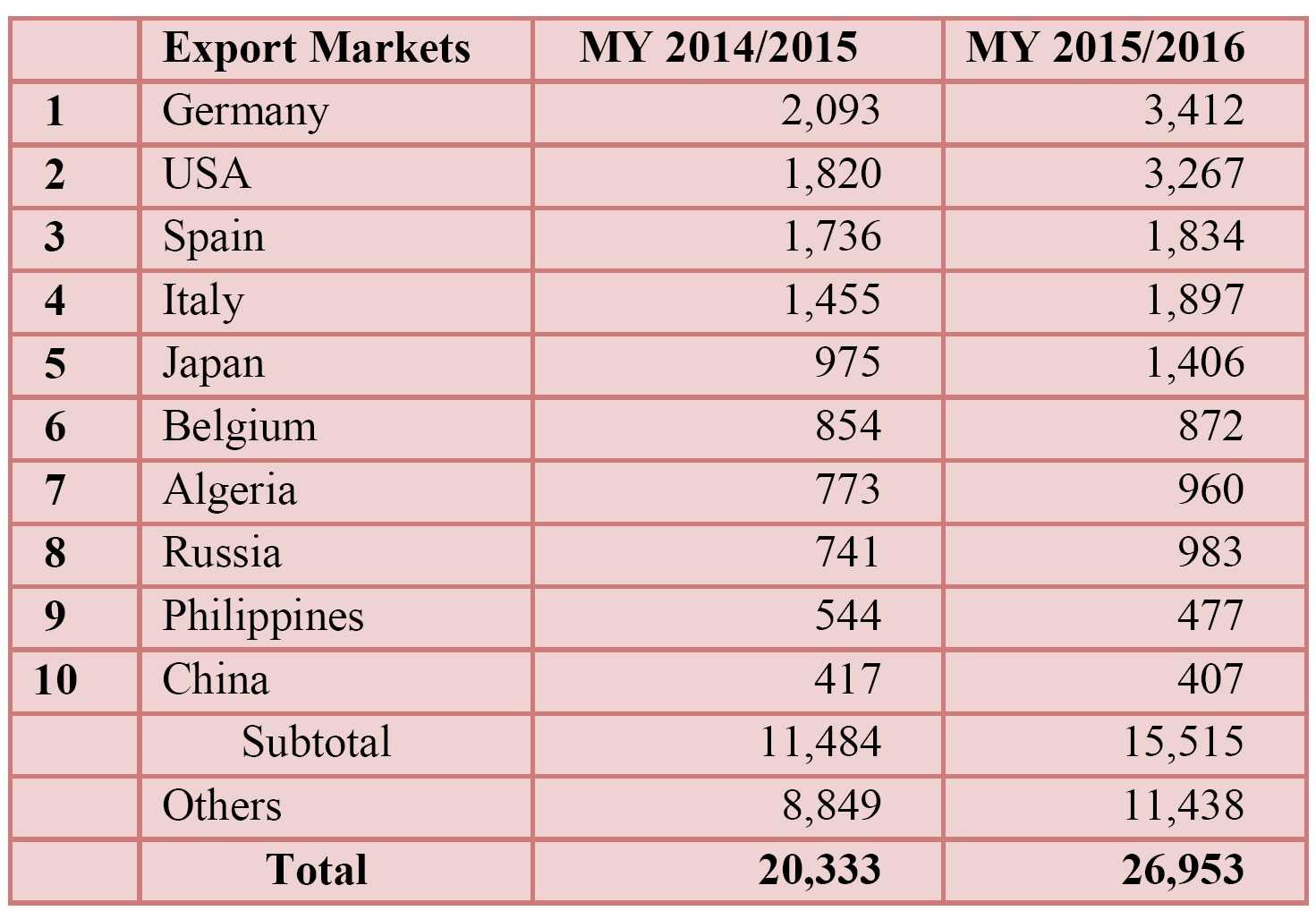

According to trade data, Vietnam exported about 26.95 million bags of green coffee beans in MY 2015/16, which is an increase of about 36.19 percent compared to MY 2014/15, due to a global supply shortfall of Robusta. MY 2016/17 green bean export is forecast at 22.55 million bags, or about 1.35 million tons, due to expected low coffee production in MY 2016/17.

The MY 2015/16 green bean exports volume include the 1.75 million bags in bonded warehouses. For MY 2016/17, Post forecasts green bean coffee exports at 22.55 million bags, down from 25.15 million bags or 10.34 percent of the official forecast and from 26.95 million bags or 16.33 percent of green bean export in MY 2015/16 due to low carry over stock and expected lower production.

Soluble and Roasted Exports

Post maintains exports of roasted coffee in MY2015/16 at 550,000 bags. However, exports of soluble were revised from 1.5 million bags to 2.0 million bags GBE (Green Bean Equivalent). Post forecasts the same volume for MY2016/17 due to the flat growth of these sectors.

Top Ten Vietnam Green Bean Coffee Export Markets in MY2014/2015 and MY2015/2016

Imports

Vietnam continues to import small quantities of green coffee beans, as well as roasted and instant coffee from Laos, Indonesia, Brazil, and the United States.

Vietnam’s import of roasted/ground coffee from the United States has increased in the past couple of years due to the expanding coffee retail sector. U.S. brands such as Starbucks, McCafé, and Dunkin Donuts, and PJ’s Coffee including several South Korean coffee brands have expanded their outlets widely in Vietnam’s big cities.

Total coffee imports in MY 2015/16 are estimated at 630,000 bags GBE. Of the total, about 160,000 bags GBE are soluble coffee, 20,000 bags GBE are roast and ground, and 450,000 bags are green bean imports. Post’s forecast for MY 2016/17 total coffee imports is 640,000 bags.

Export Prices

In MY 2015/16, the monthly export price of common ungraded green bean Robusta (FOB HCMC) decline to the lowest level over the past five MYs during the January to March 2016 period.

After, the price increased from March 2016 to September 2016, due to adverse weather conditions that impacted coffee production in both Vietnam and Brazil.

The domestic price for Robusta common ungraded coffee beans in MY 2015/16 declined to very low levels around VND 32,000/kg, in Lam Dong in January 2016, compared to VND 39,600/kg in Lam Dong during the same period in 2015.

Prices bottomed out during February and March 2016, and have rebounded steadily in April-September due to unfavorable harvest in Brazil and drought conditions in parts of Vietnam.

The price conditions were significantly different in MY 2014/15, prices declined steadily from the beginning through the end of the marketing year.

Stocks

Post estimates the MY 2015/16 ending stocks at about 3.8 million bags, or about 40.37 percent lower than MY2014/15 ending stocks, due to higher export volume.

Post’s forecast for MY 2016/17 ending stocks is about 3.09 million bags, lower compared to MY 2015/16, due to lower coffee production.